Bitcoin price tested $72,000 and then fell back to the $65,000 levels, causing significant altcoin erosion. Post-Fed intensified sales were also on the agenda of a popular analyst followed by investors for years. The analyst, who addressed the recent price fluctuation, also provides insights into the coming days. So, how does the expert analyst interpret the decline?

Why Did Cryptocurrencies Really Fall?

Willy Woo, known for his on-chain evaluations, has been in crypto for years. Woo, examining the factors that intensified the recent Bitcoin drop, wrote on his social media account that long-term Bitcoin (BTC) investors could no longer resist selling. According to the analyst, long-term sales triggered these losses.

Focusing on the Average Coin Age metric, he thinks the sharp, vertical rise here was formed by the transfer of assets to be sold on exchanges. The subsequent drop significantly confirms this.

“First, let me tell you who is selling. Old users. They are selling. They own more BTC than all ETFs combined… 10 times more. And they sell in every bull market. This model is as old as the Genesis block.”

Paper BTC Intensifies the Drop

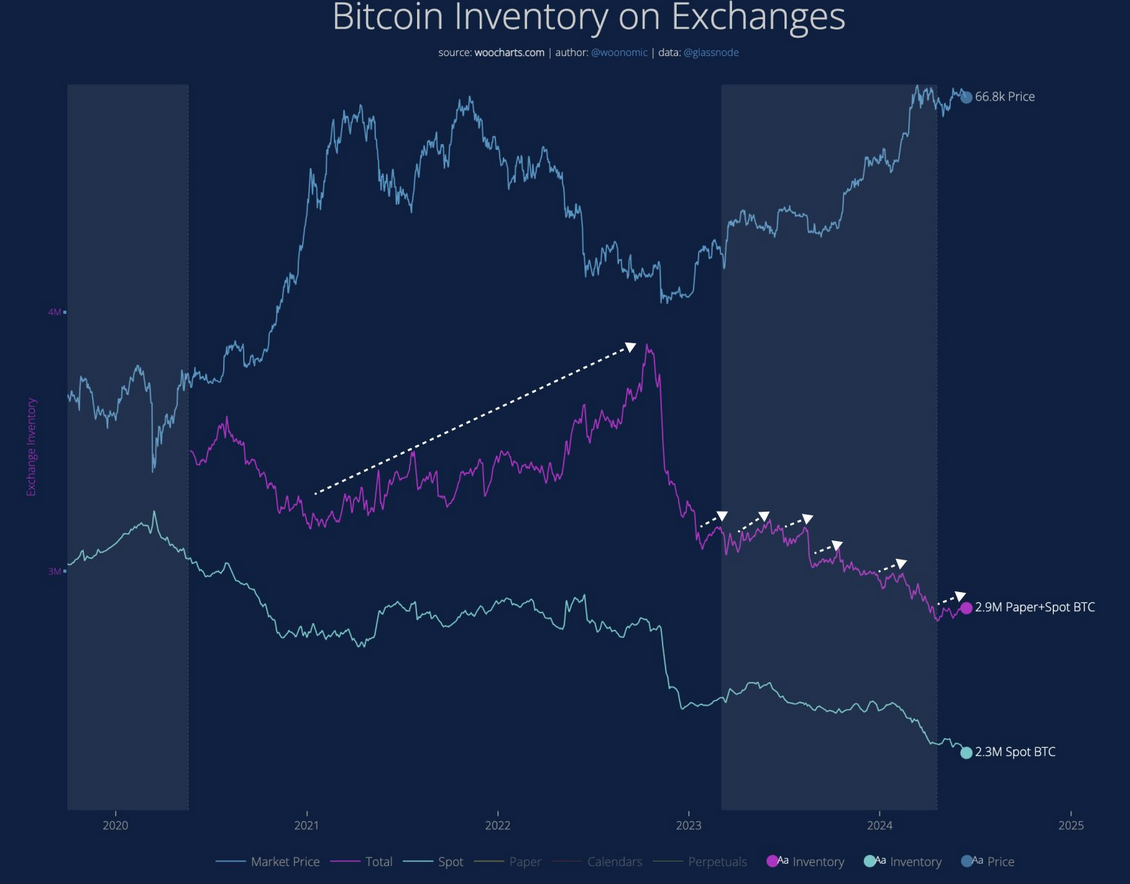

Willy Woo defines futures and futures BTC ETFs as paper BTC. He had long explained why the real supply shortage story would be written with the approval of Spot Bitcoin ETFs. In his latest assessment, he wrote the following;

“Paper BTC has filled the market since 2017. Futures markets. If you wanted to buy BTC, you used to have to buy real BTC. Now you can buy paper BTC. Thus, someone who doesn’t use coins can sell you this paper. Together, you create a synthetic BTC.

Potential demand for BTC is directed to paper BTC, met by counter-investors who do not have BTC to sell, only USD to support their positions.

In the past, BTC would increase exponentially because the only sellers were light sales from old investments and new issuance (miners’ supply sales). These were small amounts relative to demand. Today, what you want to watch is the magic of paper BTC. The 2022 bear market was defined by a flood of paper BTC where spot holders weren’t actually selling. In the current bull market, I have marked the places where paper supply increased, these were times when the price did not rise. We are currently in one of those.”

Türkçe

Türkçe Español

Español