Bitcoin continues to linger around the $42,500 region, but started to decline after the ETF approval. The ETF approval caused a rise to $49,000, but we couldn’t see further gains. This was related to the dampening of initial excitement due to absurdities like the SEC account hacking and the deletion of the official announcement after it was shared. The overall outlook for altcoins is not looking great either.

Altcoin Bull Season

Altcoin bull season is expected to occur within the year 2024, fueled by optimism for numerous events. Halving, interest rate cuts, US elections, the spread of ETFs, and many other developments seem to be pregnant with this possibility. Some analyses suggest that capital movements may have already initiated this.

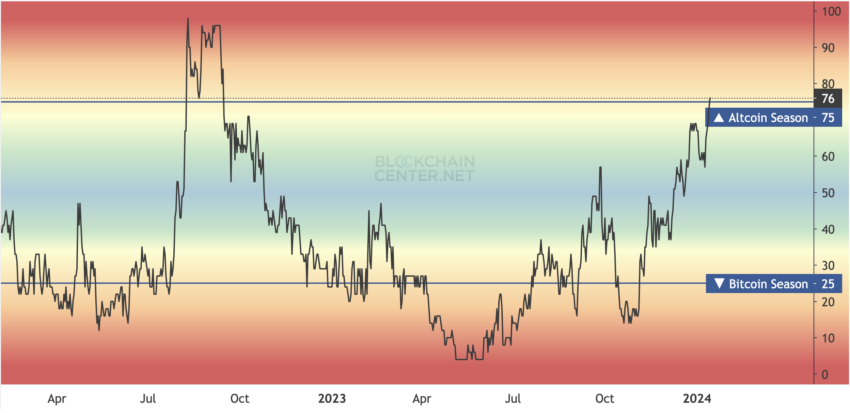

Technically, experts point to metrics indicating the beginning of a significant capital rotation from Bitcoin to altcoins like Solana (SOL), saying the time has come. The Altcoin Season Index recently climbed to 76 out of 100, suggesting we might be in the early stages, considering the critical threshold is 75.

Historically, an altcoin season is defined as the period when the top 50 altcoins outperform Bitcoin by 75% over 90 days. We last saw something similar in 2022. In the current scenario, cryptocurrencies like Ordi (ORDI), Sei (SEI), Injective (INJ), Solana (SOL) are achieving this, indicating the conditions for an altcoin season are starting to form.

Solana (SOL)

In terms of market value, SOL Coin has experienced an impressive growth period. Until last week, SOL Coin maintained a strong stance and is now striving to hold the $95 threshold. Yet, this still shows better support than most major altcoins. According to Ali Martinez, Solana could turn its direction upwards in the coming hours with the bull flag it formed on the four-hour chart.

“Solana is forming a bull flag on the four-hour chart. A sustained close above $106 could push SOL towards the $150 – $165 price range.”

Solana, known for being fast and inexpensive, appeals to a significant portion of cryptocurrency investors and has also experienced a notable recovery in terms of total locked value. If we don’t see a major collapse in crypto, a scenario where institutions re-engage in GSOL speculation could make $150 a realistic target.

Türkçe

Türkçe Español

Español