Arbitrum has had a particularly challenging past six months. The price has been trading in a downward channel. However, there are indications that the downward trend in the price of ARB may reverse. A bottom formation has occurred, suggesting that buyers are slowly accumulating before a new rally.

Optimism Continues in the Crypto Market

Following the storm caused by Binance, optimism prevails in the cryptocurrency markets. Some analysts suggest that there are no longer any obstacles in front of Bitcoin ETFs. According to Bloomberg analysts, there is a 90% chance of Bitcoin ETF approval in January 2024.

If Bitcoin ETF is approved, it is expected to create a positive atmosphere for altcoins. This situation could also lead to a frenzy of buying. Arbitrum stands out as one of the candidates for this purchase.

Arbitrum On-Chain Data Indicates Buying

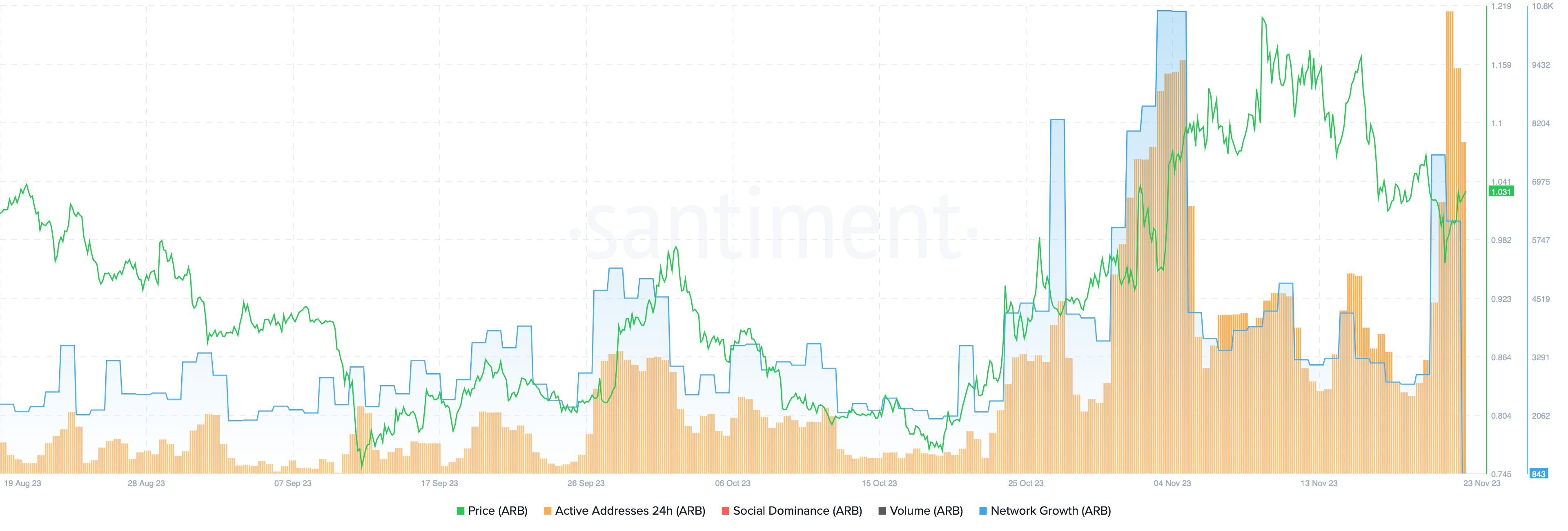

The Arbitrum network witnessed a 160% increase in active addresses between November 21st and November 23rd. Active addresses increased from 11,357 to 29,435. This increase is also an indicator of investor interest. It shows that the dip is being bought.

The growth of the Arbitrum network has also been remarkable. It showed a 160% increase on November 21st. Some speculate that this growth is related to capital inflows.

