Altcoins have slightly retreated due to the possibility of a further deepening of the recent Bitcoin downturn, testing support levels. The fluctuation of BTC is demoralizing investors who are rightfully reducing their risks. So, what are the predictions for AVAX, SOL, and LUNC Coin? What awaits investors in the coming days?

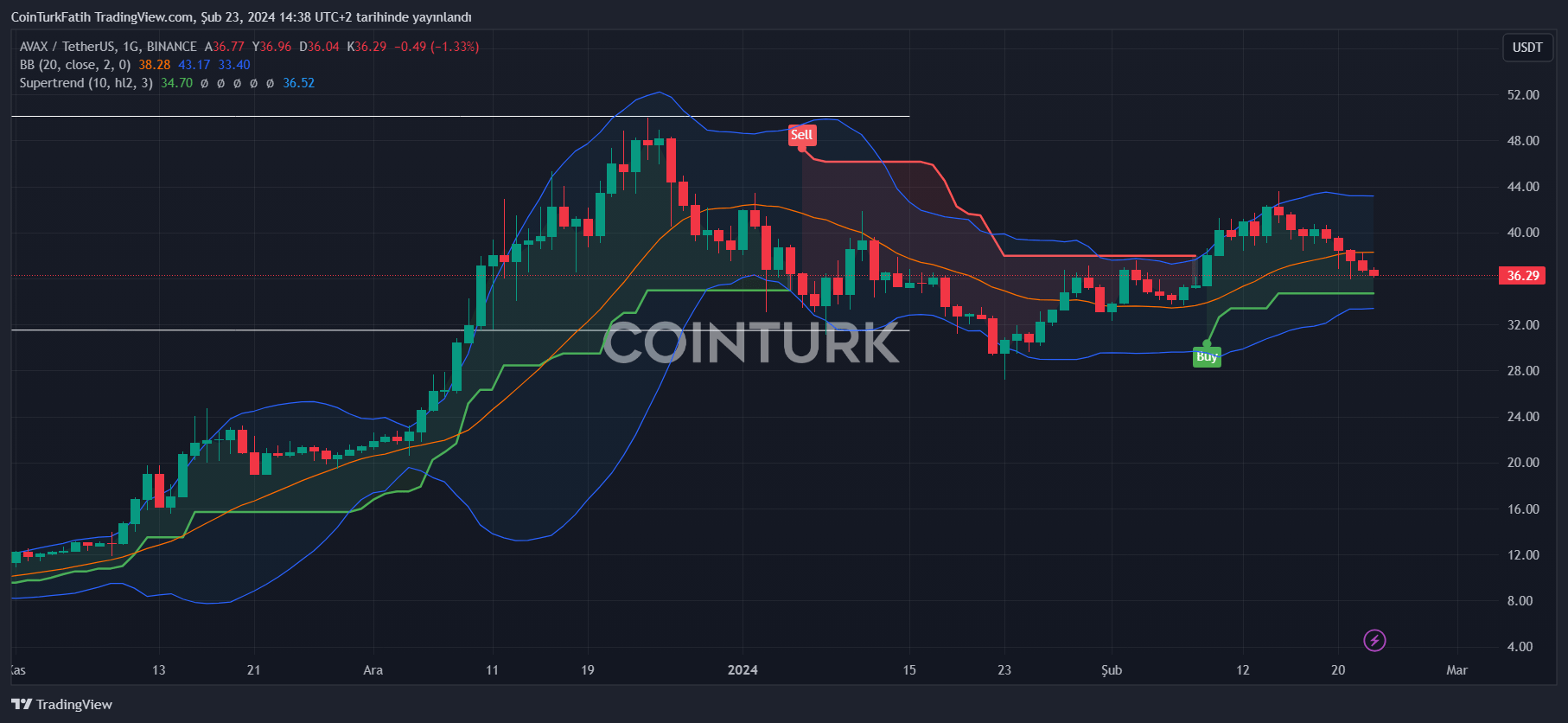

Avalanche (AVAX)

At the time of writing, the popular layer1 altcoin is finding buyers at $36, moving away from its $50 target. This is not surprising as the trend of risk reduction is dominant across the market. The volumes expected to decrease over the upcoming weekend also pose a risk for the price. For now, an outage in the Avalanche network, whose cause is under investigation (the exact cause was unknown at the time of writing), is also putting pressure on the price.

