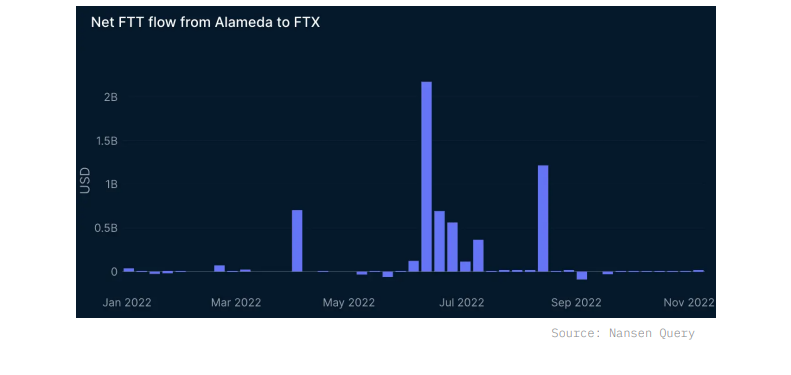

According to blockchain data analysis firm Nansen, Alameda Research conducted token transfers worth $4.1 billion before the collapse of FTX. The FTT token is among the crypto assets involved in the transfer. On-chain data shows that FTX held a significant portion of the total FTT token supply and conducted large FTT transactions between these two companies. The report also revealed that Alameda had been selling FTT tokens on unlicensed exchanges and using them as collateral from cryptocurrency lending firms.

Alameda and FTX Relationship Exposed

A report published by Nansen shed light on the close relationship between the two companies founded by Sam Bankman-Fried. The former CEO of FTX is facing a series of allegations related to the collapse of the companies and will appear in court for the first time.

According to Nansen analysts, the collapse of FTX began with the report from Alameda Research, which held 40% of the FTT supply, in September 2022. At that time, the company had tokens worth $14.6 billion. Analysts highlighted suspicious interactions observed between these two companies. According to this, Alameda conducted a series of transfers to FTX, including 4.1 billion FTT tokens and $388 million worth of US dollars, between September 28 and November 1.

On-chain data also shows that FTX holds approximately 280 million out of a total of 350 million FTT supply. This figure is equivalent to 80% of the total supply. Blockchain data also reflects a significant portion of the billions of dollars’ worth of FTT transaction volume occurring between various FTX and Alameda wallets.

Transactions Made via FTT Token

In addition to all this, Nansen stated that a large majority of the FTT token supply, consisting of company tokens and tokens outside the company, is locked in a three-year vesting contract. According to analysts, the sole beneficiary of the contract is a wallet controlled by Alameda.

In short, Nansen pointed out that the two companies control approximately 90% of the FTT token supply and claimed that these organizations could support each other’s balance sheets. The report also suggests that Alameda likely sells FTT tokens on unlicensed exchanges and uses them as collateral for loans obtained from cryptocurrency lending firms:

“This theory is supported by past on-chain data, where we regularly observed significant inflows and outflows with transfer volumes of up to $1.7 billion between FTX, Alameda, and Genesis Trading wallets, as seen in December 2021.”

Türkçe

Türkçe Español

Español