Ark Invest and 21Shares, as stated in a recent filing with the U.S. Securities and Exchange Commission (SEC), are planning to collaborate to launch an Ethereum Futures ETF. Both companies have been awaiting approval for their respective Bitcoin ETFs for the past two years.

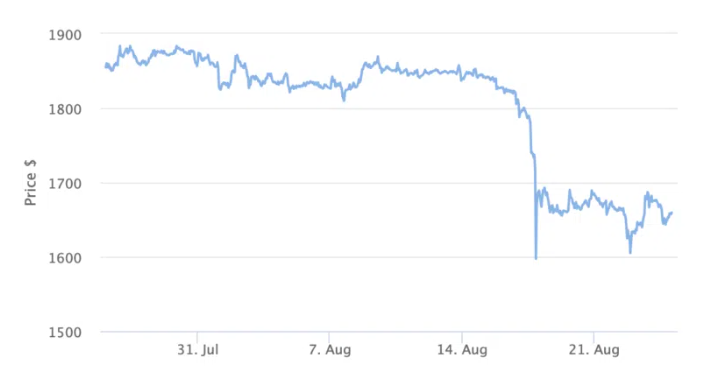

Are Ethereum ETF Rumors a Catalyst?

According to a filing made by the SEC on August 24th, Ark Invest and 21Shares are listed as sub-advisors for a joint Ethereum ETF product. However, an executive from 21Shares will actively manage the daily operations of the fund. The statement reads:

Ophelia Snyder is a portfolio manager at 21Shares responsible for discretionary investment decisions, security selection, and portfolio weights. Ms. Snyder has been primarily responsible for the day-to-day management of the Fund since its inception.

The filing claims that the future value of Ethereum depends on widespread adoption and any changes in this regard could impact its price. Like other cryptocurrencies, Ethereum is also referred to as a “relatively new and emerging asset,” and it is stated that “a slowdown or halt in the development or acceptance of the Ethereum network may adversely affect an investment in the Fund.”

This comes after news that the SEC wants to approve Ethereum Futures ETFs by October. Six other companies are currently seeking approval for an Ethereum Futures ETF.

These include the Ether Strategy ETF, Bitwise Ethereum Strategy ETF, Roundhill Ether Strategy ETF, VanEck’s Ethereum Strategy ETF, ProShares Short Ether Strategy ETF, and Grayscale Ethereum Futures ETF.

Latest Hurdles for BTC ETFs

In 2021, Ark Invest and 21Shares initially sought approval from the SEC for a Bitcoin ETF. After the initial rejection, the two investment firms faced another setback from the SEC earlier this year for the same product. Recent reports suggest that the delay could push a decision regarding the Bitcoin ETF to 2024.

Ark Invest CEO Cathie Wood actively comments on the delayed approval of a spot Bitcoin ETF. She recently stated that the SEC’s delay aims to approve multiple companies for a spot Bitcoin ETF simultaneously.

If the SEC is going to approve a Bitcoin ETF, it will approve more than one at the same time.

Türkçe

Türkçe Español

Español