With high daily active users, accumulation trends, and recently soaring prices, one AI coin has a distinct advantage. AI-focused cryptocurrencies stand out as a promising sector in the crypto ecosystem. Through tools like ChatGPT, Fireflies, Midjourney, SaneBox, and many others, AI contributes to automating daily tasks or fostering innovation in workplaces. When combined with the relatively new nature of AI in the crypto sector, investors and experts are curious about the next valuable asset in this field.

AI Coins

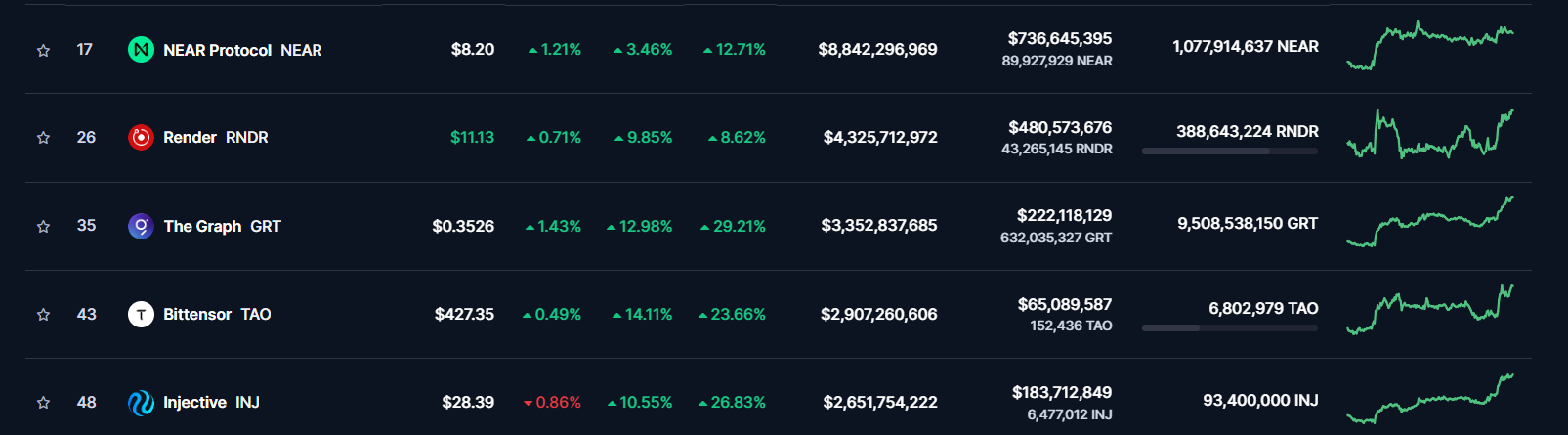

According to CoinMarketCap data, the top five cryptocurrencies in the AI sector have a combined market value of $21.2 billion. This is quite an impressive figure, considering that leading meme coin Dogecoin currently has a market value of approximately $22.18 billion.

To understand sentiment and user engagement, we decided to analyze on-chain metrics of three of the top five AI cryptocurrencies: Render (RNDR), The Graph (GRT), and Injective (INJ). The main question is: Which of these AI coins has the brightest long-term growth potential?

Introduction to the Trio: RNDR, GRT, and INJ

In the past seven days, movements in the crypto market have been notable. With Bitcoin’s 8.9% increase, RNDR experienced a 4.9% decline, while GRT and INJ rose by 13.9% and 18.1%, respectively. This shows that altcoins can often yield greater returns compared to Bitcoin when performing strongly in the market.

