Friday has arrived, and crucial data for the cryptocurrency markets will be released later today. The interest rate cut expected on September 18 will be the first in four years, making it crucial whether it will be 50bp. If the Fed is as tight on the employment front as the data shows, it should move faster.

Two Analysts’ Different BTC Predictions

Fed, employment data, and more details will be examined in the second section. While preparing this article, I noticed that two popular analysts shared completely different views just a few minutes ago. One is very hopeful for the coming days, while the other talks about a drop below $50,000. Would you like to look through their perspectives and decide for yourself?

QuintenFrancois shared an optimistic but not exaggerated assessment. While people have zeroed their risk appetite due to the boring period that has been going on for 6 months, he wrote: Crypto Traders Are Rushing to This App – Here’s Why You Should Too

“What happened in the last 6 months:

- Large amounts of GBTC exits

- MTGOX’s billions of dollars in returns

- US government BTC sales

- Germany selling 50,000 BTC.

So, what are the upcoming developments?

- Interest rate cuts (Fed and the rest of the world)

- Global liquidity growth

- US elections

- FTX paying cash to its customers (close to $12 billion)”

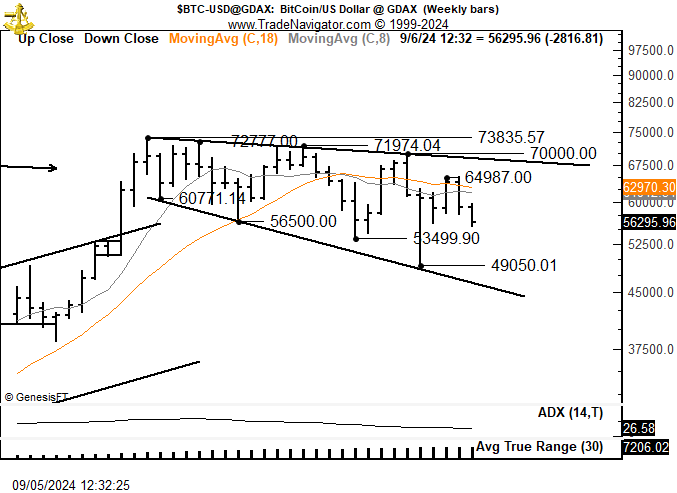

Peter Brandt, on the other hand, shared his reverse expanding triangle once again at the same time. This has become classic, and Peter wants to see himself proven right.

“This is called a reverse expanding triangle or megaphone. Testing the lower boundary will be around 46,000. A big push towards new ATHs is needed to get this bull market back on track.”

Warnings to Investors

Analysts cannot foresee the future, and news expected to bring a rise is not obligated to meet your expectations. However, the expansion of liquidity, FTX cash returns re-entering crypto, and the resolution of issues like MTGOX that have been pressuring the markets for 10 years are net positives in the medium and long term.

Despite all this, if Japan says it wants a positive interest rate environment, inflation is rising, and disrupts risk markets by making more rate hikes as it did for the first time in 20 years, good news will be overshadowed. There can always be things that overshadow good or bad news.

While it is uncertain whether we will live long enough in the long term, let’s look at what awaits us in the coming hours.

US Unemployment Rate

The expectation is 4.2%, and the previous month’s announced figure was surprisingly 4.3%. Amid downward revisions in employment, a high figure would strengthen the 50bp cut scenario.

Non-Farm Payrolls

The expectation is 165,000, and the previous month’s figure was again low (contributing to the rise in unemployment) and was announced as 114,000.

Position According to Data

There are 3 ways, and Goldman explains how the interest rate decision will be affected by the upcoming data.

- If the unemployment rate comes in at 4.19% or lower, a 25bp cut is expected.

- An unemployment rate between 4.2% and 4.29% keeps the 25bp cut door open, but if Non-Farm Payrolls stay below 150,000 (in addition to the unemployment rate situation), a 50bp rate cut (on September 18) can be expected.

- An unemployment rate of 4.3% or higher means a 50bp cut, regardless of Non-Farm Payrolls.

Türkçe

Türkçe Español

Español