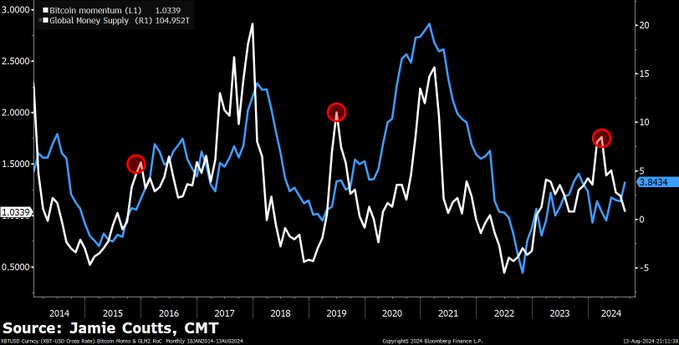

A closely followed name in the cryptocurrency world, Real Vision analyst Jamie Coutts, indicated that a significant rise is imminent for Bitcoin (BTC). According to Coutts, one of the most important factors that could drive the price of the largest cryptocurrency up is the acceleration of global liquidity momentum. This situation historically prepares a favorable ground for Bitcoin.

Global Liquidity Movements Could Trigger a New Rally

Coutts emphasized that this activity in global liquidity coincides with the “froth” in the launch of exchange-traded funds (ETFs) and the withdrawal of overly leveraged positions from the market. According to him, this indicates a scenario that could herald the major rises Bitcoin has made in the past.

The analyst reminded that in the last decade, Bitcoin hit bottom a few months before the global money supply hit bottom and then made a significant rise. He added that a mid-term correction was observed after these rises.

Coutts argues that an increase in the global money supply is inevitable. According to him, in a debt-based financial system, the money supply needs to continuously expand. If this does not happen, the collapse of the system will be inevitable.

The Strength and Weakness of the US Dollar Will Also Determine Bitcoin’s Direction

Another critical factor determining the direction of Bitcoin’s price is the strength or weakness of the US dollar. The US Dollar Index (DXY) is an indicator that measures the value of the US dollar against other major global currencies.

Coutts noted that Bitcoin experienced its fastest rise during periods when the US dollar lost value. Currently, the DXY is at 102.55, approximately a 4% drop from its peak level reached in April 2024.

The Real Vision analyst stated that the weakening of the US dollar is coordinated by the Federal Reserve (Fed) and indicated that this situation signals that global liquidity is being injected into the market. Coutts considers this an important development that could ignite a rise for Bitcoin.

Türkçe

Türkçe Español

Español