Checkmate, a well-known on-chain analyst, suggested that Bitcoin (BTC) is poised for significant price movement after a long period of consolidation. Sharing his views with his followers on the social media platform X, the analyst highlighted a crucial on-chain metric indicating that Bitcoin might soon exit its consolidation phase.

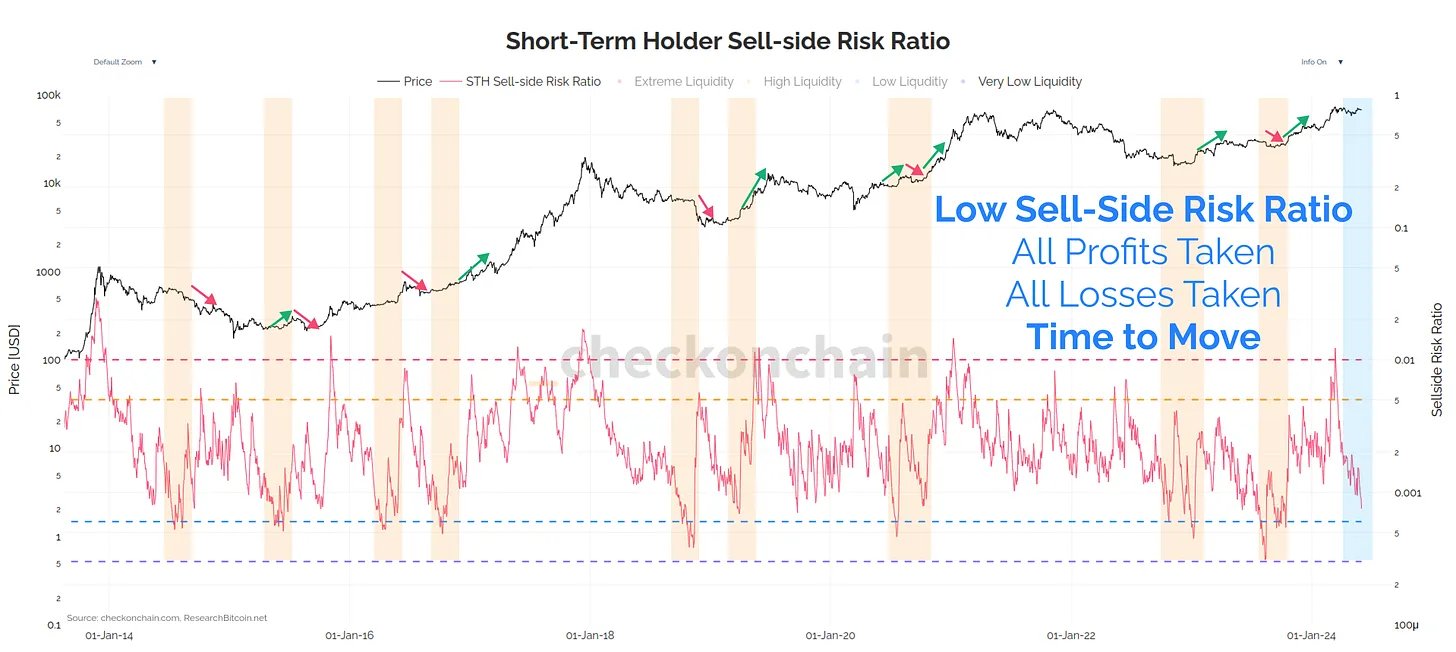

Decrease in Sell-Side Risk Ratio

Checkmate‘s analysis focuses on the sell-side risk ratio for short-term investors, which is currently in rapid decline. This metric shows that sellers who have held Bitcoin for less than 155 days are losing momentum. These short-term investors are critical as they drive short-term price movements. According to the analyst, the decreasing sell-side risk ratio suggests that Bitcoin is “coiled like a spring” and ready for significant movement.

The concept of range contraction leading to range expansion is central to Checkmate’s analysis. The on-chain analyst believes that the current consolidation phase will soon give way to a more volatile, trending market. This transition is characterized by the buildup of potential energy, like a compressed spring, which eventually leads to significant price movement when released.

US 10-Year Treasury Warning for Bitcoin and Cryptocurrencies

Checkmate also pointed to the US bond market as a potential catalyst for Bitcoin’s next major move. The analyst noted that the 10-year Treasury yield (US10Y) is currently in an uptrend. Yields approaching 5% could create adverse conditions for Bitcoin and other cryptocurrencies. Higher yields typically indicate tighter financial conditions, less valuable collateral, and a general decrease in risk tolerance among investors.

The analyst referred to significant sell-offs in the bond market between August and October 2023, during which the US 10-year Treasury yield approached 5%, leading to substantial sell-offs in both stocks and Bitcoin. During that period, BTC experienced a 12% drop in a single day but later recovered by 30% after a two-month consolidation phase. This historical context underscores the sensitivity of Bitcoin’s price to movements in bond yields.

Checkmate warned that if the 10-year Treasury yield rises towards 5%, it could indicate increased risk for Bitcoin and other financial assets. Such conditions might require intervention from the Fed and the US Treasury to stabilize the market. According to the analyst, the bond market has the power to determine the stability of risk assets and financial markets.

At the time of writing, the US 10-year Treasury yield is at 4.394%, while Bitcoin is trading above the $71,000 threshold. The current situation highlights the delicate balance in financial markets and the potential for significant movements in BTC‘s price depending on bond market dynamics.

Türkçe

Türkçe Español

Español