Developments in macroeconomic data continue to occur in the crypto market. Accordingly, like many cryptocurrencies, Ethereum’s price has significantly dropped in the last few days. Currently, the second-largest crypto asset by market value is trading at around $3,500, with a 9% weekly decline according to Coingecko data.

Notable Comments on Ethereum

However, some analysts believe Ethereum will encounter good days, and some speculate it will reach an all-time high in the coming months. Popular analysts Wolf and Jelle, who are X users, are just two of these names.

Wolf presented a price chart showing that Ethereum has been on an upward trajectory since the beginning of 2024. The analyst predicted that increasing volatility in the near future would eventually lead to a bull run and a new all-time high for the asset, targeting above $5,000.

Jelle claimed that Ethereum successfully retested its 50-day EMA average. The analyst believes the asset’s valuation could reach new highs once it surpasses the $3,700 region. The 50-day Exponential Moving Average (EMA) is a significant technical analysis tool that can suggest potential price movements. It helps determine the prevailing trends over the last 50 days but focuses more on the most recent data compared to the SMA average, providing insights into potential buying and selling levels.

What Awaits Ethereum?

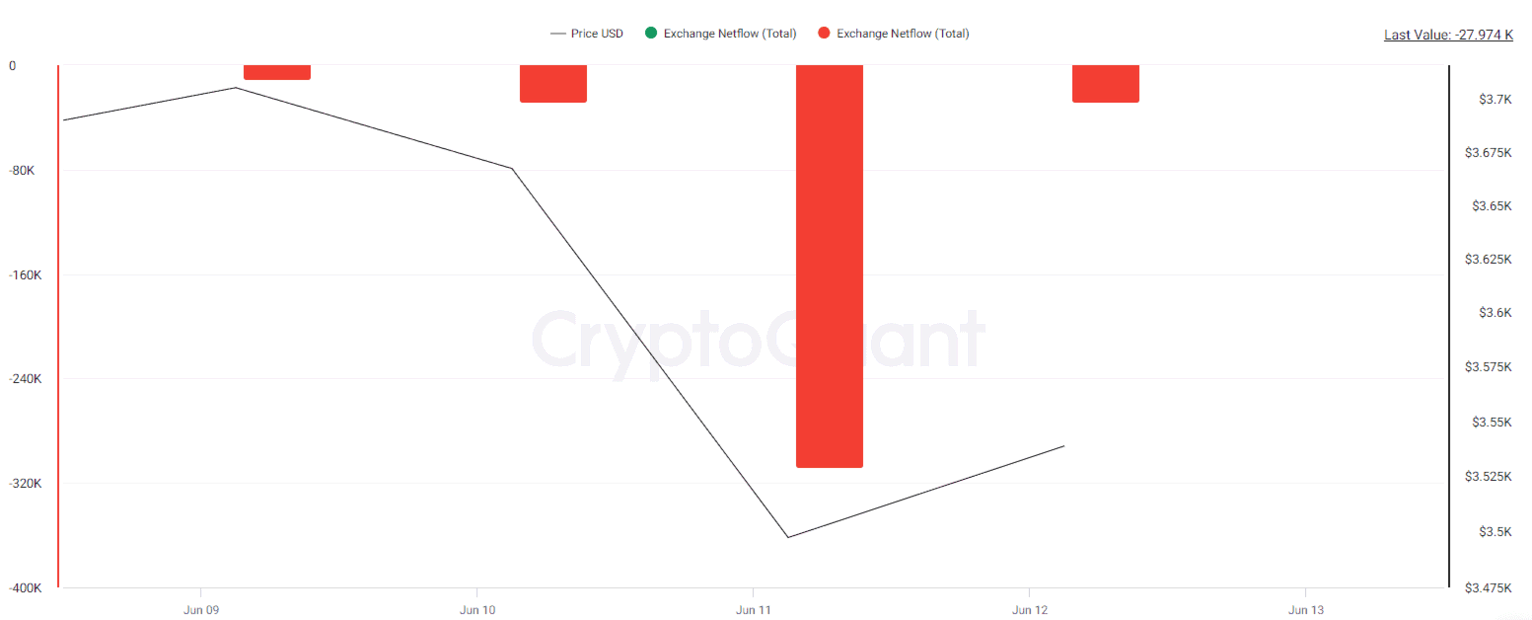

Some key indicators also suggest that a revival in Ethereum price might be possible. One example is Ethereum’s negative exchange net flow over the last four days. The shift from centralized trading platforms to self-custody methods is considered bullish as it reduces immediate selling pressure.

Separately, Ethereum’s Relative Strength Index (RSI) dropped to 20.7, the lowest level in several months, on June 11 and is currently at 36. The data has not crossed the 70 threshold since May 23. The RSI is a momentum indicator that measures the speed and change of price volatility, identifying overbought or oversold conditions in the market. Its value ranges from 0 to 100, with a rate above 70 indicating that a pullback might be near.