The U.S. Securities and Exchange Commission (SEC) is expected to approve the country’s first spot Bitcoin ETF this month. Currently, there are 12 spot Bitcoin ETF applications before the SEC, and it is anticipated that the regulator will greenlight all of them by January 11. With this expectation, Bitcoin’s price, which had been on the rise, has paused, and some believe that the ETF approval might end up being a “buy the rumor, sell the news” event. According to a closely followed figure in the cryptocurrency market, Gert van Lagen, the ETF approval will not result in a “buy the rumor, sell the news” scenario but will instead continue to drive the price up.

Analyst Does Not Expect a Drop After Spot Bitcoin ETF Approval

Bitcoin, which has been on an uptrend in anticipation of this event, especially saw an incredible surge to $45,000 in the last quarter of 2023. Since then, the largest cryptocurrency has pulled back and shown a tendency to consolidate, leading to divided opinions on the impact of the spot Bitcoin ETF approval. While some believe the approval will support Bitcoin’s rise, others suspect it might lead to a “buy the rumor, sell the news” outcome.

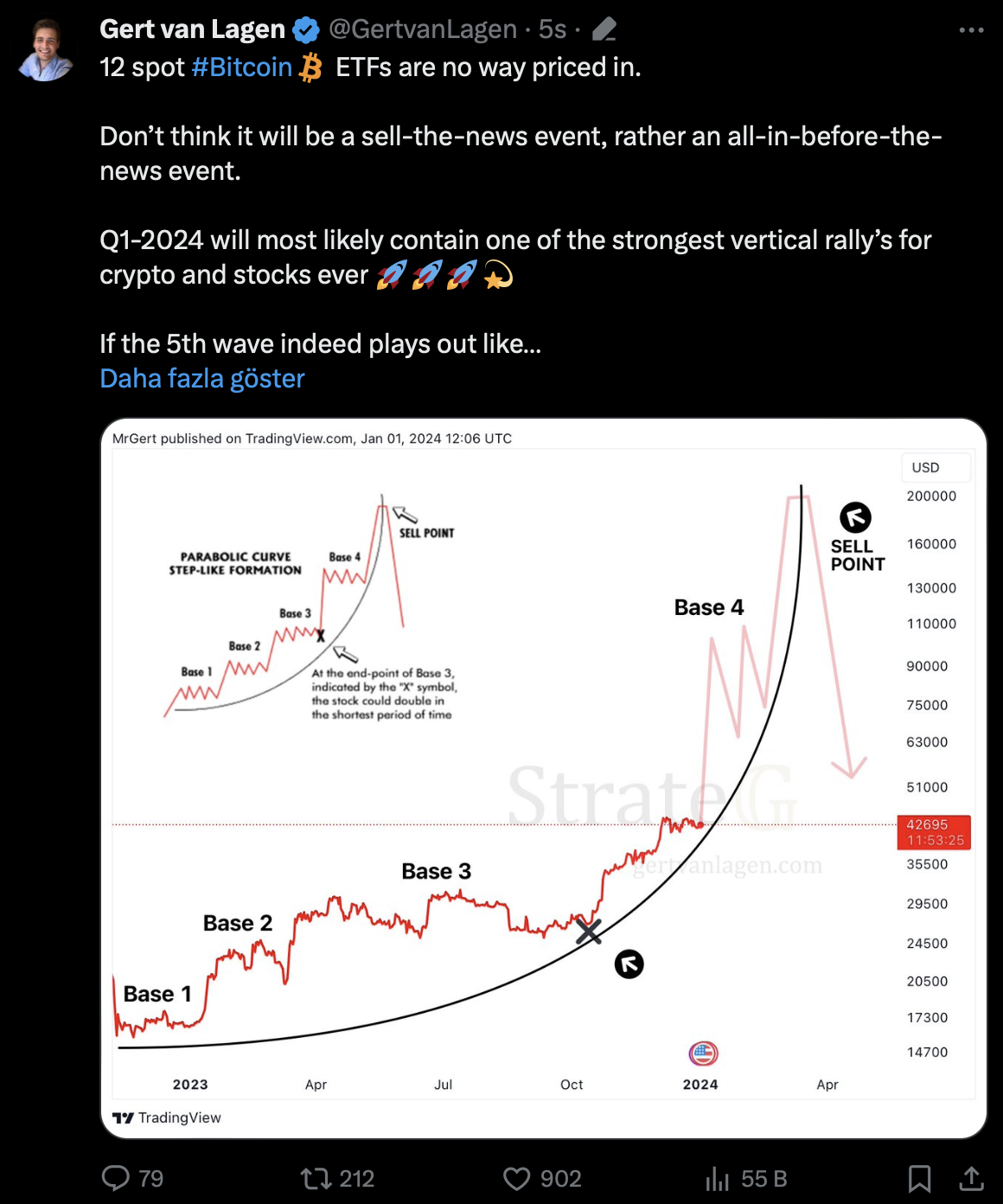

Experienced technical analyst Lagen expects the spot Bitcoin ETF approval to turn a new page for Bitcoin. The analyst emphasized in a personal X account that the approval will evolve the uptrend in the largest cryptocurrency to its fourth phase, stating:

The 12 spot Bitcoin ETFs have definitely not been priced in. One should not think this will end up as a “buy the rumor, sell the news” scenario; instead, consider it as the precursor to all the news to come.

The first quarter of 2024 is likely to witness one of the strongest sharp rallies ever for cryptocurrencies and stocks. If the fifth wave continues as expected, I would anticipate the block reward halving to be a trigger for a “buy the rumor, sell the news” event.

Spot Bitcoin ETF Approval Could Lead to a Surge in Institutional Interest

The approval of a spot Bitcoin ETF is one of the most significant developments anticipated in the crypto world for 2024. This regulatory green light is expected to increase market liquidity and promote a stronger trading environment for cryptocurrencies.

Leading global investment bank Goldman Sachs analysts Mathew McDermott and Steven T. Larsen predict an increase in institutional interest in cryptocurrencies for this year, expressing a positive view on the decision. The bank’s analysts believe that the SEC’s move could pave the way for increased participation from traditional financial institutions that have been cautiously observing the crypto market.

As is known, Goldman Sachs launched GS DAP, a platform designed for the efficient management of tokenized assets, in connection with this regulatory development. The launch of this platform marks a significant milestone in the digital asset sector and indicates that the commercial potential of tokenization is increasingly being recognized. The bank’s strategic initiative is expected to facilitate operations and open up new opportunities for commercial activities in the emerging crypto market.