One of the market‘s closely followed analysts made an important statement about altcoins. According to the analyst, a major breakthrough in altcoins is likely by July, and groundwork is being laid for this.

Analyst’s Perspective on Altcoins

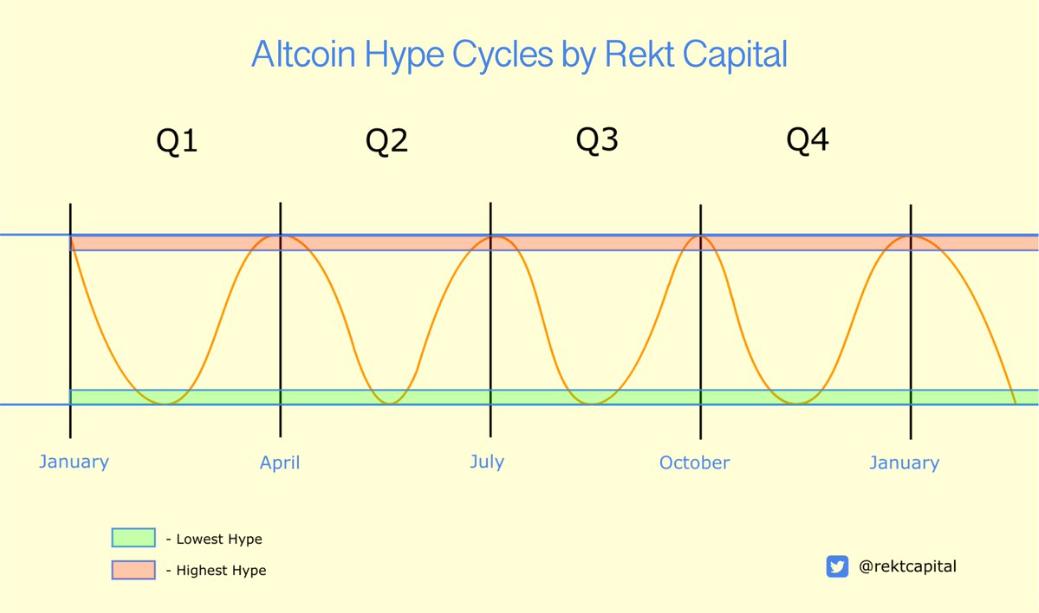

Rekt Capital, a well-known analyst in the crypto world, shared with thousands of users on the social media platform X that after a period of market consolidation, a potential altcoin “hype cycle” could occur in the second quarter of the year.

There is still time for the Q2 altcoin hype cycle to start. However, the foundations for the next altcoin rally wave are being built as we speak. Market-wide breakouts cannot occur without first experiencing slow consolidation periods.

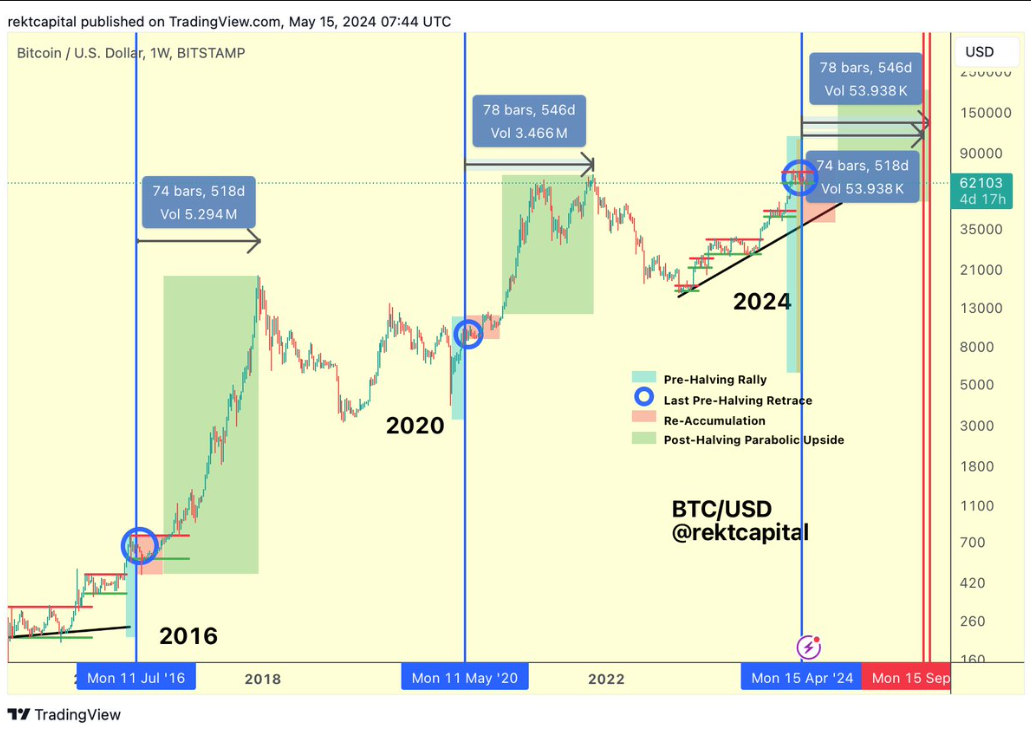

The analyst states that if a historical precedent is seen on the Bitcoin side, the cycle peak of BTC, which is at the top of cryptocurrencies, is likely to occur in September or October of next year.

In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving. In the 2019-2021 cycle, Bitcoin peaked 546 days after the halving. If history repeats and the next bull market peak occurs 518-546 days after the halving, this means Bitcoin could peak in mid-September or mid-October 2025 in this cycle. Currently, Bitcoin is accelerating by about 200 days in this cycle. Therefore, the longer Bitcoin consolidates after the halving, the better it will be to resynchronize this current cycle with the traditional halving cycle.

How Much is Bitcoin Worth?

Bitcoin rose above $66,000 yesterday but failed to maintain this level and fell below $65,000. After a slight recovery, BTC is still trading in the negative zone at the time of writing.

Following a 1.33% drop in the last 24 hours, BTC is trading at $65,191 at the time of writing. Looking at BTC’s price movement over the last 7 days, a 3% increase is seen, while a 2% increase is observed over the 30-day period.

With the recent drop, BTC’s market cap returned to the $1.28 trillion level, falling below the $1.3 trillion threshold. Additionally, a noticeable drop was observed in the 24-hour trading volume. BTC’s 24-hour trading volume fell by 26% to $30 billion, indicating a decline in interest.

Türkçe

Türkçe Español

Español