The approval of a spot Bitcoin ETF appears on the horizon, bringing expectations and optimism to the cryptocurrency market. Notably, 89.38% of Bitcoin (BTC) holders are currently in profit, highlighting the overall positive sentiment among investors as the market prepares for a potential breakthrough. But what does this situation mean?

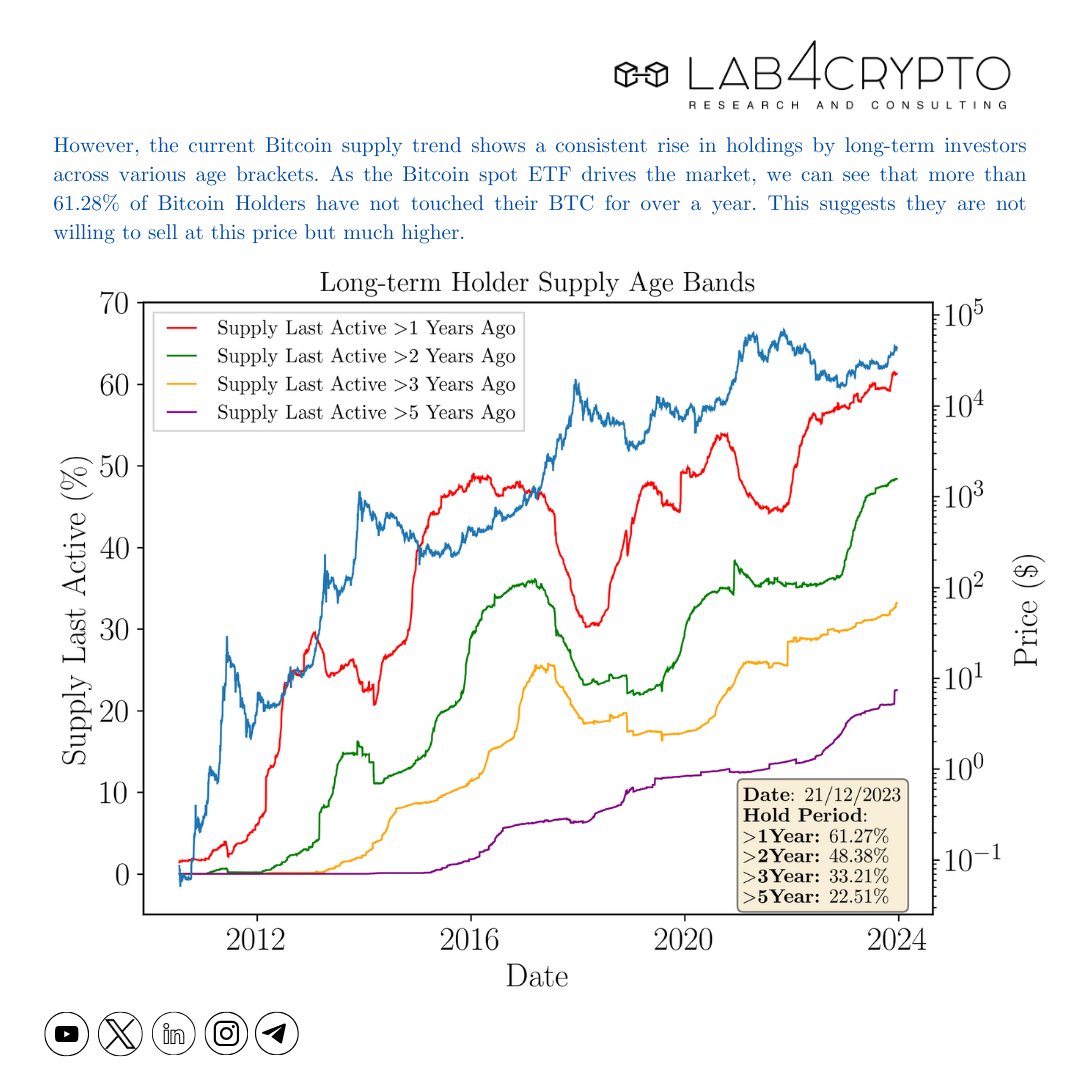

Resilient Holders: Over 61% Avoided Selling Within a Year

Despite attractive profits, a notable trend emerges from the resilient Bitcoin supply environment. 61.28% of cryptocurrency BTC holders have refrained from selling their assets for a year. This indicates a strong belief among a significant majority of investors.

On the other hand, there is another point indicated by this situation. Accordingly, it’s not just reluctance to sell at current prices, but also a strong belief in the potential for much higher valuations.

Market Confidence and Long-Term Vision

The prevailing sentiment among BTC holders, with the overwhelming majority currently in profit, points to a positive outlook for the cryptocurrency. As the market awaits the potential approval of a spot Bitcoin ETF, the high profitability among investors adds an extra layer of optimism.

Moreover, the resilience shown by more than 61% of those who have held their BTC for a year or longer demonstrates a long-term vision. This collective confidence and commitment among Bitcoin holders not only bodes well for the stability of cryptocurrency but also reflects a broader belief in sustainable growth potential in the foreseeable future.

Investors seem ready for a potential increase in value, which suggests that the market may be preparing for a significant bullish momentum phase. Such an expectation is a sign that the upward trend experienced over the past two months may continue.

If this expectation continues, the journey towards $50,000 for the cryptocurrency Bitcoin price seems likely next week. Of course, BTC’s journey to this level increases the possibility of further rises for altcoins. We may see more investor appetite next week.

Türkçe

Türkçe Español

Español