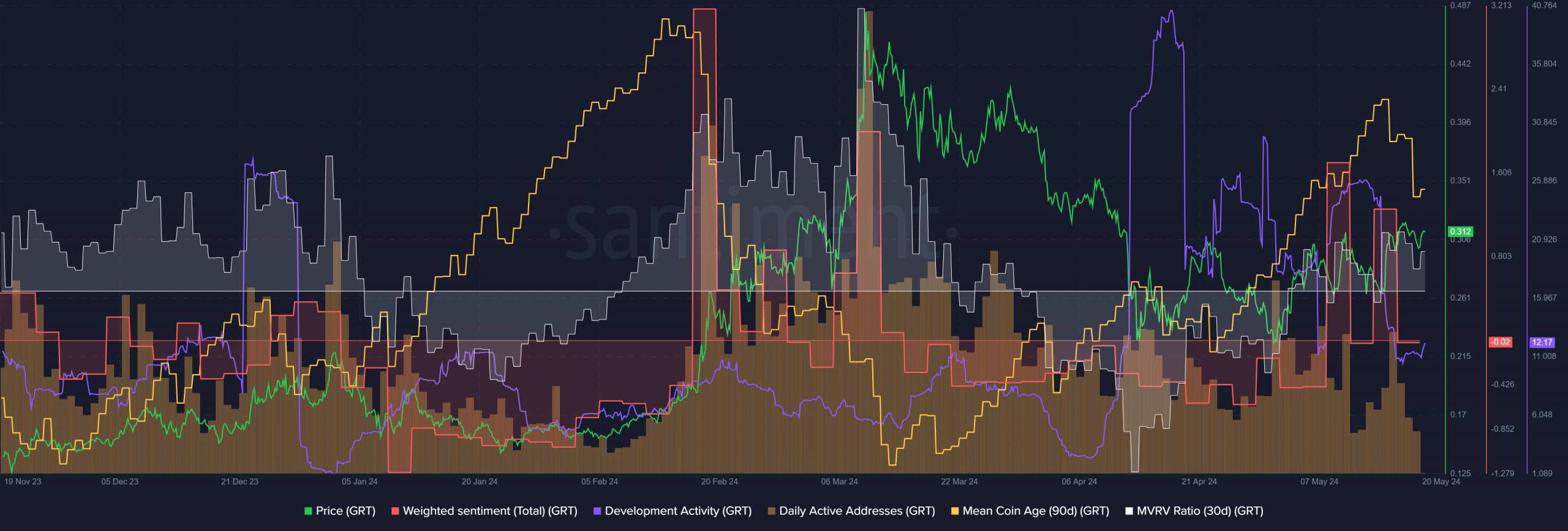

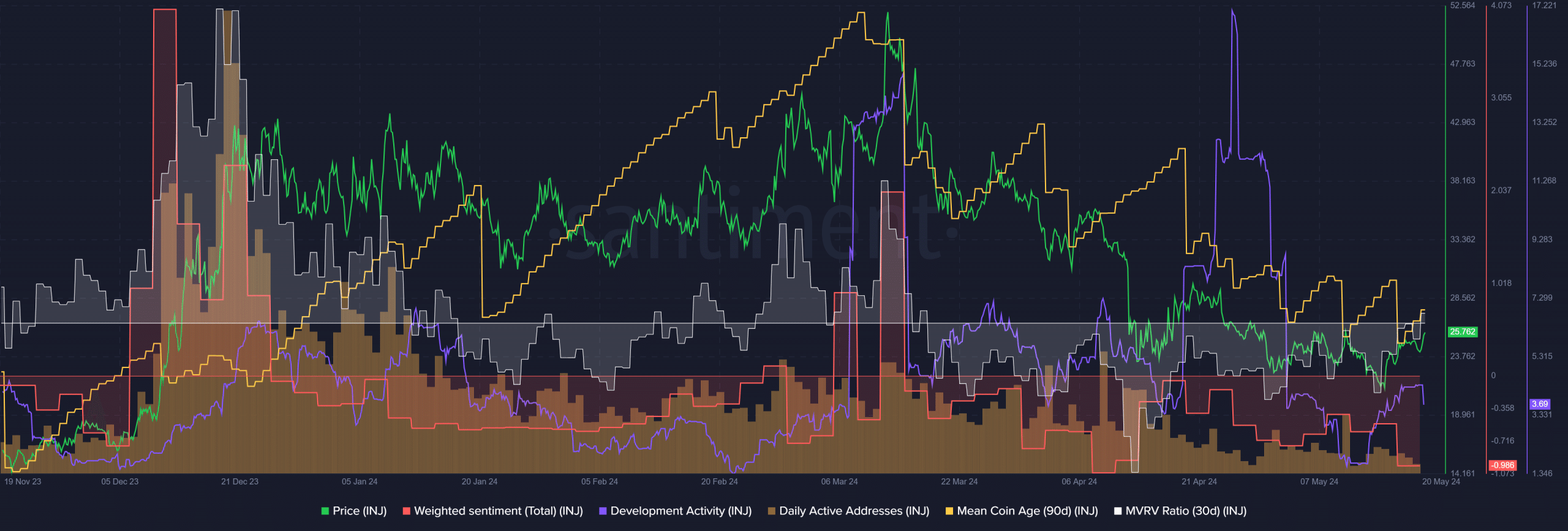

However, this general picture does not fully reflect the single-day price trends of the tokens. Technical analysis shows that INJ, in particular, has performed poorly. Both INJ and GRT show a clear downward trend in daily charts, indicating a short-term bearish trend.

