Bitcoin (BTC), despite the recent rise due to speculations related to the approval of the first spot exchange-traded fund (ETF) in the US, is struggling to overcome the key resistance level below $45,000. The general opinion in the market is that Bitcoin is preparing for a major rally, aiming for its all-time high and even beyond.

Analyst Marks a Critical Threshold for Bitcoin: $48,500

Cryptocurrency expert Tradingshot stated in his analysis published on TradingView on December 29 that the critical threshold for Bitcoin is $48,500. According to the analysis, surpassing this threshold could lead to a parabolic rally. Tradingshot emphasized that Bitcoin has seen significant mid-cycle growth in the last two months and is approaching the very important $50,000 level. The analyst is focusing on the possibility that breaking the $48,500 resistance could mark the beginning of the parabolic phase of the bull cycle.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

In a note attached to his analysis, the analyst said, “Bitcoin has seen significant mid-cycle growth in the last two months and is approaching the very important $50,000 level. Technically, a break above the $48,500 resistance would mark the beginning of the parabolic phase of the bull cycle.”

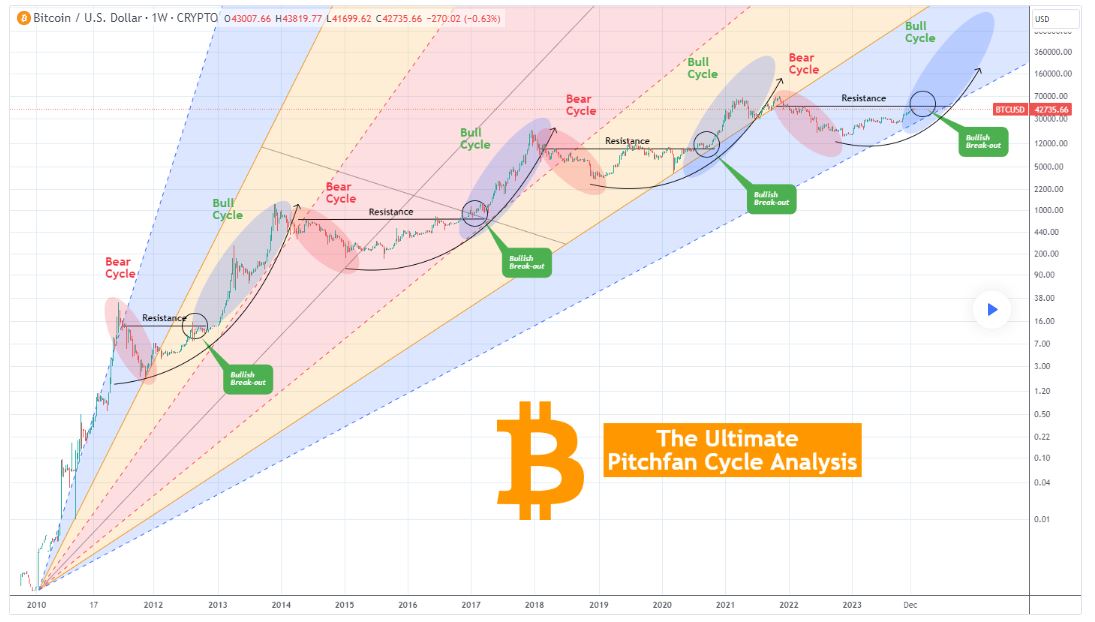

To visually depict this transition, Tradingshot used the technical analysis tool Pitchfan to highlight the significance of Bitcoin’s current market movement surpassing its peak point. According to the expert, historical patterns suggest that resistance breakouts in the Bitcoin market often coincide with the halving of block rewards, a fundamental event that typically signals the start of a rally towards a new record level.

With only four months left until the block reward halving, the analyst underlined that every pullback to the MA50 (50-day moving average) on the daily timeframe represents a significant buying opportunity for investors using Dollar Cost Averaging (DCA) strategies.

Bitcoin Consolidates Below $45,000

Bitcoin, while showing signs of short-term consolidation, is in a much stronger position compared to 18 months ago, bolstered by speculations of spot ETF approval. Notably, not all market participants expect the ETF approval to trigger a significant price movement for Bitcoin. Experienced cryptocurrency analyst CrediBULL Crypto suggested that both the anticipation and the actual approval of the ETF resulted in buying excitement but warned that the approval might end with a “buy the rumor, sell the news” outcome.

On the other hand, current market sentiment continues to indicate a potential long-term holding behavior for Bitcoin. According to data from the on-chain data platform CryptoQuant dated December 29, Bitcoin reserves on cryptocurrency exchanges reached their lowest level in several weeks, indicating that investors are focusing on future gains.

The data shows that during December, the amount of BTC on leading centralized cryptocurrency exchanges hovered around 2.04 million units. However, with over 33,000 Bitcoins exiting in the last 24 hours, the reserves on the exchanges dropped to the lowest level in a week, resulting in the outflows exceeding 2 million units.

Türkçe

Türkçe Español

Español