While it was forming green candles on the rise, it is now creating the opposite to complete the peak, and AVAX may continue to melt down to $34. Below this, we risk seeing accelerated selling and a test of the $31.5 level.

In the opposite scenario, surpassing $43.5 could target AVAX back to $50.

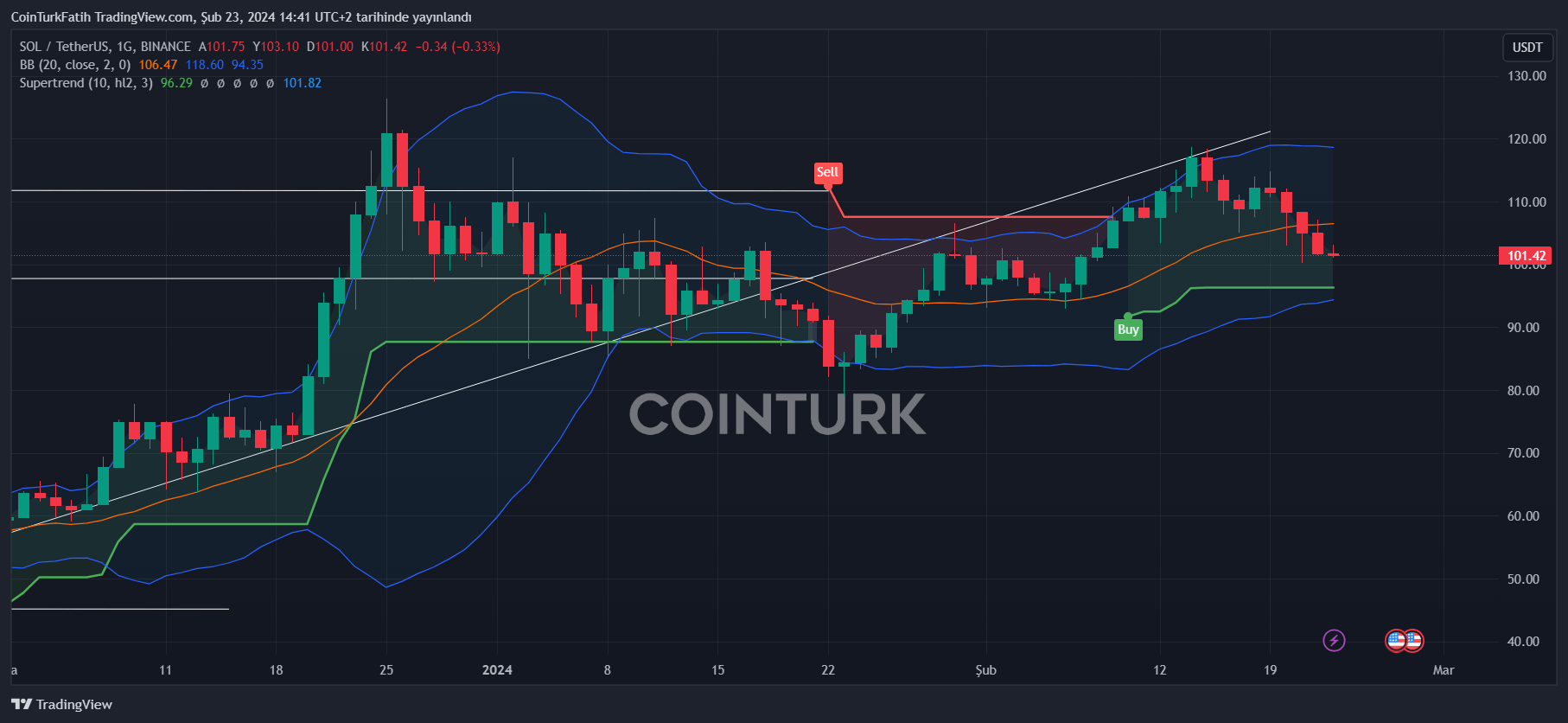

Solana (SOL) Commentary

Although it briefly surpassed BNB in market value several times, this has now reversed. The SOL Coin price is at the $100 threshold at the time of writing. The general market sentiment, profit-taking, and the approaching weekend are also negatively affecting it.

