Bitcoin  $94,340 price stood at $63,000 at the time of writing, with altcoins remaining relatively stable. Trading volumes experienced a typical weekend decline. The ongoing closures above $61,700 for BTC are one of the promising indicators for the upcoming days. What is the current situation in the cryptocurrency markets?

$94,340 price stood at $63,000 at the time of writing, with altcoins remaining relatively stable. Trading volumes experienced a typical weekend decline. The ongoing closures above $61,700 for BTC are one of the promising indicators for the upcoming days. What is the current situation in the cryptocurrency markets?

Bitcoin (BTC)

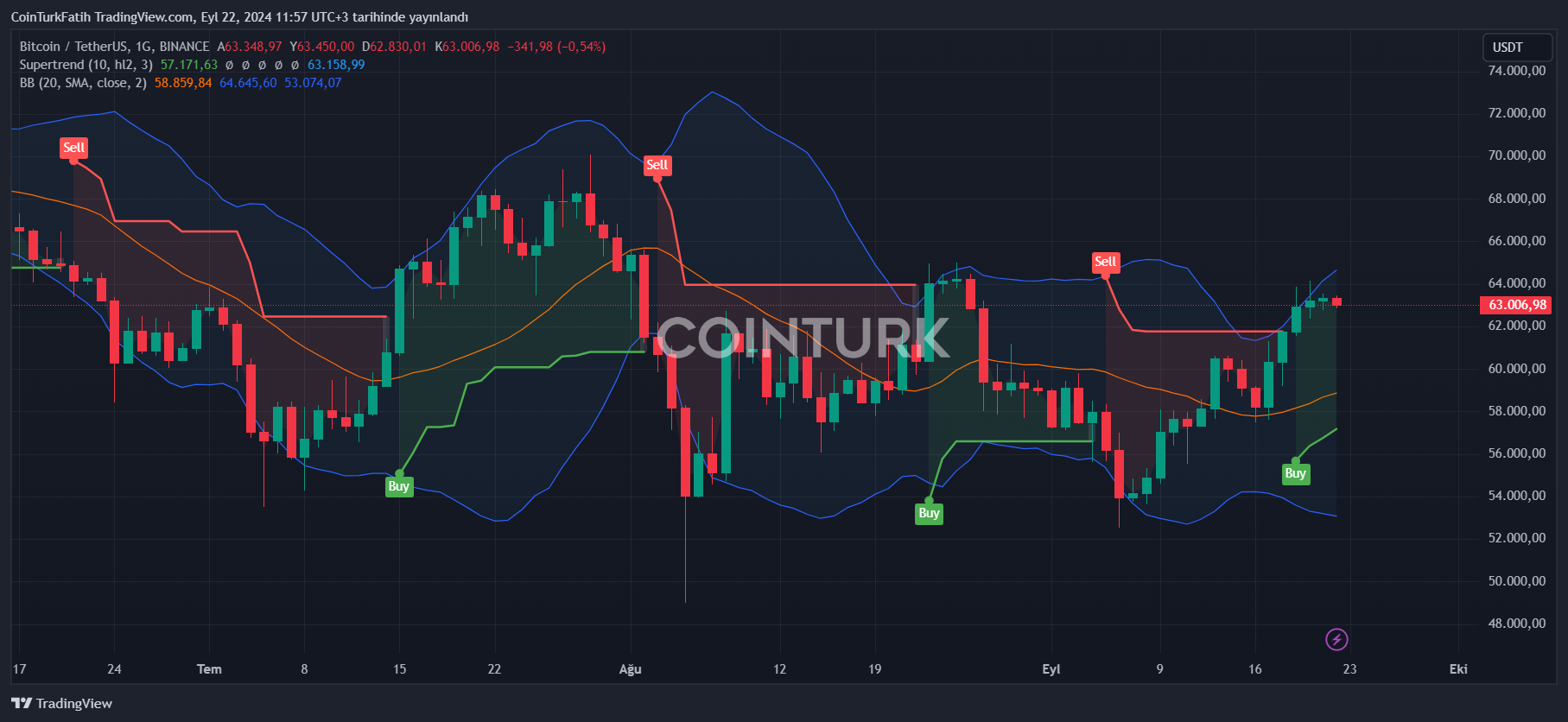

After several weeks of downward movement, many analysts compared the current situation to two previous similar periods, sharing a 23-day upward expectation. On September 7, BTC initiated this rebound, witnessing a price increase of $9,800, which translates to an 18% rise. During this period, several significant developments have occurred.

The most notable development was the announcement of a 50bp interest rate cut on Wednesday. The Fed has started to lower interest rates, with expectations for reductions of 25bp and above continuing until a pause occurs. The good news is that just as the Fed awaited convincing data for interest rate cuts, it will also require convincing data to halt rates. Hence, one or two months of poor inflation data may not pose a substantial issue.

While Mondays have historically been bearish for cryptocurrencies, the preservation of $63,000 over the weekend increases the potential for testing $65,700 and $70,000. In a positive scenario, altcoins might witness gains exceeding 20%.

Current Status of Cryptocurrencies

The total volume across all cryptocurrency exchanges has dropped to $44 billion. Despite a 32% decline in volume compared to yesterday, sellers did not benefit as they had during previous holiday periods. Weekly, ETH has gained nearly 8%, hovering around the $2,600 mark, reflecting potential for a new test at $2,850.

Among the top 100 cryptocurrencies, TAO, SUI, FTM, APT, and PENDLE saw the largest gains over the past week. Recently, analysts highlighted a potential bullish setup for SUI Coin, which has reached its target. Meanwhile, TAO leads with nearly 50% gains.

KCS, KAS, and ICP represent some of the few altcoins within the top 100 experiencing losses. The total market capitalization of all cryptocurrencies stands at a support level of $2.2 trillion, with the fear index climbing above neutral at 51.

Türkçe

Türkçe Español

Español