Cryptocurrency investors love to talk about 8-10 year goals but often get stuck on short-term targets. Especially new investors are intolerant of losses and repeatedly experience the fate of fickle investors in each cycle. They sell one altcoin at a loss to buy another altcoin, only to sell it at a loss again. Eventually, breaking even becomes the main goal.

Annual Goals for Cryptocurrencies

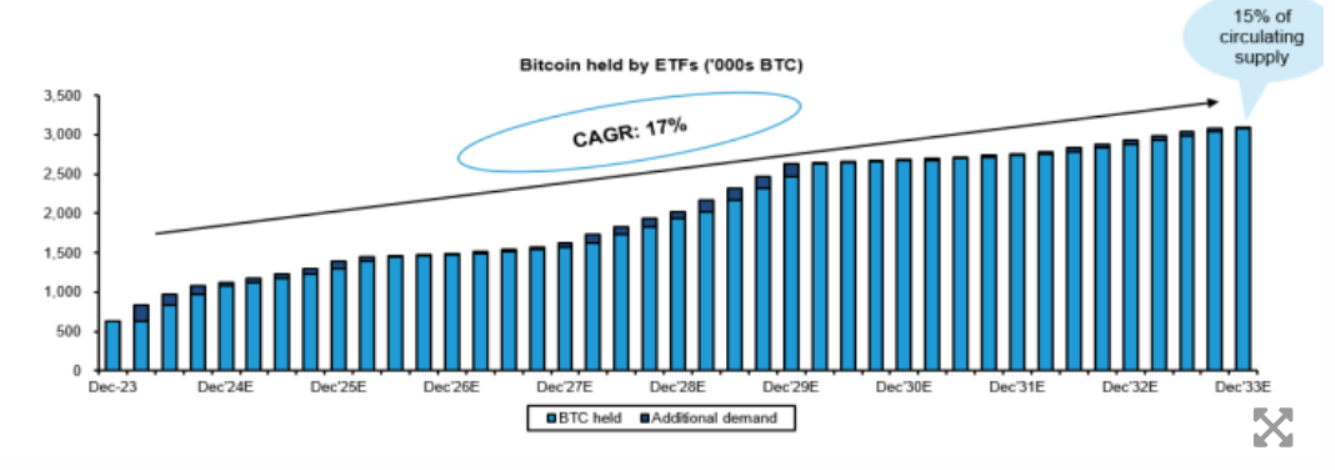

Analysts at Bernstein had set a target of $150,000 for BTC by the end of next year following the approval of Spot Bitcoin ETFs in January. Now, they are revising this target to $200,000. The basis of the analysts’ predictions is the assumption that approximately 7% of BTC’s circulating supply will remain inactive as ETF reserves.

Bernstein analysts Gautam Chhugani and Mahika Sapra wrote the following in a note sent to clients who receive investment advisory, research, and reporting services from them:

“We expect Bitcoin ETFs to be approved on major brokerage/large private bank platforms in the 3rd/4th quarter. They are currently on the brink of this. Institutional trading seems like a ‘Trojan Horse’ for adoption, and these investors are in the process of evaluating ‘net long’ positions.”

Today and Predictions for Crypto in 2033

Experts who also addressed the current state of Spot BTC ETF flows say that 80% of the flows come from self-directed individual investors through broker platforms. This is good news because it means that institutional investors have not fully entered this space yet, and despite this, there have been such massive inflows.

“Approximately $15 billion in net new flows have been provided by ETFs. We expect Bitcoin ETFs to account for ~7% of circulating Bitcoin by 2025 and ~15% of Bitcoin supply by 2033. We think Spot Bitcoin ETFs will reach a total accumulation (asset size) of $190 billion at the peak in 2025 and $3 trillion in 2033.”

Experts also had things to say about today:

“We believe Bitcoin is in a new bull cycle. ‘Halving’ presents a unique situation where the natural Bitcoin selling pressure from miners is halved (even more as they stockpile more in anticipation) and new catalysts for Bitcoin demand emerge, leading to exponential price movements.”

Türkçe

Türkçe Español

Español