Bitcoin, Mt. Gox’s ongoing 140,000 Bitcoin repayment and the German government’s Bitcoin liquidations have shaken the market. Both factors increase the likelihood of Bitcoin sales worth billions of dollars, causing investors to question further negativity in the Bitcoin market after a 15% drop in the first week of July.

What’s Happening on the Bitcoin Front?

Independent market analyst Matthew Hyland confirmed a downward price target for Bitcoin below $38,000. In his July 8 post, Hyland supported the bearish trend by showing Bitcoin’s breakdown in the multi-month consolidation range on the weekly chart and noted the low likelihood of the cryptocurrency returning to the same range.

The bearish outlook was strengthened by Bitcoin’s weekly relative strength index (RSI) reading around 45. This RSI level indicates that neither buyers nor sellers are in control. However, the prevailing bearish trend in the market suggests more room for a decline until the RSI level reaches at least the oversold threshold of 30.

Similarly, Bitcoin could continue to fall until it reaches the RSI oversold level of 30, aligning with Hyland’s downward target below $38,000. Hyland shared the following statements on the matter:

“The weekly RSI has almost pulled back to the lows of August/September last year when Bitcoin was trading at $25,000. Another red weekly candle could likely push the RSI to lower levels, creating an opportunity for bullish divergence.”

Famous Analyst Comments on Bitcoin

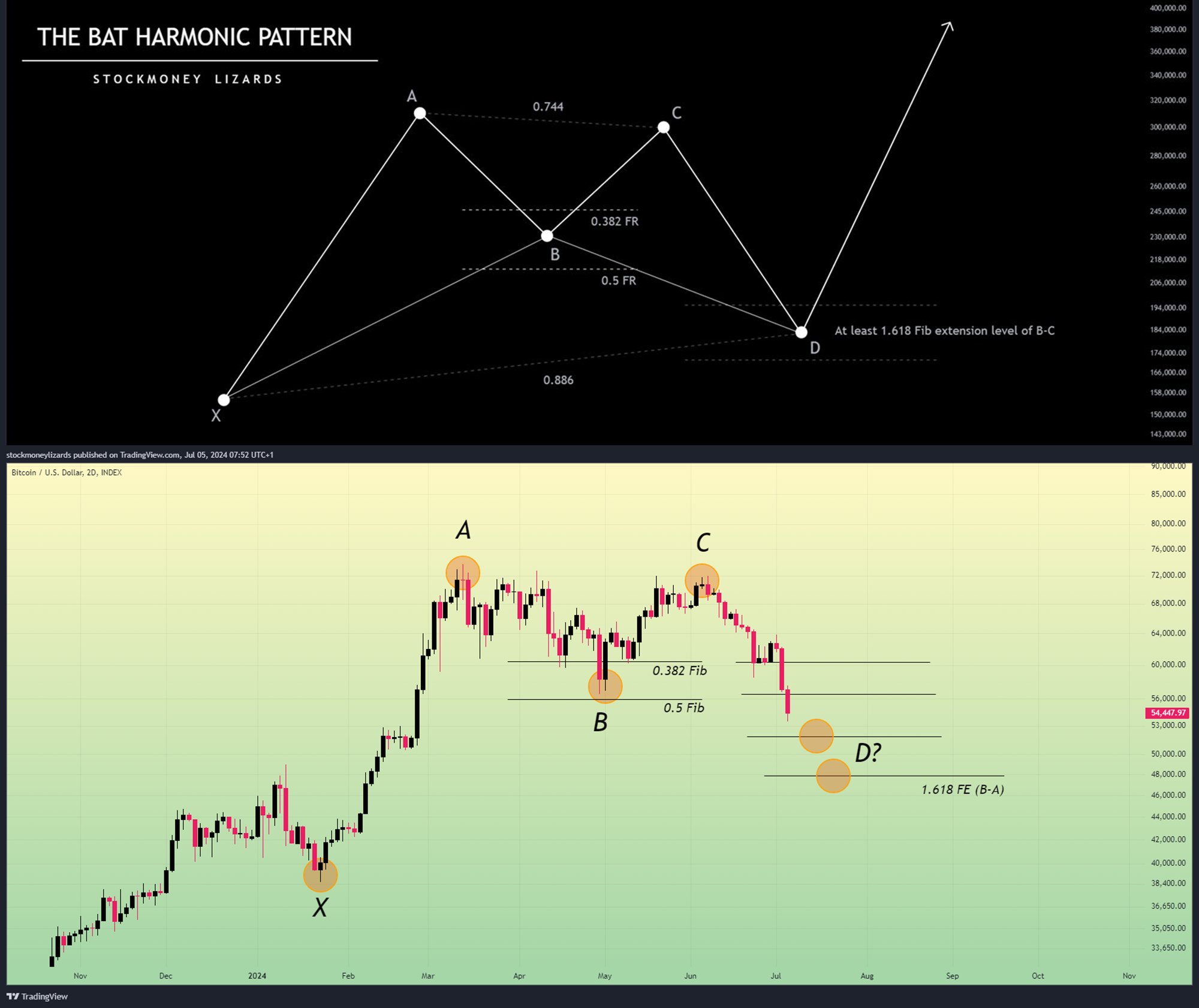

Popular market analyst Stockmoney Lizards also predicts a further decline in Bitcoin price, but the analyst’s target is $50,000. The analyst refers to a formation called the bat harmonic behind the limited bearish trend. The formation starts with an initial price movement (XA), followed by a retracement (AB), another move (BC), and a final leg (CD) extending up to 88.6% of the XA leg.

Point D is the critical area where investors typically expect a reversal confirmed by additional signals such as candlestick patterns or volume. In the case of Bitcoin, point D corresponds to the $50,000 level, after which the price could experience a sharp recovery:

“We expect another liquidity flow potentially below the $50,000 level with a long wick to form the $52,000 support.”

Türkçe

Türkçe Español

Español