The year 2024 is highly active for cryptocurrencies. On January 10, the effects of the Bitcoin ETF started to be seen and occupied the market for a while. After this period, BTC reached a new ATH in March, which was a surprise before the halving. Subsequently, as the price clearly fell, attention turned to the halving, and after it occurred, the market became active again. Recently, after the SEC’s decision on the spot Ethereum ETF, the market became active again, and BTC once more exceeded $70,000. During this period, PEPE and some altcoins reached ATH, drawing attention. Amidst all this, a famous analyst turned his attention to BTC and made significant statements about what could happen in the market.

Analyst’s Bitcoin Commentary

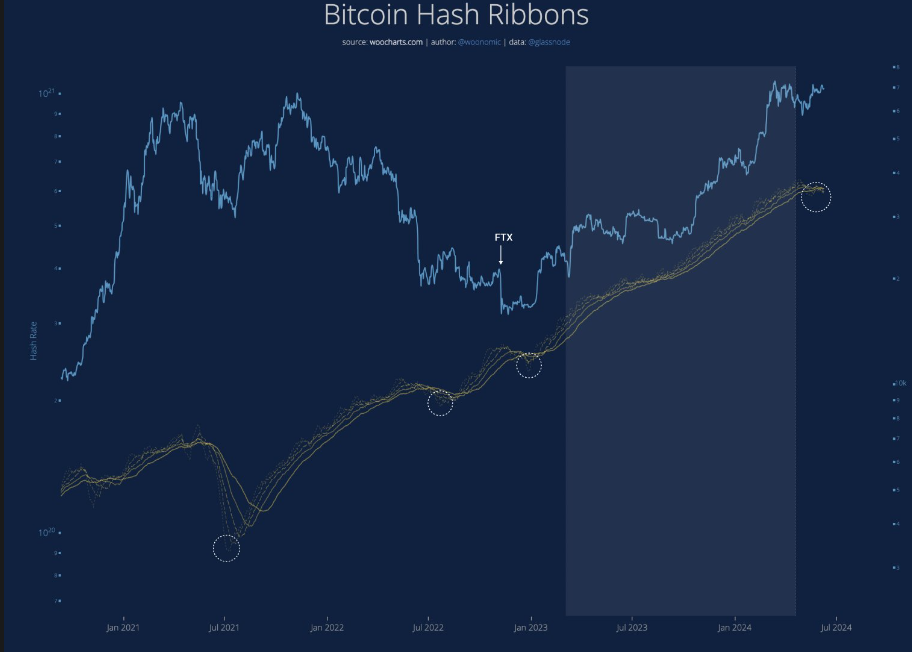

According to Willy Woo, one of the well-known analysts in the market, Bitcoin (BTC) is in an important process centered around miners. Woo shared posts on X to make important statements. According to Woo, due to the Bitcoin halving event in April, the number of weak-looking miners in the market is decreasing day by day.

The halving event, which forms four-year cycles, is known for reducing the Bitcoin reward provided to encourage miners to join the network by half, thus limiting the BTC supply entering the market. Woo states that miners who lost their strength after the halving event exited BTC, and then there was a recovery in Bitcoin’s price.

But first, we need to clear the open interest tied to futures trading. Liquidations need to occur before a price rise.

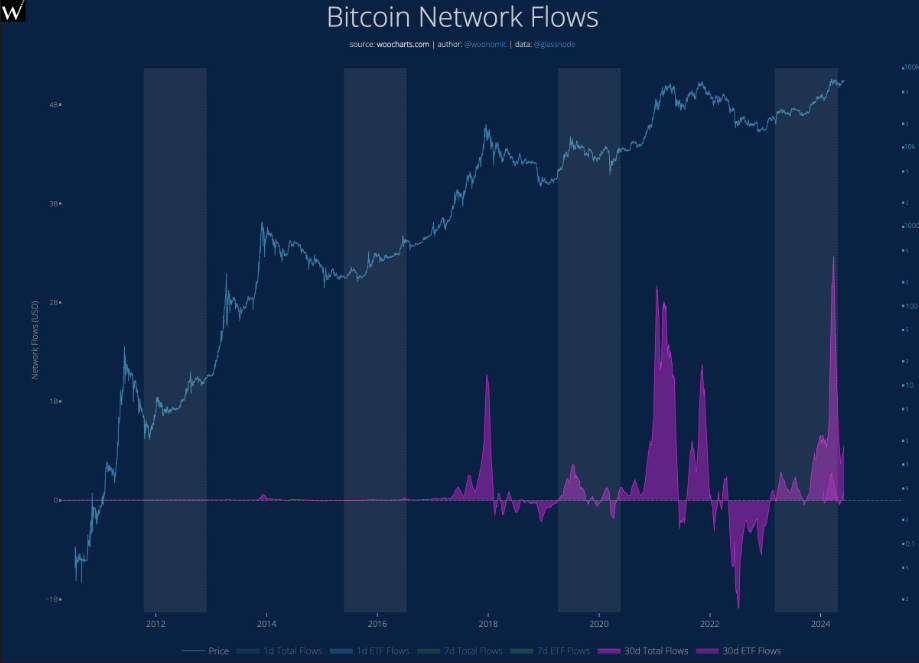

Woo also shared a chart showing Bitcoin’s network flows, explaining how the process is progressing.

The analyst explained the subject as follows:

Visualization of capital flows entering and exiting the Bitcoin store of value network over time. The units on the left are in billions of USD daily. Slowly, slowly… then all at once.

What is Bitcoin’s Current Price?

As of the time of writing, Bitcoin continues to find buyers at $69,000, influenced by the FED decision. Bitcoin has risen approximately 2.83% in the last 24 hours, reflecting market anxiety after falling to around $66,000 yesterday.

On the other hand, BTC is currently more than 9.5% away from its historical peak of $73,738 seen on March 14. While the widespread view in the market is that a new ATH could emerge within a year after the halving, the future will be closely watched.

Türkçe

Türkçe Español

Español