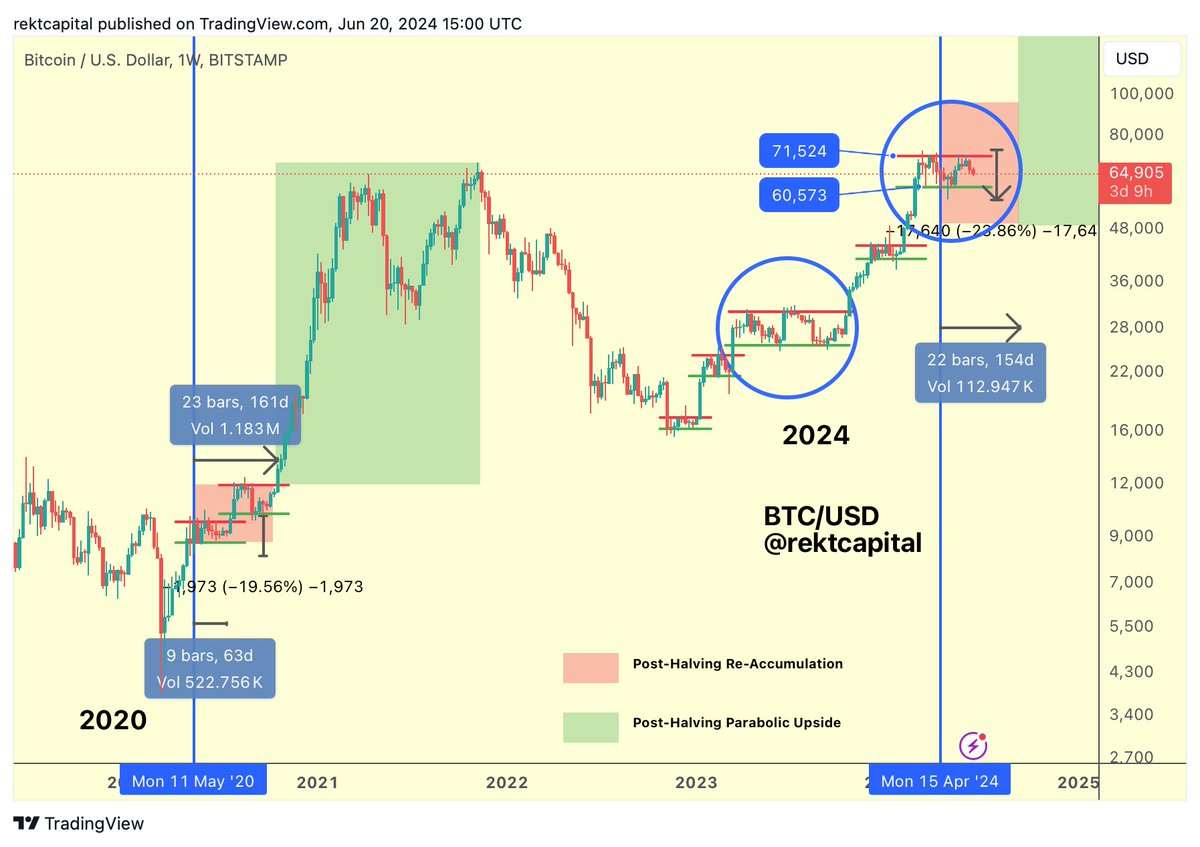

If early bull market behavior repeats, Bitcoin‘s consolidation phase may be over. Popular trader and analyst Rekt Capital made new comparisons between Bitcoin’s price movements this year and in 2023 in his latest market commentary. Rekt Capital suggests that Bitcoin may have been trading within a definite range since the last halving event in April, but the lack of price increase should not worry the bulls.

What’s Happening on the Bitcoin Front?

Looking at the past and present stages of the Bitcoin bull market, it showed that the BTC/USD pair experienced long-lasting movements as recently as last year, and he stated the following:

“Bitcoin tends to form accumulation ranges after the halving event, but we saw that Bitcoin also formed a similar-looking range in this cycle.”

