As we enter 2024, expectations for Spot Bitcoin ETFs in the market have further increased. Amidst these expectations, there has been a development where issuers of two Bitcoin exchange-traded funds shared the fees they will charge investors if their ETFs are approved.

Preparations Continue for Bitcoin ETFs

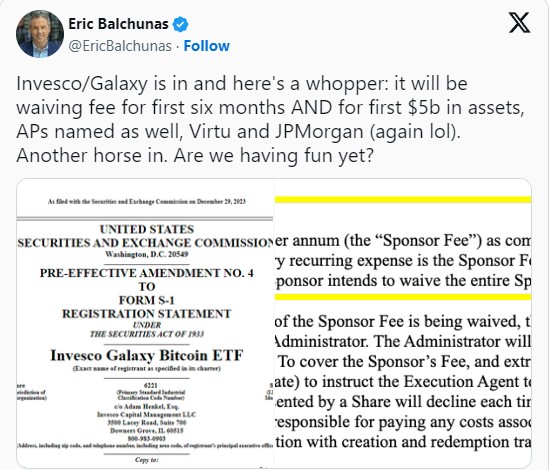

According to a report shared by Fortune, Fidelity Investments Wise Origin Bitcoin Trust will charge investors an annual fee of 0.39%, while Galaxy/Invesco will charge 0.59% annually for their BTCO fund.

Galaxy/Invesco took it a step further by announcing they will waive the fee for the first six months of the fund’s operation to increase attractiveness for investors. The source of this information was indicated as a court filing dated December 29.

The report also included other information. It was mentioned that Jane Street Capital would be an “authorized participant” for the Bitcoin ETFs of Fidelity, WisdomTree, and Valkyrie. Opinions emerged that Jane Street Capital would be allowed to benefit from arbitrage opportunities that may arise from price differences between the shares of these funds and Bitcoin itself.

Valkyrie expanded the situation further by designating Cantor Fitzgerald as a second authorized participant. Galaxy/Invesco and BlackRock took a giant step by connecting with JPMorgan and also designated Virtu as an authorized participant.

It is believed that a “cash” model will be used in the formation of ETFs and in payment matters. More explicitly, authorized participants will not be able to buy Bitcoin and invest in funds directly.

Instead, they will make cash investments equivalent to the amount of Bitcoin they wish to invest, which will later be used by the fund to purchase BTC. According to the report, the U.S. Securities and Exchange Commission (SEC) has shown resistance to allowing broker-dealers to handle Bitcoin, hence the preference for such a solution.

Current Status of ETF Expectations

Bitcoin investors have been waiting for a long time for the approval of a spot ETF in the United States. They argue that this could bring new investors to Bitcoin and potentially increase its price. The SEC, after rejecting several Bitcoin ETFs in the past, decided to conduct more comprehensive reviews and ensure compliance.

The decision may have been significantly influenced by Grayscale’s victory in a lawsuit against the agency last August. Following this event, the situation seemed to reverse. The U.S. Court of Appeals ruled that the SEC had arbitrarily rejected Grayscale’s spot Bitcoin ETF application and needed to reconsider its decision.

Since then, including today, there have been numerous new Bitcoin ETF applications and revisions, including those from Fidelity, WisdomTree, Invesco Galaxy, and Bitwise.

While all this is happening, the exact date when the SEC will announce its decision remains uncertain. Some leading market figures point to the next few days, while a report published today indicates January 8-10 as a potential timeframe.

Türkçe

Türkçe Español

Español