Popular crypto analyst Ali Martinez shared a condition that could help Bitcoin (BTC) price surge in the coming weeks. Here are the details in the cryptocurrency! Many in the crypto ecosystem are curious if Bitcoin price will return to its ATH.

Expectations of a Bitcoin Decline

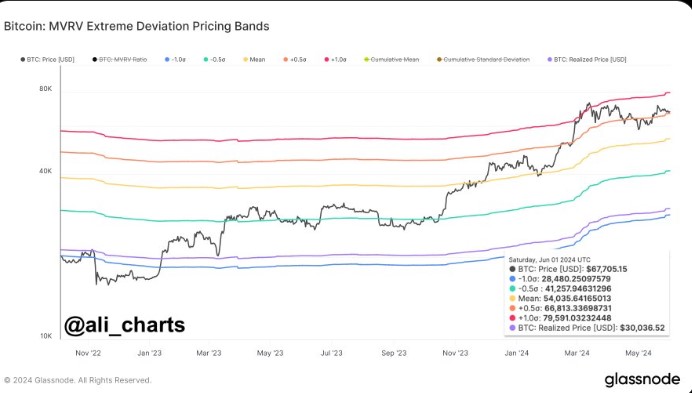

According to popular analyst Ali Martinez, Bitcoin is currently around the +0.5 Standard Deviation mark based on the MVRV extreme deviation pricing band chart he shared. At this level, the token’s price is fixed at $66,800. At lower standard deviations, Bitcoin’s price may fall further over time.

If the standard deviation drops by 0.5 from the current level, the cryptocurrency could fall to $41,250.94. It is worth noting that Bitcoin price has not tested this low level since the beginning of February this year. In the worst-case scenario, if the standard deviation shifts to 1, BTC could drop to $28,480.25. Conversely, a change in the opposite direction is expected, and the token’s price could rise to $79,591.03 with 1 standard deviation.

Factors Influencing BTC’s Rise

Currently, more overall strength is exerting pressure on Bitcoin, affecting its price. One of these forces is the unexpected exits occasionally experienced by BlackRock, Fidelity Investments, and Grayscale’s spot Bitcoin ETF products. Although these unplanned exits do not negatively impact the token’s price, stagnation generally affects the token’s rise.

Bitcoin continues to be the most preferred digital currency by Wall Street investors. As Michael Saylor previously noted, contrary to the prediction that the spot Ethereum ETF would not be approved by the SEC, the commission led by Gary Gensler gave the green light to the products in May. Although the actual transactions of these products have not yet started, the support Bitcoin needs can be provided by the approval of S-1 registrations for the relevant applicants. While Ethereum will be the primary beneficiary, Bitcoin price is also on track to maintain the trend in the coming weeks.

Türkçe

Türkçe Español

Español