Dogecoin (DOGE) is the largest altcoin by market cap, and its support test was successful. After the rapid losses in BTC price, this was inevitable. Recently, we mentioned a potential new attempt at $0.093. Now, while BTC tries to hold above $54,000, the volatility isn’t over. So, what are the current predictions of different analysts for DOGE?

Dogecoin (DOGE) Analyst Comments

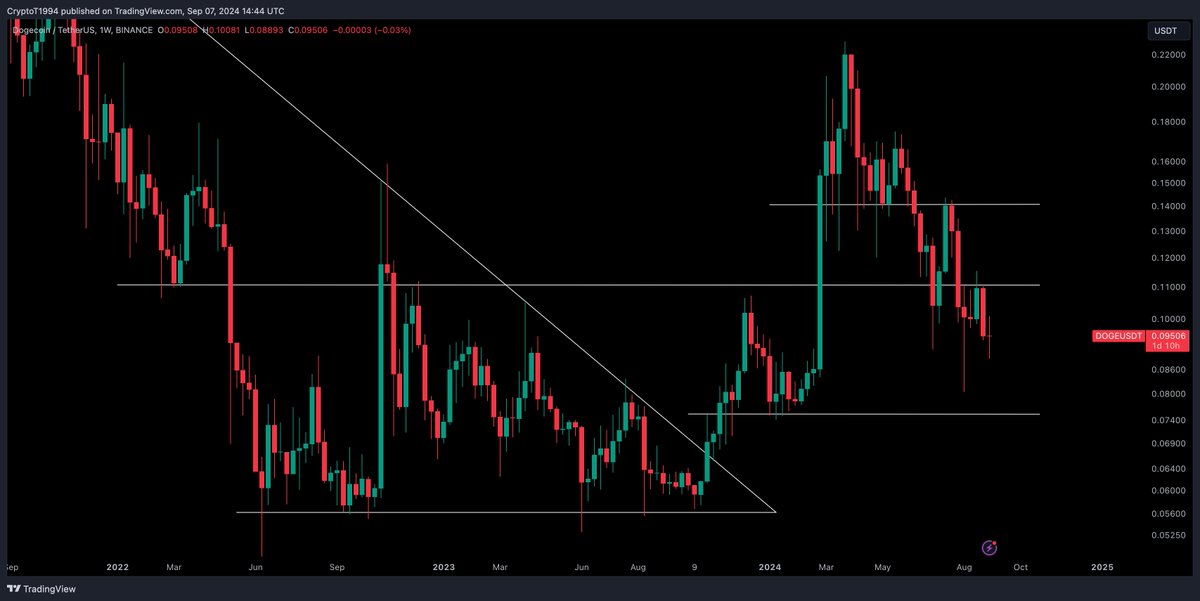

First up is Crypto Tony, a well-known analyst in the crypto world. Although the recent BTC price fluctuations make predictions meaningless, it might be useful to look at the price levels he considers important. In the graph he shared below, the analyst marks important support and resistance levels, identifying $0.11 as the key area that needs to be reclaimed.

“I think the level to wait for a cautious entry with solid footing is $0.11.”

If the selling continues, the decline could deepen to $0.074 and then to $0.056. The level where the rally would accelerate is $0.14. Above this area, new peaks between $0.22 and $0.3 could be targeted.

In an environment where even new meme coins struggle to attract volume and altcoin investors are suffering, can DOGE reclaim $0.11? In the short term, it doesn’t seem like a very reasonable scenario. However, when BTC starts to recover, these are the levels that will be etched in the minds of investors eager for DOGE.

Key Levels for DOGE

The second crypto analyst is TraderSZ, who also recently shared a graph indicating that DOGE price is holding above important support. The analyst marks profit areas for long positions and highlights the ranges where the price has fluctuated before. Here, the fluctuation between $0.114 and $0.130 is the first opportunity area. In a possible rise, short-term gains can be made with sales at resistance.

If the range between $0.146 and $0.179 is surpassed with volume, it could lead to new attempts up to $0.22. In an environment where Bitcoin  $0.000039 price exceeds $70,000 again and risk appetite for altcoins multiplies in the last quarter, these ranges can be kept in mind for daily trading opportunities.

$0.000039 price exceeds $70,000 again and risk appetite for altcoins multiplies in the last quarter, these ranges can be kept in mind for daily trading opportunities.

Of course, analysts share their assumptions based on past movements, and there is no obligation for the price to adhere to these levels.

Türkçe

Türkçe Español

Español