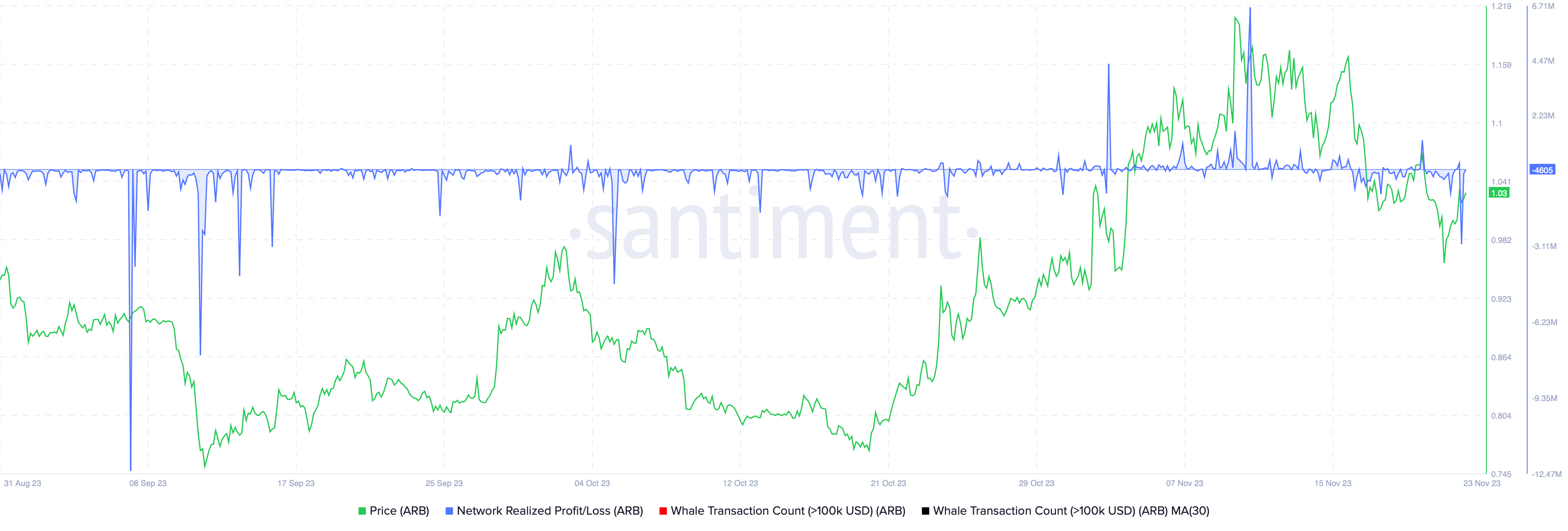

There was a development where $3,060,000 worth of ARB was sold at a loss according to the Non-Performing Loans (NPL) metric within the network. Although someone may incur losses during such sales, it is seen as an opportunity for long-term holders to accumulate.

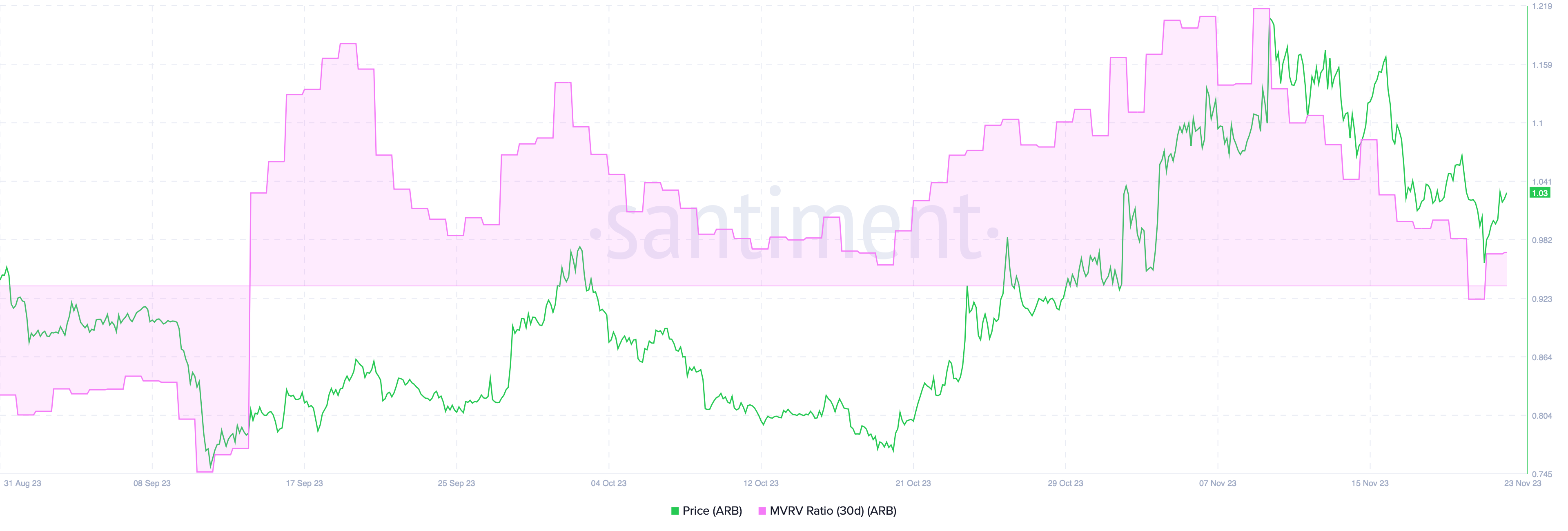

It is worth noting that unrealized profits are very detrimental to bulls. However, this situation appears to be favorable for Arbitrum. The 30-day Market Value to Realized Value (MVRV) ratio of Santiment shows that the unrealized profits of individuals who purchased ARB decreased from approximately 38% on November 10th to 4% at the time of writing this article.

This decline signifies the resetting of unrealized gains for Arbitrum. This new development increases the likelihood of a rally that is not threatened by sellers.

Is There a Possibility of an Explosion for Arbitrum?

The price of Arbitrum is currently trading at $1.03. However, if the bulls persist, the price could reach $1.12 with a 9% increase. If the price surpasses this obstacle, it could test the key resistance level of $1.29.

However, it is also a reality that there are downward movements, and in a scenario where the bulls fail, alarm bells will ring for ARB. In such a case, there is a possibility that the price could drop as low as $0.85. If ARB cannot hold at this key support level, the price could reach $0.76.

Türkçe

Türkçe Español

Español