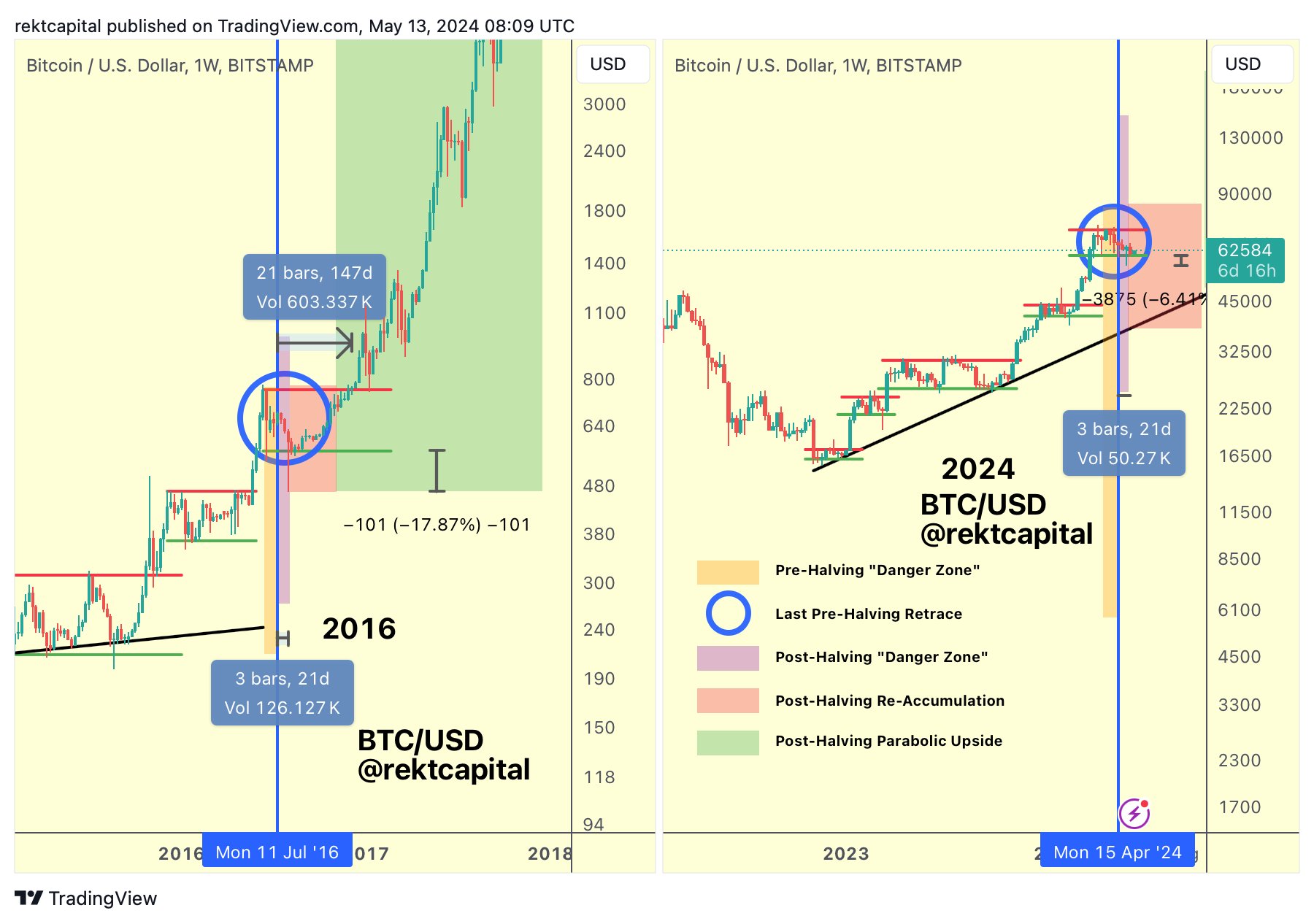

Referring to past data, a crypto analyst suggests that Bitcoin may have escaped the dangerous zone post-halving and is now heading towards accumulation. On May 13, crypto market analyst Rekt Capital shared a Bitcoin market cycle chart on X, indicating an update that the asset has corrected from the dangerous zone following the halving event.

What’s Happening on the Bitcoin Front?

The well-known analyst added that Bitcoin celebrated with a good rise from the low support of the re-accumulation range. In previous market cycles, the dangerous zones before and after halving were periods when the asset declined on both sides of the halving event.

In this cycle, Bitcoin dropped 23% from its mid-March peak price to $56,800 on May 1, marking the potential bottom of the post-halving danger zone. The analyst added that if $56,000 is not the bottom, then this current pullback would officially equal the longest pullback of 63 days in this cycle. However, history shows that this pullback ended at $56,000 in 47 days.

Bitcoin is now recovering, trading above $63,000 at the time of writing, supporting the return to the re-accumulation zone analysis. However, historical cycle movements are not always indicative of future movements, and further pullbacks during the horizontal volatility period following the halving event are still possible. Nonetheless, the analyst was confident that the current support levels would continue and shared the following statements:

“Bitcoin shows early signs of slowing momentum on the sell side and is gradually developing a curl against the $60,000 support.”

Comments on Bitcoin from Notable Figures

Meanwhile, Raoul Pal, founder of Global Macro Investor, wrote in a post on X on May 13 that the macroeconomic process is driven by the global liquidity cycle during the summer and fall periods. He noted that cryptocurrency performed well in the so-called banana zone, particularly in the second half of the year, highlighting it as the year when the prices of these high-risk assets rose.

Earlier this month, former BitMEX CEO Arthur Hayes agreed that a period of horizontal trading and accumulation is likely before the markets start to move again this year. He also mentioned a potential liquidity injection from the Federal Reserve’s monetary policy that could flow into riskier assets like cryptocurrencies.