AltLayer (ALT), the 45th altcoin project on Binance‘s Launchpool, will be listed on the cryptocurrency exchange today for trading. While it is expected that ALT will be listed on other cryptocurrency exchanges following the Binance listing, it has been identified that market maker GSR, which has been powering crypto innovation since 2013, is in preparation.

GSR Transfers Millions of ALT to Exchanges

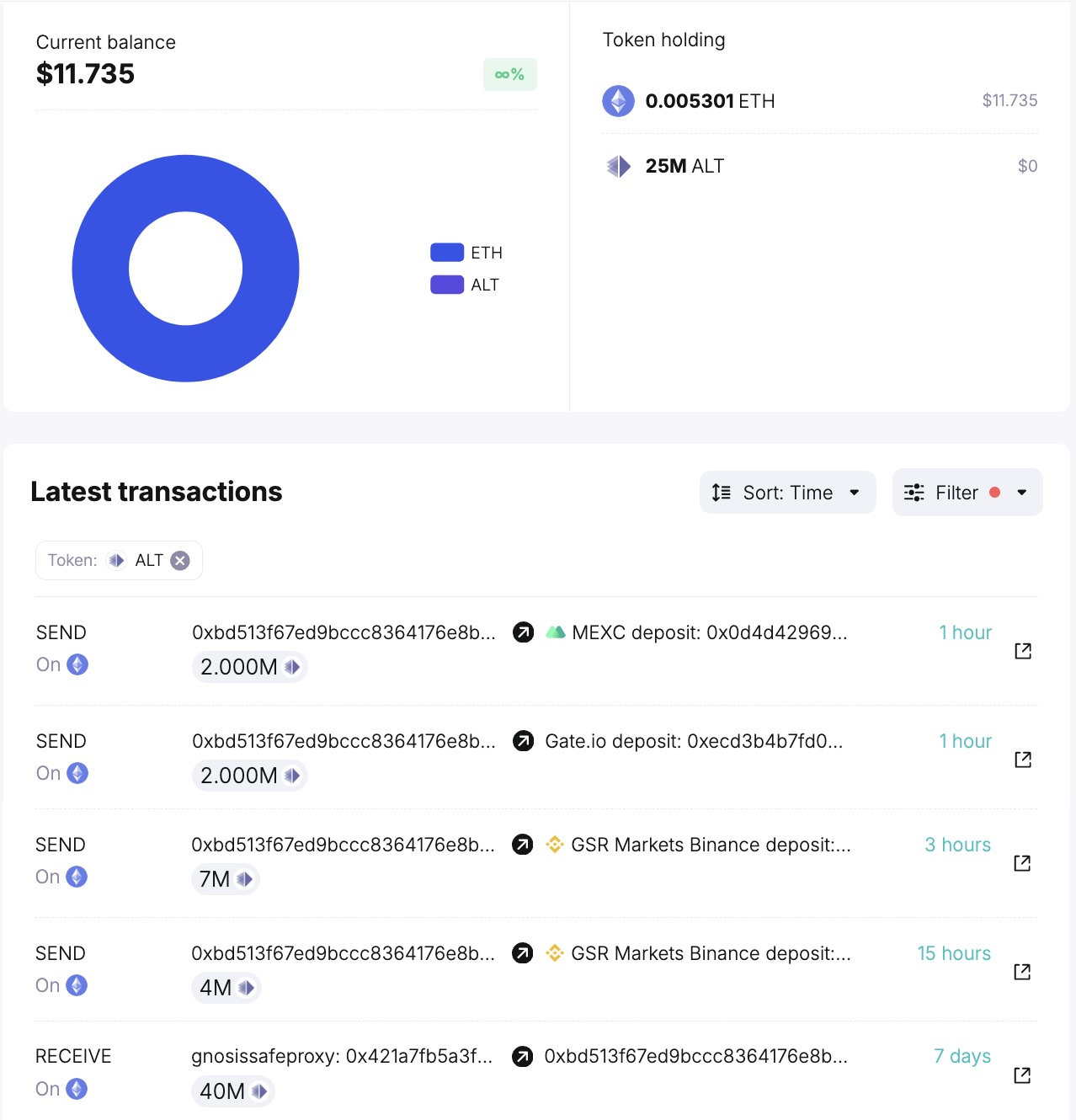

AltLayer’s ALT, the 45th altcoin project on Binance’s Launchpool, will be listed on the cryptocurrency exchange today at 13:00. The on-chain data platform Spot On Chain reported that market maker GSR transferred ALT to multiple cryptocurrency exchanges before the Binance listing.

According to on-chain data, 40 million ALT were transferred from a multi-signature wallet address to GSR six days ago. The data shows that GSR deposited 15 million ALT to exchanges such as Binance, MEXC, and Gate before the listing.

The Role of Market Makers

Being a market maker, GSR’s transfers of ALT to cryptocurrency exchanges are not intended for selling. A market maker is a person, institution, or intermediary firm ready to buy or sell in financial markets to facilitate trading transactions and increase market liquidity. Market makers take on the role of setting buying and selling prices for a financial instrument and continuously offering bid and ask quotes.

Market makers have many duties. They provide buying and selling prices for a specific financial instrument. These offers are important for providing liquidity in the market and facilitating transactions for other participants. Market makers try to control fluctuations in the market to maintain price stability, which reduces excessive volatility.

Market makers also undertake the task of narrowing the spread. The spread represents the difference between the buying and selling prices. Market makers, by narrowing the spread, enable investors to trade at more favorable prices and provide the opportunity for instant transactions by continuously offering buying and selling prices.

Market makers are often encouraged to provide liquidity in financial markets and increase trading volume, but this role comes with some risks, especially sensitivity to rapid changes and fluctuations in the market. Market makers typically earn income from commissions or spreads from trading transactions.

Türkçe

Türkçe Español

Español