Past negative experiences sometimes shed light on the path for future events, and Young Ju cautions. The biggest trigger of the 2022 bear market that devastated the cryptocurrency markets was the collapse of Terra (LUNA). The destruction was due to an algo stablecoin structure that failed to account for fluctuations in Bitcoin prices.

Could Be Devastating for Bitcoin

The bad outlook on algorithmic stablecoins was due to the collapse of Terra’s UST. The poorly designed and failed UST mechanism triggered a death spiral. It later emerged that Do Kwon once again anonymously orchestrated a similar destruction. Do Kwon is now under house arrest and has escaped prison, but cryptocurrency investors could experience similar events again.

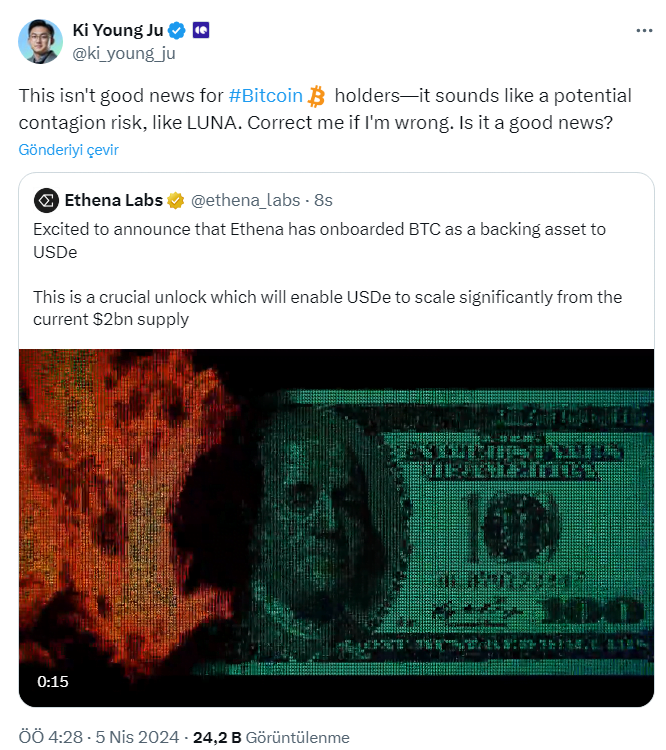

CryptoQuant CEO Ki Young Ju sees a significant risk in Ethena adding BTC as a collateral asset to USDe and stated the following;

“Ethena adding BTC as a collateral asset to USDe is not good news for Bitcoin investors. It looks like a potential risk similar to LUNA. Correct me if I’m wrong. Is this good news?”

Ethena and USDe

Ethena’s announcement made about 7 hours ago spoke of Bitcoin becoming the underlying asset for the stablecoin. This story, reminiscent of the Terra incident, which initially caused a rise in BTC prices, could yield similar results in the short or long term.

Before moving on to Ethena’s announcement, we need to briefly talk about this stablecoin. USDe’s peg to 1 dollar is maintained by using delta hedging derivative positions against the collateral held in the protocol. In addition to staking income for ETH, Ethena claims to have launched a resilient stablecoin with funding income from futures markets. Although different from Terra’s UST story of direct use as an underlying asset, USDe’s architecture does not seem isolated from the contagion risk highlighted by the CryptoQuant CEO.

The announcement made by Ethena stated the following;

“I am excited to announce that Ethena has included BTC as a supporting asset for USDe.

This is a very important step that will significantly scale USDe from its current supply of 2 billion dollars. The unprecedented growth seen since the launch tells us that we have a long way to go.

With the 25 billion dollars of BTC open interest ready for Ethena to delta hedge, USDe’s scaling capacity has increased by more than 2.5 times. In just one year, the BTC open position in major exchanges (excluding CME) has risen from 10 billion dollars to 25 billion dollars, and the ETH open position from 5 billion dollars to 10 billion dollars. BTC derivatives markets are growing faster than ETH and offer better scalability and liquidity for delta hedging.

BTC also provides a better liquidity and duration profile compared to liquid staking tokens. As Ethene approaches 10 billion dollars, this provides a more robust support and ultimately a safer product for users. Although BTC does not have a native staking yield like staked ETH, in a bull market where funding rates are over 30%, the 3-4% staking yields are less significant. The current environment is ideal for optimizing the scalability of USDe. Starting tomorrow, BTC support positions will be transparently reflected on dashboards.”

Türkçe

Türkçe Español

Español