As June comes to an end, the altcoin market continues to show significant weakness. Last weekend, the altcoin market lost over $25 billion in value, with Ethereum (ETH) and the top ten altcoins losing between 3-10%. Despite these losses, analysts believe this could be the last correction before new capital starts flowing back into the altcoin market.

“Downtrend is About to End”

Famous crypto analyst Michael van de Poppe believes the current downtrend for altcoins is about to end. In a recent tweet, Poppe expressed optimism, stating that the altcoin downtrend is nearing its end. He predicted that significant capital inflows into altcoins could start next week or the week after.

The analyst emphasized his confidence in current altcoin positions and expects a risk-taking period to begin soon as the market nears the end of its decline and investors prepare for a potential bullish rotation. Poppe noted the dire state of the altcoin market, with many altcoins reaching new lows in Bitcoin (BTC) valuation. However, he pointed out that during similar past events, some altcoins surged by 300-500%.

Similarly, crypto analyst Kerry, who remains optimistic about the future of altcoins, noted that the altcoin market cap is still 50% below its all-time high in 2021, and the recent correction has pulled it down by another 30%.

Expecting a Rally of Up to 100% in Altcoins

As the correction nears its end, Poppe expects a potential rally of up to 100% in altcoins, which could align with Bitcoin’s trajectory. This bullish outlook suggests that the altcoin market could see significant gains once the downtrend ends and capital starts flowing back into altcoins.

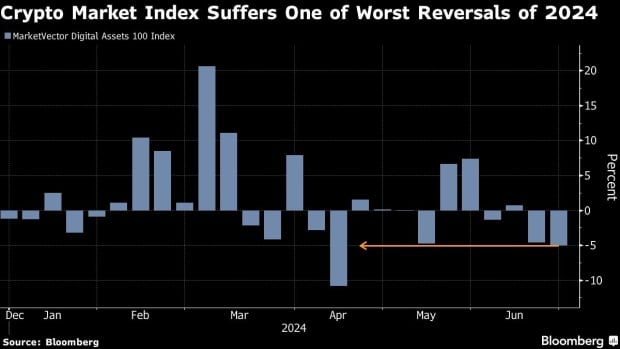

Additionally, it’s essential to consider the broader context of the crypto market. Last week, the crypto market experienced its second-worst weekly decline of 2024 due to decreased demand for spot Bitcoin ETFs and uncertain monetary policy. According to Bloomberg, the top 100 cryptocurrencies lost 5% in value last week. This market turbulence primarily stems from the Federal Reserve’s (Fed) uncertainty regarding interest rate cuts, as rates remain at their highest level in the past twenty years.

Despite current issues, analysts like Poppe remain generally optimistic about the future of altcoins. They believe the end of the current correction phase will initiate a period of growth and capital inflow, potentially leading to significant rallies in the altcoin market.

Türkçe

Türkçe Español

Español