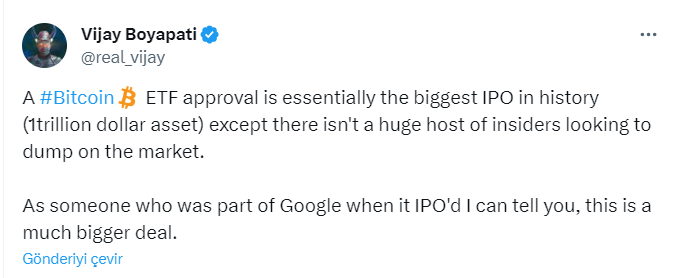

Famous analyst Vijay Boyapati today shared an intriguing perspective regarding the potential approval of a Bitcoin ETF, highlighting its significance as comparable to the most important Initial Public Offering (IPO) in history. Let’s examine Boyapati’s views and the consequences of such an approval.

Bitcoin ETF and Boyapati’s Deductions from Google’s IPO Experience

According to Vijay Boyapati, the approval of a Bitcoin Exchange-Traded Fund (ETF) would be equivalent to witnessing the largest public offering in history, given the asset’s astonishing valuation of 1 trillion dollars. Boyapati draws parallels with the traditional IPO model but underscores a significant difference: the absence of a significant insider group ready to liquidate their holdings in the market.

Boyapati, who had a connection with Google during its IPO, offers a firsthand comparison to underscore the unprecedented magnitude of a potential Bitcoin ETF approval. According to Boyapati, the impact and outcomes of such an approval would surpass even the massive public offerings witnessed in the traditional financial world.

Comparing Bitcoin ETF to Traditional Public Offerings

In a traditional public offering scenario, insiders, including early investors, employees, and founders, typically hold significant stakes in the newly public company. This can lead to an increase in selling activities as insiders seek to benefit from the IPO. In contrast, Boyapati implies that the approval of a Bitcoin ETF would eliminate this aspect, offering a unique and potentially more favorable landscape for investors.

As the crypto currency community awaits the potential approval of a Bitcoin ETF, Vijay Boyapati’s views provide a valuable perspective. The effects of such an event would resonate beyond the crypto space, impacting the broader financial environment. Investors looking to stay ahead of market trends and developments will find Boyapati’s comparison with traditional IPOs enlightening.

Unlocking Opportunities with the Approval of a Bitcoin ETF

Understanding the potential impact of a Bitcoin ETF approval enables market participants to strategically position themselves. As Boyapati points out, the absence of a major sell-off from insiders could contribute to a more stable and optimistic market response.

Investors navigating the crypto world are encouraged to become informed by leveraging the views of experienced analysts like Vijay Boyapati. Boyapati’s assessment indicates a new positive phase for Bitcoin.

Türkçe

Türkçe Español

Español