Bitcoin price is currently at $61,500, and the outlook for altcoins is poor. We see the situation of risk-averse investors in volume data. The concerning factor is the potential for macroeconomic negativity to suppress cryptocurrencies for more than a few months. So, why is tomorrow a big day?

A Big Day for Cryptocurrencies

Tomorrow, before the US stock market opens, a critical data point that could shake risk markets will be released. Of course, I am talking about the US April inflation data. This data came in terrible in the first quarter, and for months, Fed members advised against being pessimistic until more data was seen to determine if the roadmap needed updating.

On May 14, the US Core Producer Inflation data came in at 0.5% monthly. This figure was expected to be around 0.2% under normal conditions. The lack of cooling in the PPI data brings concerns that we might see a bad surprise in the CPI data as well. Today’s price lingering at $61,500 clearly explains this concern.

If tomorrow’s US inflation data comes in above the 3.4% expectation, things could get complicated. The monthly expectation is 0.4%, and the target for core inflation is 3.6% (previously 3.8%). Investors will focus on the announced figures of these data. We will share this data as a last-minute update. If the data comes in above expectations, we could see sharp declines depending on how high it is. Although Powell’s statements today did not mention additional rate hikes “for now,” they focused on the possibility of “delaying rate cuts.” If this “tight monetary policy” narrative is voiced more loudly and the environment necessitating it remains strong, risk markets could see bad days.

Famous Economist’s Crypto Predictions

If we are talking about macroeconomics, we can also look at the latest comment made by Raoul Pal. Can we trust his macroeconomic skills since he is extremely positive about crypto? Maybe not. So, what does Pal say?

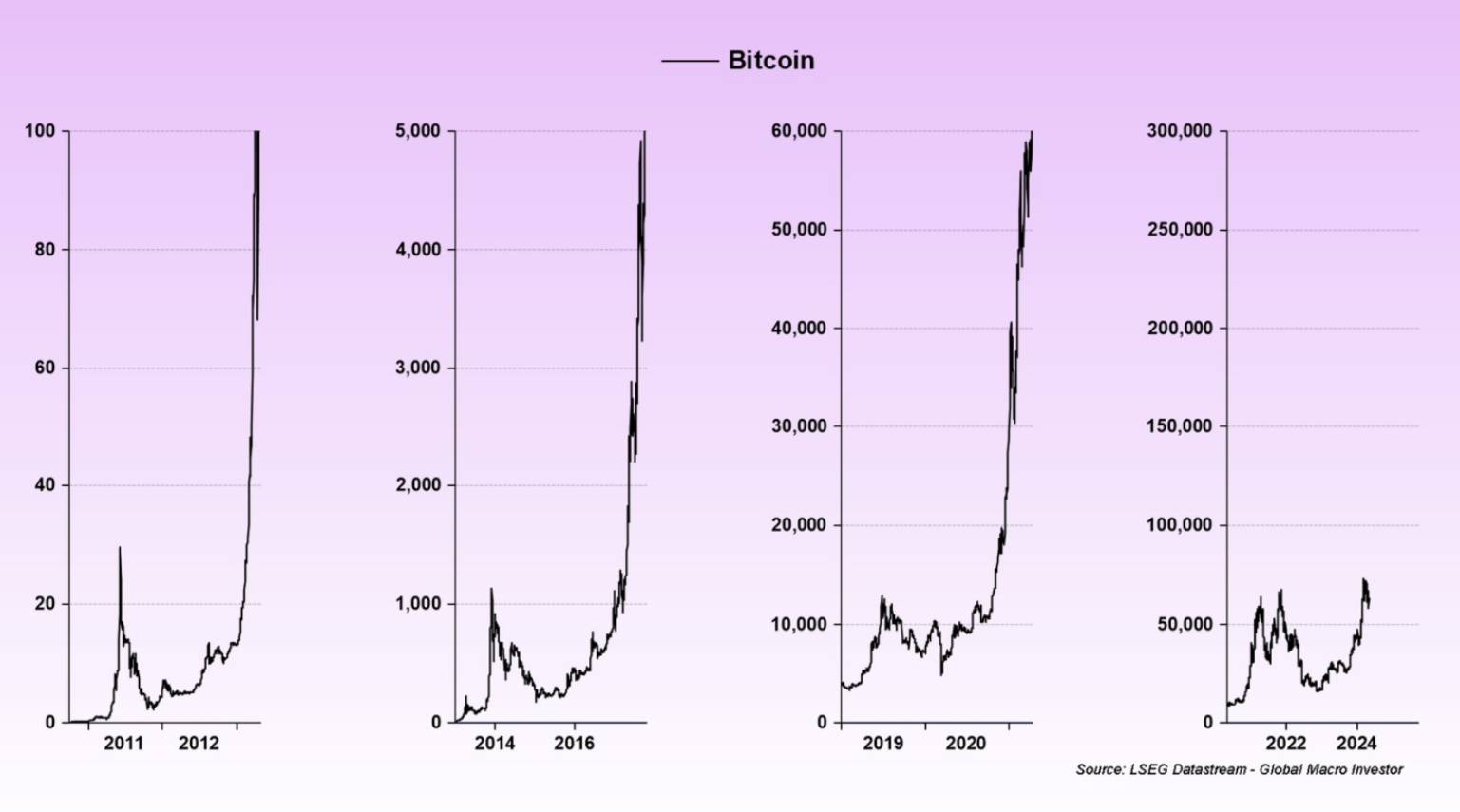

According to him, the crypto markets will soon rise. He cites the global liquidity cycle that has continued since 2008 as the reason. If his predictions come true, we will soon see days when some assets like Solana and Ethereum outperform Bitcoin, and meme coins reach absurd prices again. However, with the possibility of the first rate cut in September weakening, how realistic this prediction will be remains doubtful for now. But crypto is always full of surprises.