Critical days seem to have begun for Bitcoin. As the Fed’s interest rate decision is eagerly awaited, speculations about market movements continue. Analysts’ comments during this period also hold significant importance. A prominent analyst, known for his predictions, has once again drawn attention with his comments on Bitcoin’s future. So, what does the analyst think will happen with Bitcoin?

Analyst’s Bitcoin Commentary

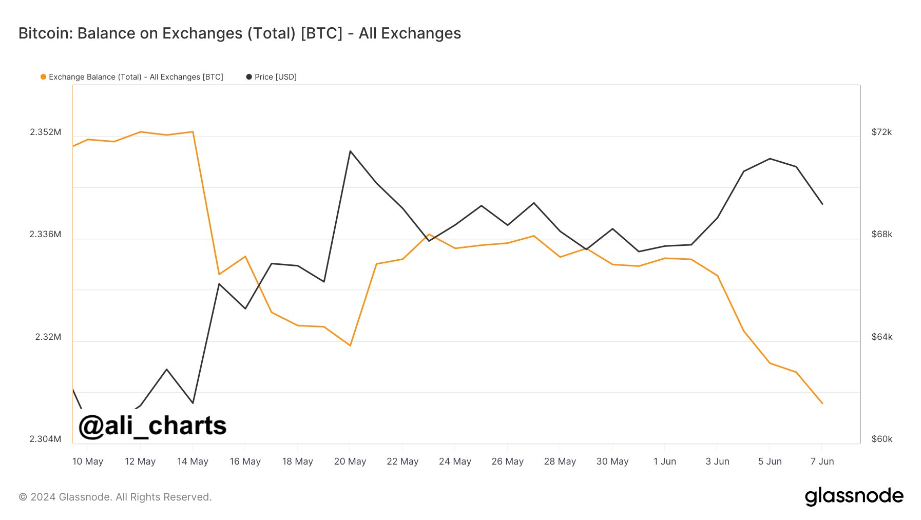

A well-known market analyst has once again commented on Bitcoin. As declines continue in the crypto market ahead of the Fed’s interest rate decision, Bitcoin (BTC) continues to see outflows from exchanges. Analyst Ali Martinez shared his views on Bitcoin in a post.

Martinez revealed in his post that approximately 22,647 BTC, valued at around $1.57 billion, were withdrawn from crypto exchanges to wallets over the past week.

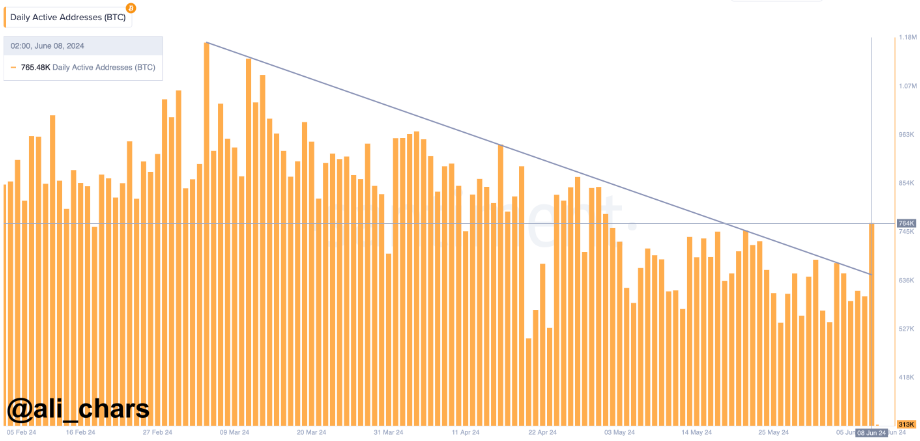

Martinez also highlighted an important point, noting that the number of Bitcoin addresses conducting daily transactions recently broke the downtrend that started on March 5, and added:

Within 24 hours, 765,480 BTC addresses were active. This increase in network activity is a positive sign for the continuation of the BTC bull run.

Bitcoin’s Future

The analyst mentioned that Bitcoin is “anchored in a strong support zone” between $69,380 and $67,350, but BTC has now fallen below these levels. In this zone, 1.97 million address holders had purchased 964,000 BTC, and these addresses are currently at a loss.

Martinez made the following statement on the matter:

It is crucial for BTC to maintain this level to sustain its upward momentum.

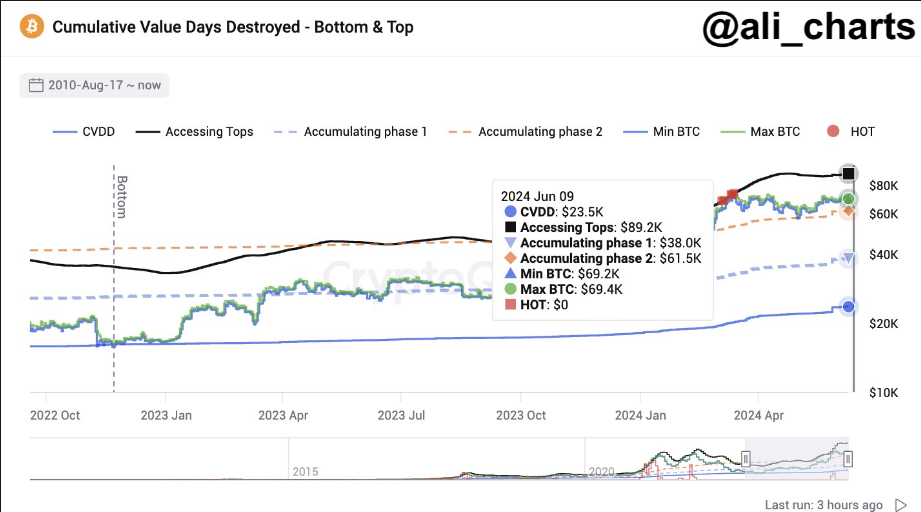

The analyst also shared a chart showing Bitcoin’s cumulative value days (CVDD). This metric examines the price value at which each Bitcoin was transacted, considering the time elapsed since the last transaction.

According to Martinez, the CVDD indicator he shared points to the next Bitcoin peak level at $89,200.

As of the time of writing, Bitcoin is trading at $66,400 after a drop of over 5% in the last 24 hours. Following the price drop, the market cap fell to $1.3 trillion, while the trading volume surpassed $36 billion after a 95% increase.

Türkçe

Türkçe Español

Español