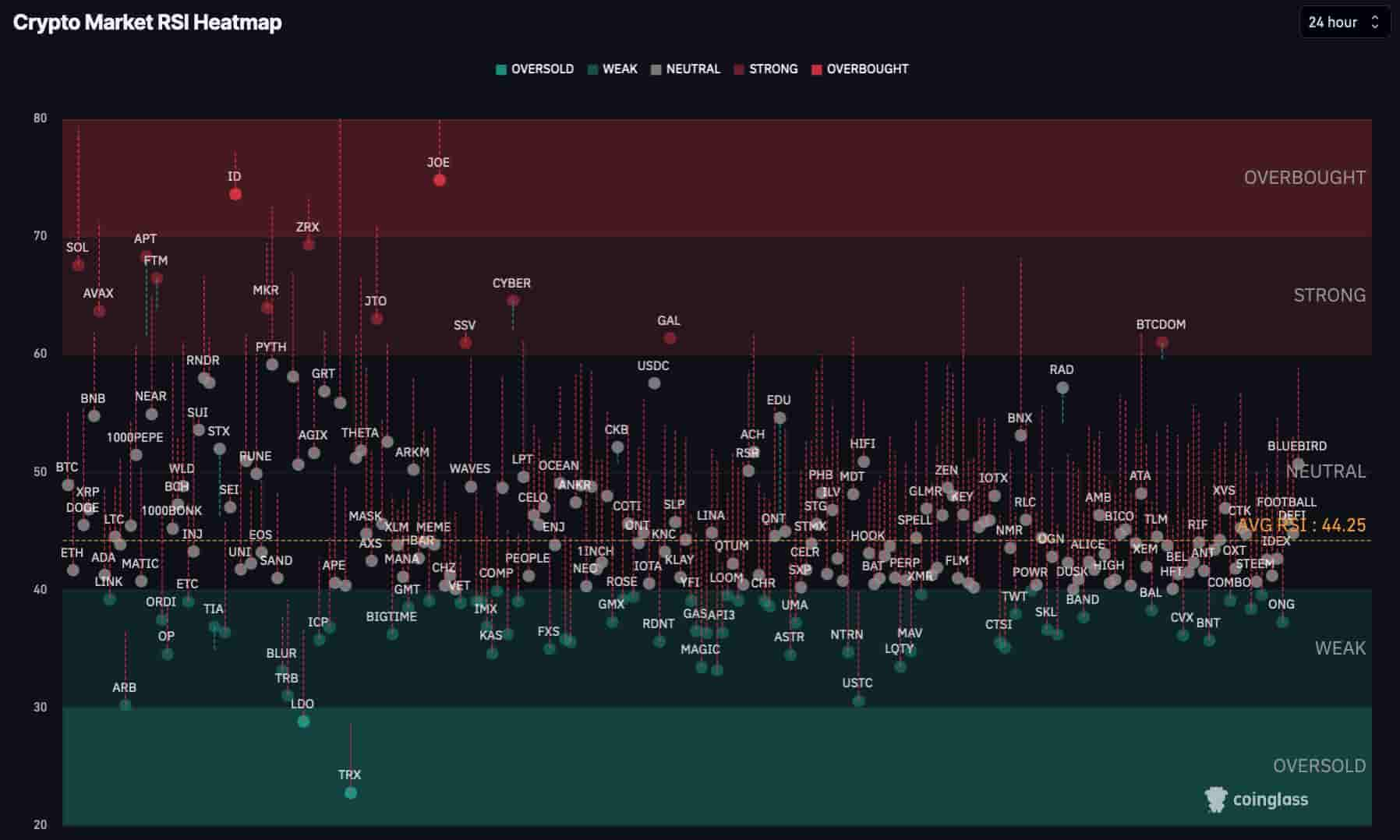

The cryptocurrency market has been the target of a significant downturn, with billions of dollars wiped from its value in the last 24 hours. Despite the overall market crash, the Relative Strength Index (RSI) indicators of two particular altcoins continue to signal overbought conditions, indicating a strong downturn. The RSI is known to serve as an important indicator of market sentiment.

TraderJoe (JOE) and Space ID’s (ID) RSI Levels Sound the Alarm

Despite market fluctuations, TraderJoe (JOE) and Space ID (ID) are notable for maintaining their overbought status as indicated by their RSI. JOE, the native asset of Avalanche‘s leading decentralized exchange, has a daily RSI value well above the market average at 74.83. Similarly, Space ID’s daily RSI value stands at 73.63, indicating strong momentum despite price drops in the last 24 hours.

Despite being in an overbought state, both JOE and ID have experienced significant price drops in the last 24 hours. JOE’s price has fallen by up to 20% to $0.8459, while ID has seen an 8.74% increase to $1.60 in the same time frame.

TraderJoe and Space ID stand out in the cryptocurrency world for serving different purposes. While TraderJoe operates as a decentralized exchange within the Avalanche network, Space ID is designed as a protocol to create a naming service network similar to the Ethereum Name Service (ENS) on Ethereum.

An Overbought Signal Does Not Guarantee a Downturn

Investors and traders should be aware that an overbought RSI signal does not guarantee a short-term price crash. Although RSI technically presents a potential sign of weakness, altcoins can show resilience and rise. Indeed, ID’s recent 10% increase despite its overbought RSI confirms this.

Generally, before making any investment decision, investors and traders should consider other factors and technical indicators. Despite sell signals, both JOE and ID could surprise investors by maintaining their strong momentum and outperforming the general market.

Türkçe

Türkçe Español

Español