Bitcoin faced a new wave of selling pressure after the Wall Street opening on December 15, falling below the $41,700 level. At the time of writing, Bitcoin was trading at $42,108, with data from TradingView indicating that the BTC/USD pair had experienced a drop of over $1,300 or 3.2% during the day.

What’s Happening on the Bitcoin Front?

Recently recovering from sudden volatile movements on December 14, Bitcoin could not maintain the $43,000 level due to selling pressure from investors. The weakness in Bitcoin’s price coincided with the news that the United States Securities and Exchange Commission (SEC) had rejected a request from the major exchange Coinbase to revise its crypto regulations. SEC Chairman Gary Gensler stated the following:

“Today, the Commission rejected a rule-making petition submitted on behalf of Coinbase Global, Inc. I am pleased to support the Commission’s decision for three reasons. First, existing laws and regulations also apply to the crypto securities markets. Second, the SEC is also addressing the crypto securities markets through rule-making. Third, it is important to preserve the Commission’s discretion in setting its own rule-making priorities.”

The SEC is already involved in the current crypto market process, due to expectations that it will approve the first U.S. Bitcoin spot price exchange-traded fund services (ETF) at the beginning of 2024. In an interview with Bloomberg on December 13, Gensler acknowledged the latest legal process related to the institution’s repeated rejections of Bitcoin spot ETF applications.

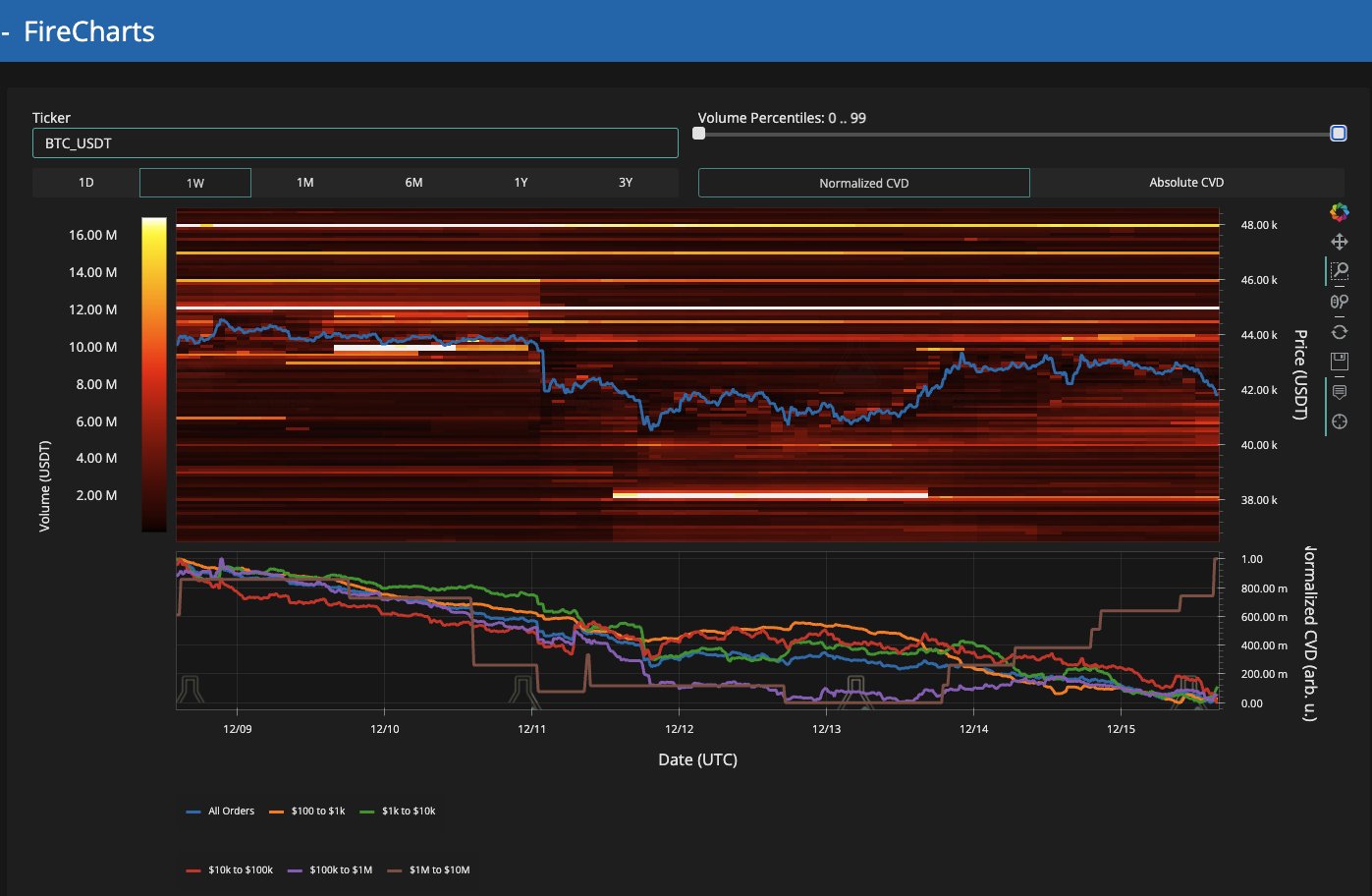

Popular investor Skew, analyzing the current state of the BTC/USD pair’s order books, noted an increase in bid support around the $41,000 level. Skew shared his thoughts on the subject as follows:

“The increasing bid depth around $41,000 will be interesting from here on out. The active supply is around $44,000.”

Whale Purchases Continue

With these developments, Keith Alan, the founding partner of trade data source Material Indicators, pointed out the ongoing struggle to turn an important weekly level into support. This step came in the form of a 0.5 Fibonacci retracement line near the $42,500 level, which is one of the several key hurdles to be crossed on the way to the all-time high of $69,000.

Material Indicators also noted that large-volume investors have increased their purchasing activities during this period, with the following statement:

“Mega Whales are buying and trying to reclaim the $42,000 level.”