Bitcoin may have closed the week below $70,000, but analysts continue to target an all-time high in the not-so-distant future. 10x Research CEO Markus Thielen stated in a note dated June 7 that Bitcoin reaching a new all-time high is imminent.

ATH Expected for Bitcoin!

Thielen referred to the beginning of a global central bank easing cycle, confirmed by rate cuts in Canada and Europe this week, and expressed their bullish outlook with the following statement:

“With weakening growth, employment, and consumer spending in the US, inflation slowing down is imminent.”

US employment data was mixed; the unemployment rate rose to 4.0%, but the number of jobs added was a positive surprise. Bitcoin price increased by only 3.1% despite the $4.8 billion inflow last week, falling short of the 5.8% rise predicted by regression analysis.

Thielen provided a detailed analysis of Bitcoin price movements related to capital inflows, suggesting that approximately $13 billion in new inflows would be needed to reach $83,000. He stated that a break above the $71,600 trend line would result in more upward buying, but the $13 billion inflow requires considerable commitment and added:

“We still think this is possible due to a weaker US employment market and next week’s lower inflation data creating a macro backdrop for all-time highs.”

What’s Happening on the Bitcoin Front?

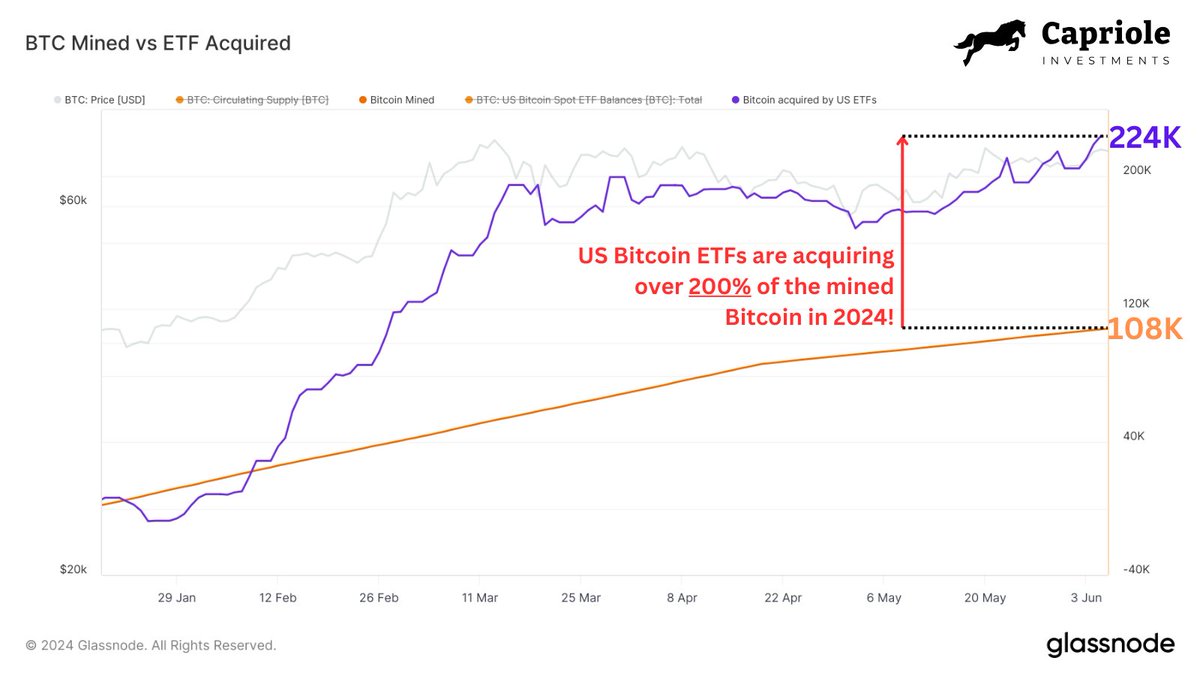

Capriole Fund founder Charles Edwards said long-term sales are hindering the price rise. Bitcoin was trading at $69,420 and found support in the Asian session on Sunday morning after a 2.5% drop in recent days. Further analysis could see the price drop to the $67,500 support levels, but Bitcoin needs to surpass $71,500 to see more upward momentum.

Thielen was not as optimistic about Ethereum, stating that they were fundamentally less optimistic about Ethereum and expected the ETF process to disappoint Ethereum demand. Ethereum fell to $3,640 over the weekend, breaking the key support at $3,725 but managed to reclaim the $3,700 level during weekend trading. Broadly, crypto markets remain in their range-bound channels and generally stay in the accumulation zone following the Bitcoin halving event.