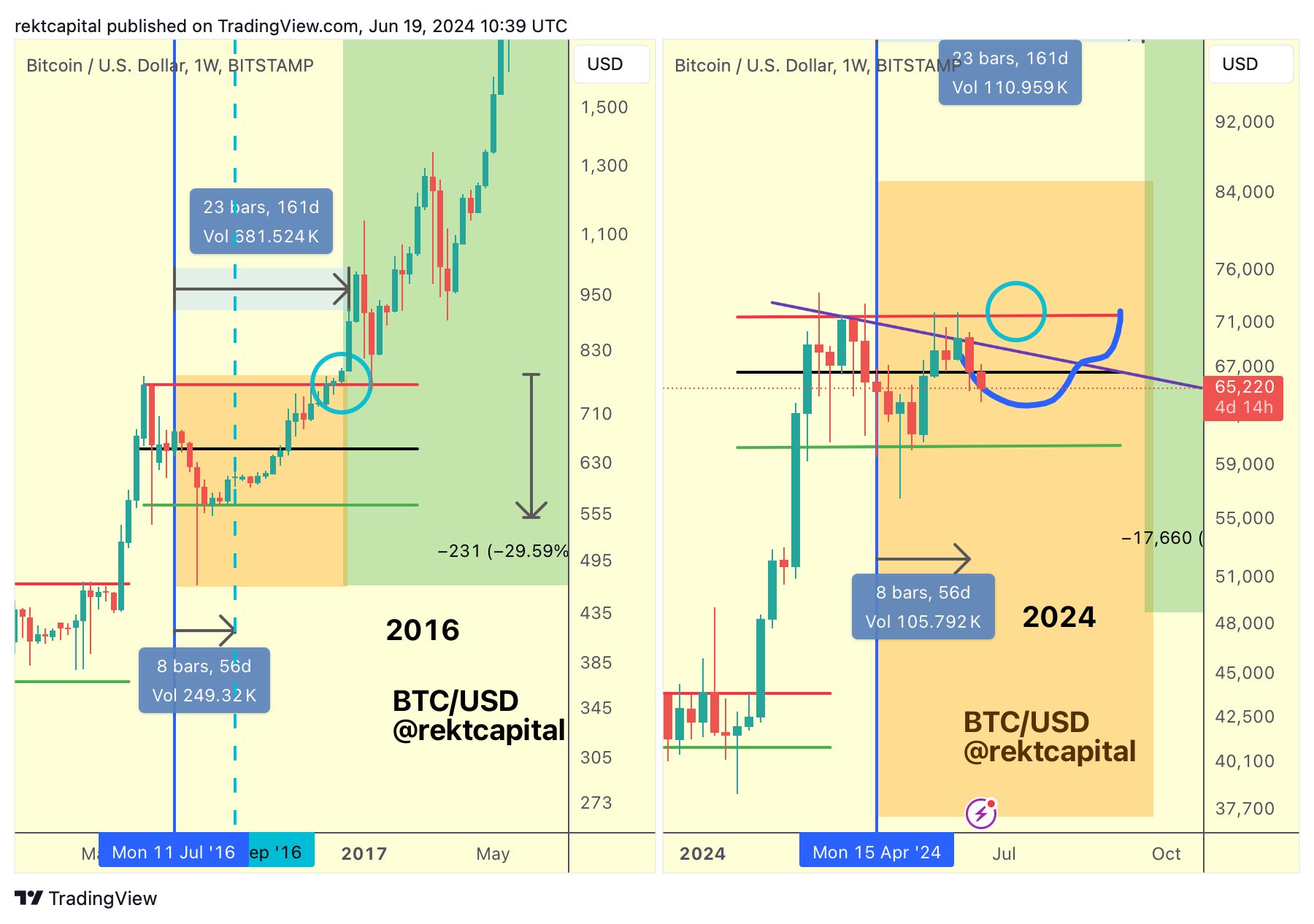

An attached chart directly compared the current status to a multi-month consolidation phase spanning the 2nd and 3rd quarters of 2023. If such a setup were present now, Bitcoin would remain in a narrow trading range for a few more months. Meanwhile, other analyses argued that this week’s Bitcoin price correction was long overdue compared to previous bull markets. The chart shared below highlights a process comparing 2024 to the early stages of the Bitcoin bull market in mid-2016.

Notable Statement from a Famous Figure

The re-accumulation phase reflects not only on prices but also on miner activities. Since the halving process reduced miners’ block subsidy by 50%, a new capitulation began according to the popular Hash Ribbons metric.

This compares the 30-day average hash rate to its 60-day equivalent, and capitulation begins when the former falls below the latter. Historically, such periods signaled favorable buying opportunities, with the most recent occurring in the third quarter of last year. Blockchain data analysis platform Woobull’s creator Willy Woo commented on this topic this week:

“I know this sucks, but Bitcoin won’t break all-time highs until more pain and suffering emerge. On the bright side, miners are capitulating, and when this ends, it almost always results in a significant rally. Look for squeezes in this band. Buy and hold in these zones.”

Türkçe

Türkçe Español

Español