Strong signals have started to appear for the rise of altcoins in the cryptocurrency market. Bitcoin’s (BTC) dominance in the market has reached a peak of 57.67%, indicating a potential cycle peak. This development has increased expectations of an approaching altcoin season. Investors are turning to large-volume altcoins as the historic altcoin season begins.

Bullish Breakout in Toncoin (TON)

One of the factors strengthening this bullish expectation is the approval of multiple spot Ethereum ETFs in the US. Additionally, the approval of the first spot Solana ETF in Brazil and the resolution of the lawsuit between the SEC and Ripple are seen as significant milestones in the altcoin market. All these developments are increasing investors‘ interest in altcoins, bringing new momentum to the market.

At this point, Telegram-supported Toncoin (TON) attracted attention with its bullish breakout at the beginning of this year. The Web3-based Layer-1 network has approximately $600 million in total locked value and $619 million in stablecoin value. Toncoin’s strategic partnerships with Tether (USDT) and gamifi projects like Hamster Combat and Notcoin (NOT) significantly contribute to TON’s rise.

Toncoin’s listing on Binance was a significant factor driving the altcoin’s price upwards. Since Monday, TON’s price has risen by over 8%, starting to trade at around $6.66. However, for TON to sustain its bullish momentum, it is critical to turn the 50-day Moving Average (MA) into a support level.

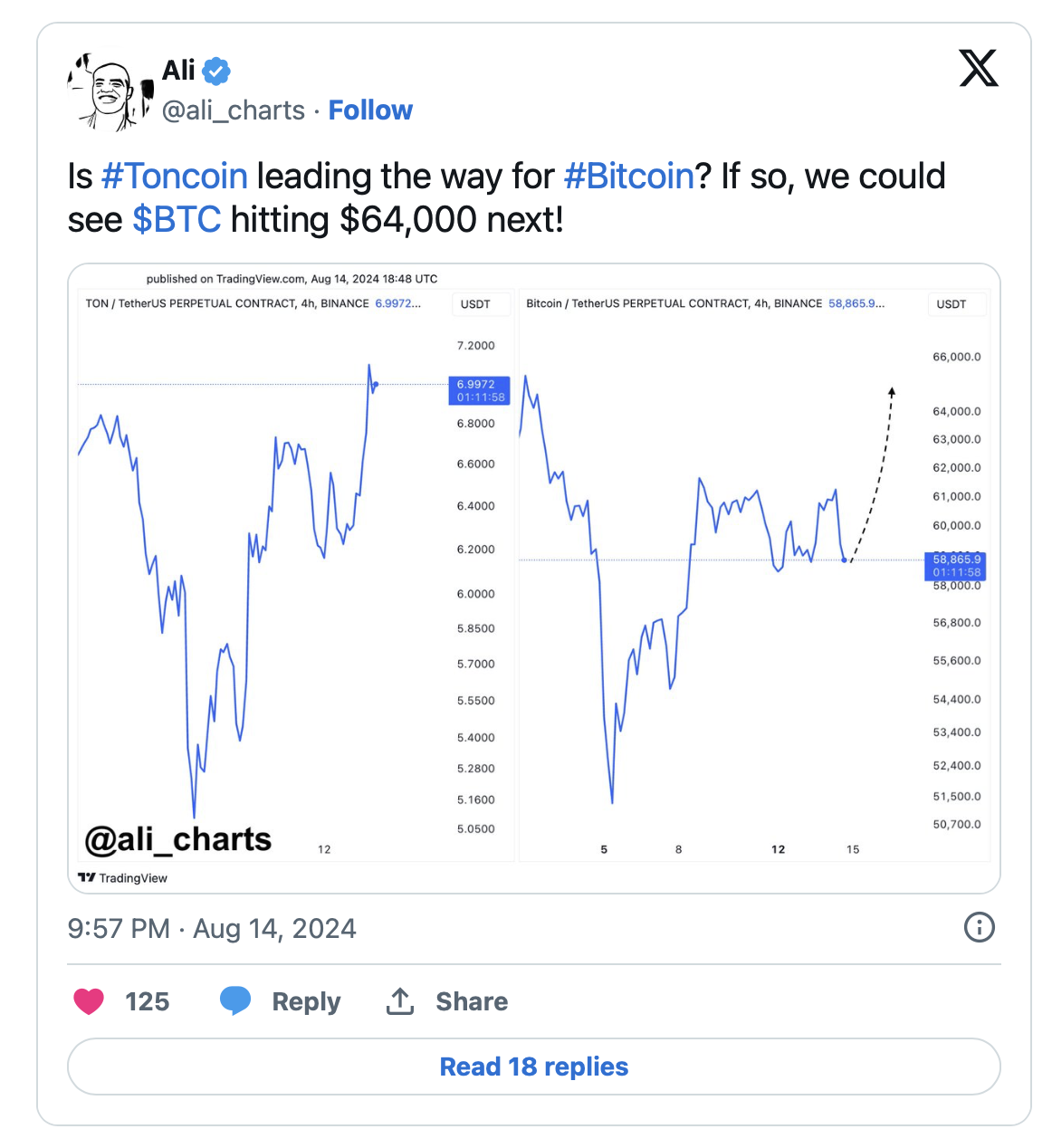

Bitcoin’s Price Movement and Emerging Fractal Pattern

According to experienced crypto analyst Ali Martinez, if Bitcoin’s price breaks a similar fractal pattern seen in TON’s price, it could rally towards $64,000. Bitcoin’s price encountered resistance at $61,000 after a death cross formed between the 50 and 200-day MAs and then pulled back to the support level at $58,000.

From a technical standpoint, the price of the largest cryptocurrency is at a major breakout point that will determine its price movement in the coming months. This breakout could trigger either an upward trend or a deeper correction.

Türkçe

Türkçe Español

Español