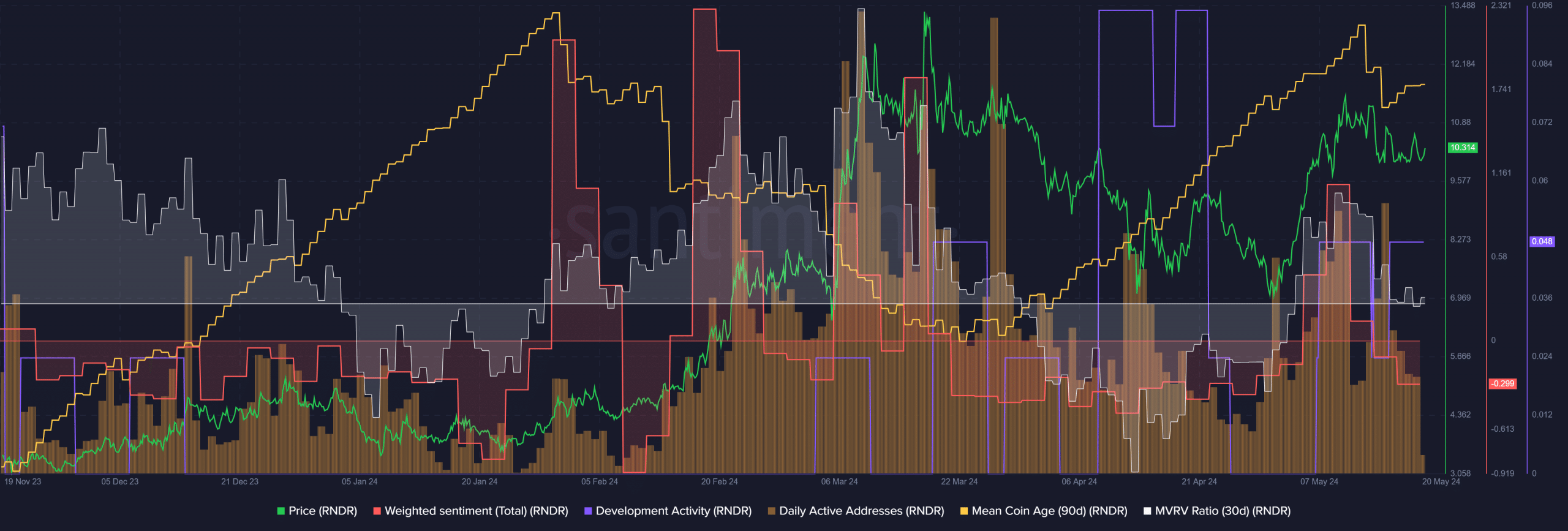

On the other hand, RNDR has formed a short-term range below the $11.3 resistance level. This indicates that price movements are limited below a certain resistance level.

Purpose of the Tokens

The purpose of these tokens is also important. Render Network is a peer-to-peer P2P platform that uses Blockchain to distribute GPU processing power. Its goal is to democratize the GPU cloud and make it more efficient and scalable.

The Graph is an indexing protocol that provides developers with access to the necessary data to build decentralized applications. It also aims to reduce developers’ costs and improve server uptime.

Injective, on the other hand, serves as a decentralized exchange, enabling cross-margin trading, futures, and forex transactions. Built as a Layer-2 application, it uses cross-chain bridges to provide investors access to assets across different networks.

On-Chain Metrics Reflect Price Trends to Some Extent

Over the past three weeks, RNDR has shown an increase in daily active addresses, but development activity has remained low. This is a concerning development for RNDR, unlike Cardano. Weighted sentiment has remained negative, and the increasing trend in the age of the cryptocurrency reflects accumulation in the market.

On the other hand, GRT experienced a decline in daily active addresses but had reasonable development activity. Although weighted sentiment was negative, it showed signs of recovery in recent weeks. The increase in the age of the cryptocurrency and the positive MVRV ratio provide positive signals for accumulators and short-term investors.

Injective, however, showed a sharper downward trend compared to the others, with a decline in active users and low development activity. Weighted sentiment remained negative, and the average coin age was also in a downward trend. This increases the selling pressure.

RNDR, with high daily active users, accumulation trends, and rising prices, may outperform the other two in the coming weeks.

Türkçe

Türkçe Español

Español