Geoff Kendrick, an analyst at Standard Chartered, predicts that Bitcoin (BTC) could rise to $100,000 before this year’s US presidential election. Kendrick’s bullish outlook is based on various factors, including upcoming economic data and political developments. Kendrick believes that the Non-Farm Payroll (NFP) data, expected to be released on June 7 and anticipated to be positive for the markets, could push Bitcoin to an all-time high over the weekend and potentially pave the way for further gains.

If Trump Wins, $150,000 Could Be on the Table

According to Kendrick, as the US elections approach, Bitcoin could reach $100,000, and if former President Donald Trump wins, the price could climb to $150,000 by the end of the year.

The analyst noted that the current President Joe Biden administration’s mixed signals regarding cryptocurrency regulation (approving spot Ethereum ETFs but vetoing efforts to repeal SAB 121) suggest that Trump might be more favorable to the cryptocurrency market. Kendrick’s views highlight the potential impact of political outcomes on Bitcoin’s price trajectory.

On the other hand, Kendrick emphasized the importance of the NFP data to be released on June 7, suggesting that “friendly” results could pave the way for a new all-time high for Bitcoin over the weekend. The analyst predicts that such a scenario could lead Bitcoin to reach $80,000 by the end of June. This potential milestone would mark a significant step in the ongoing rise of the largest cryptocurrency and could set the stage for even higher prices later in the year.

Year-End and Long-Term Predictions

Looking ahead, Kendrick set a year-end price target of $150,000 for Bitcoin and predicted it could reach $200,000 by the end of 2025. The analyst noted that a price of $150,000 by the end of 2024 would bring Bitcoin’s market cap to $3 trillion, putting it in the same league as Nvidia (NVDA), which recently reached this market cap milestone. This comparison highlights Bitcoin’s potential to solidify its status as a significant asset in the global financial world.

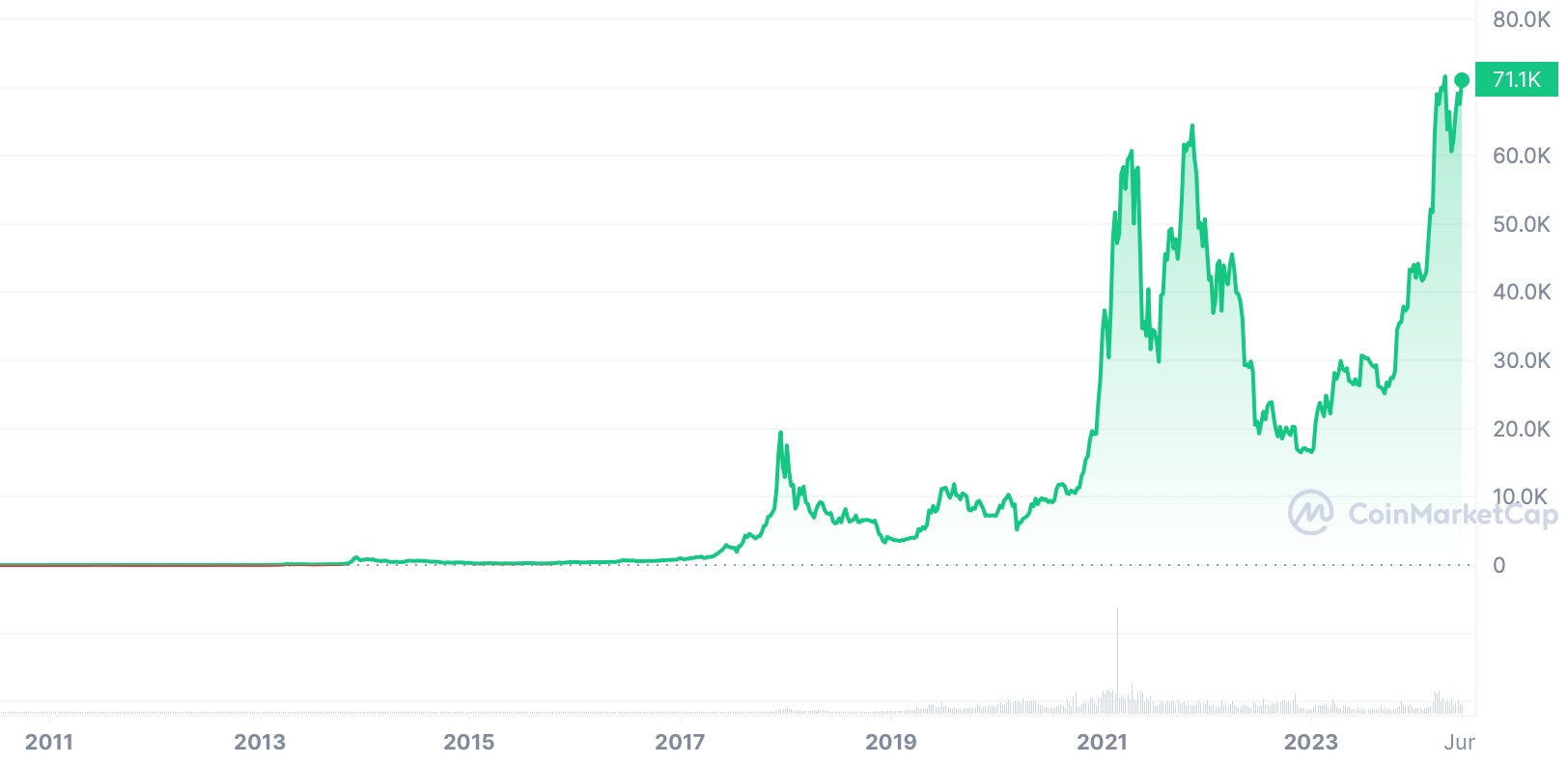

With current data, BTC is trying to hold around $71,000 at the time of writing. Despite recent stagnation, expected economic data and political events seem poised to serve as significant catalysts for future price movements.