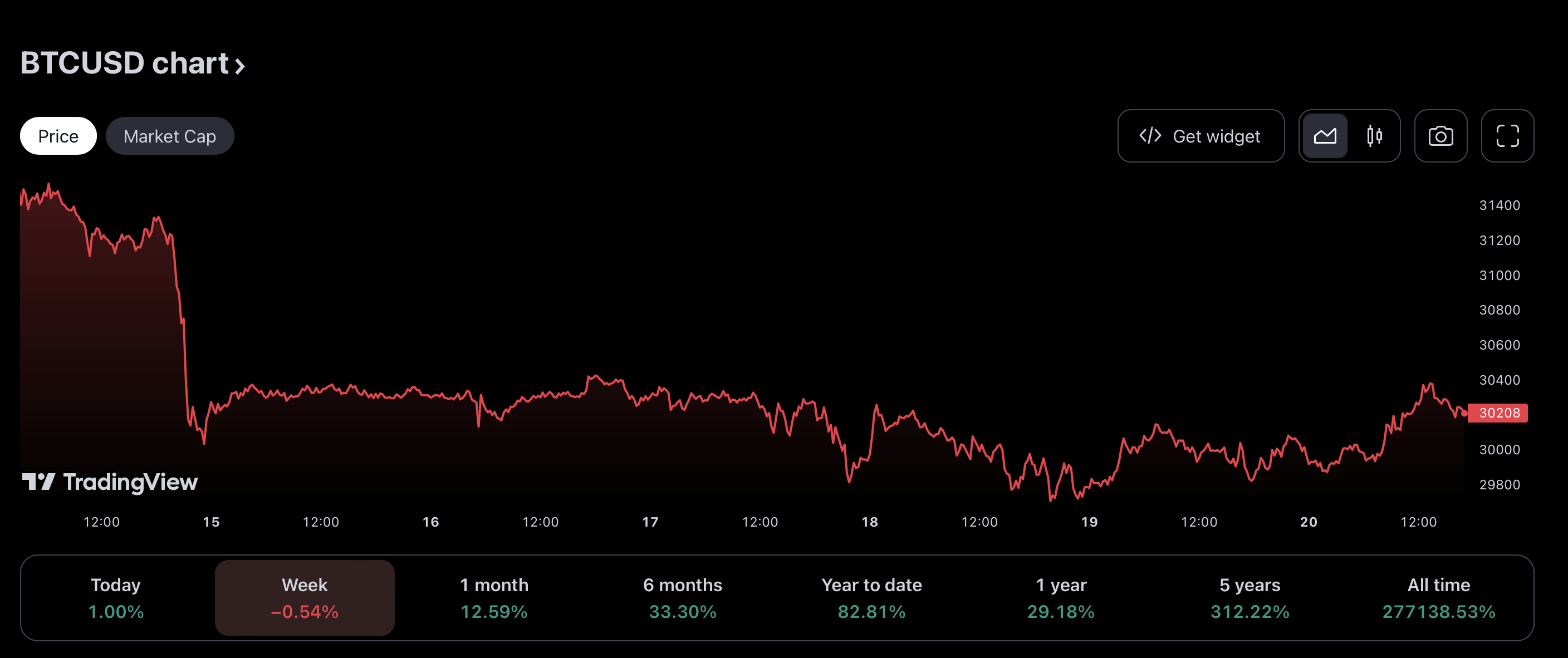

Last week, the leading cryptocurrency Bitcoin (BTC) reached price levels of up to $31,500 with the historic decision in the Ripple case and the subsequent gains it recorded in a matter of days. However, after starting the new week with a decline, BTC fell to levels of $29,900 during the week. With the price movements it has recorded in the past week, BTC has started trading at price levels of $30,000.

Bitcoin Consolidation Continues

The cryptocurrency market experienced a significant increase last week after the judge in the Ripple case ruled that Ripple’s sales of XRP did not constitute investment contracts. However, with the market starting to decline again at the beginning of the week, the leading cryptocurrency Bitcoin (BTC) fell to levels of $29,900 after reaching price levels of $31,500 last week.

The leading cryptocurrency, which started to consolidate at the $30,000 price levels in the past week, began trading at $30,200 with an average increase of about 1% in the last 24 hours as the market started the day with an upward trend.

Meanwhile, analyst Michael Van de Poppe, who evaluated the current situation in the market, suggested that in order for BTC to accelerate its upward movement, it needs to surpass the price levels of $30,300 and $30,500 in the short term.

Analyst Points to Critical Price Levels

As the uncertainty in Bitcoin continues, cryptocurrency analyst Michael Van de Poppe evaluated the current technical outlook in a series of tweets and pointed out possible price levels that could play a critical role for BTC in the near term.

The analyst argued that the price levels he thought BTC should surpass in order to accelerate its upward movement are quite critical. He stated that for the cryptocurrency market to initiate a strong upward movement again, BTC needs to surpass the price levels of $30,300 and $30,500 respectively, and that once these levels are surpassed, the upward momentum could gain speed.