You can read this news on COINTURK: 3 Different Analysts’ Comments on Ethereum (ETH) in the Last 24 Hours

The largest altcoin by market value, Ethereum (ETH), recently lost the support level we highlighted. Analysts who expect a drop to $2,111 have expressed their concerns. Since BTC fell to $55,606 in the last 24 hours, ETH is now trading at $2,400. So, what are the predictions of different analysts in the last 24 hours?

Posedion ETH Price Prediction

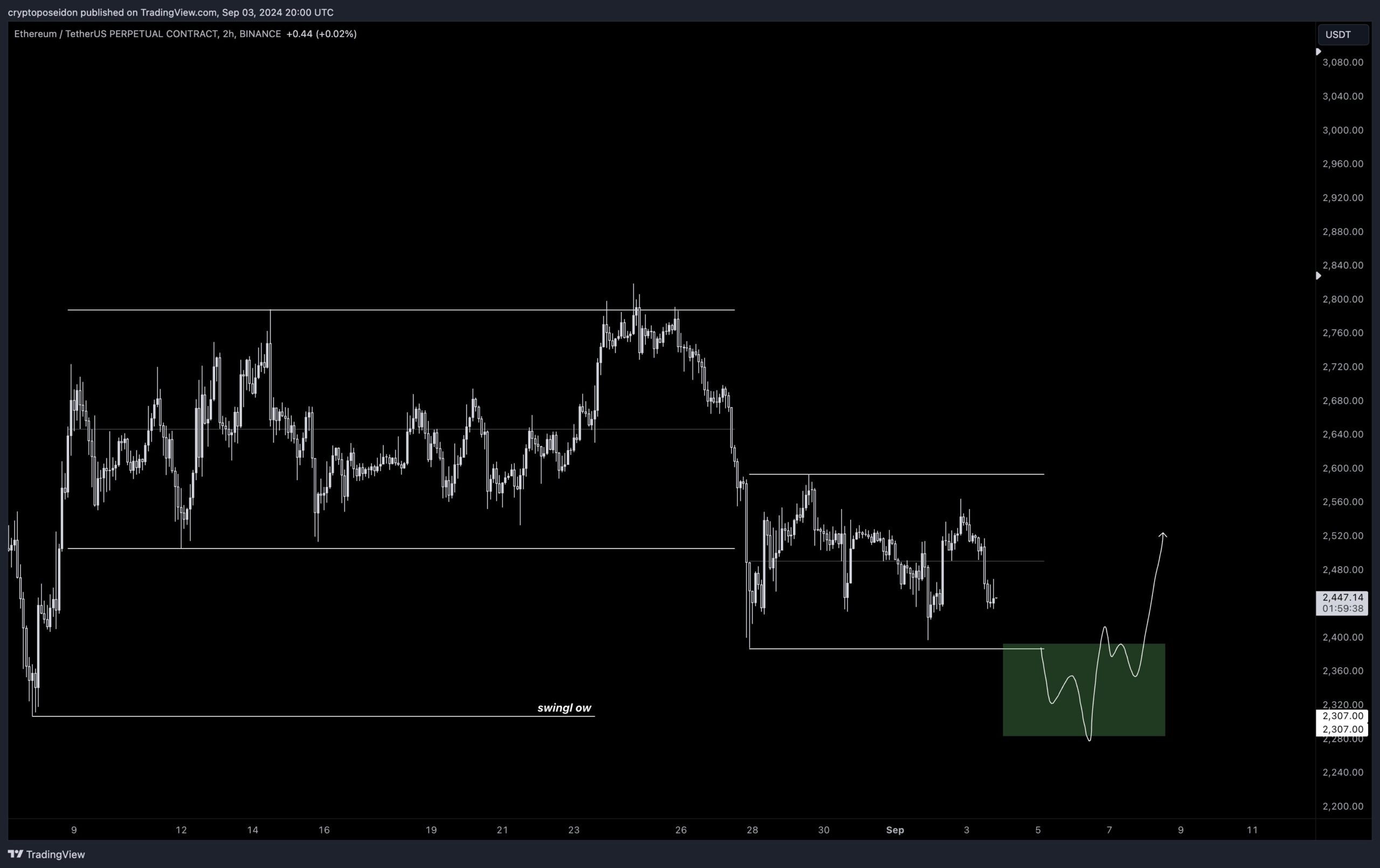

Popular technical analyst Crypto Posedion shared his evaluation earlier today, addressing the current situation following the recent drop. Highlighting the weakness in buyer appetite, the expert suggests that buyers might find an entry opportunity in the green zone.

“The price testing the daily demand level more than 4 times without any reaction suggests that 2450 will not hold again. I might be wrong, but I closed my long-term trades at the breakeven point.

I expect lower levels below $2,300. Buyers might find a buying opportunity in the green box.”

Trader Fred and ETH Chart Analysis

Sharing his predictions on the short and medium-term route, Trader Fred wrote that closures below the black line would indicate a continuation of the downtrend. Highlighting the CME gaps above, the analyst thinks the price has reached a reasonable range for entry.

“Above the black line means an uptrend, below it means the pullback will continue.

Now, we have just touched the liquidity (Orange lines) and we still have CME gaps above to revisit.”

XRP and ETH Chart Analysis

For Cryptoinsightuk, an interesting movement is noted in the XRP/ETH pair. Although the higher lows motivate him, it doesn’t seem likely that XRP Coin will gain strength against ETH given the current overall market sentiment. Daily and weekly closures above the marked area will open the door for further increases according to the analyst.

Will Ethereum (ETH) Price Increase?

Considering the potential for new lows below $55,000 for BTC, a positive divergence for ETH seems difficult. Moreover, throughout August, we highlighted that the deflation story for ETH was nearing its end. We also mentioned that the Ether team, after its second major update following the PoS transition, could trigger such a scenario by significantly reducing transaction fees.

The circulating supply, which started to increase as of April, will soon lead to positive inflation. Therefore, to see a reversal in ETH price, we need an increase in risk appetite and BTC closing above $70,000.

Türkçe

Türkçe Español

Español