SOL Coin, forming a similar peak to AVAX, is moving with the risk of dropping to the $93 region. It would not be surprising to see accelerated selling if the price loses $100. The key support zone is found in the $87-88 range. Below this, we could see a major bottom that could reverse the uptrend. We had mentioned that SOL Coin’s price was trading at a positive premium compared to BNB in terms of TVL.

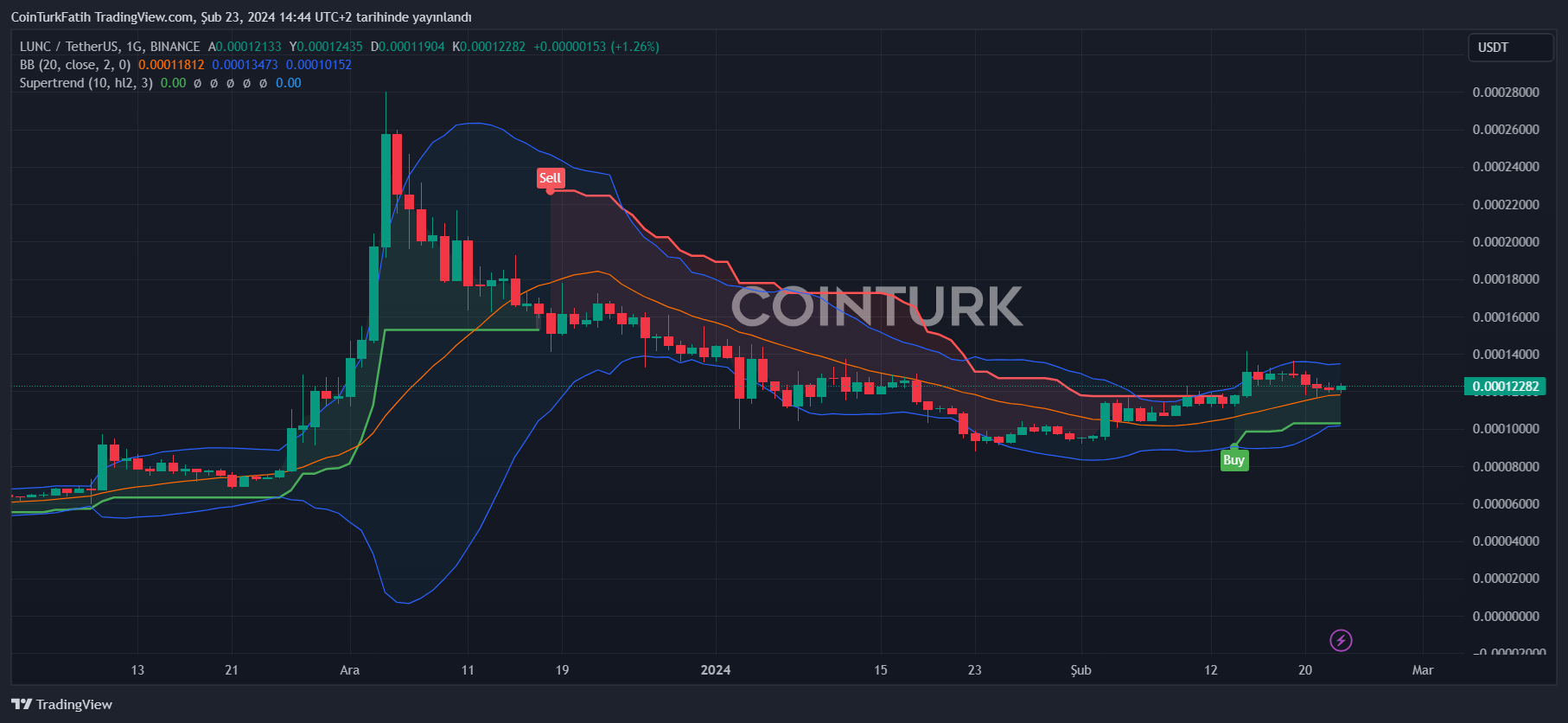

LUNC Chart Commentary

After the collapse of Terra, the legacy of the ghost town continues to survive. LUNC Coin fell from a peak of $0.000280 to $0.000088. Now it is trying to maintain the $0.000117 support to avoid deeper lows.

If LUNC price loses this support in the coming days, it could fall to $0.0001035 and the bottom support level. Closures below this could push the price to a $0.000067 base, erasing gains from the last rise.