Renowned investment firm ARK is selling Grayscale Bitcoin Trust (GBTC) shares in the midst of market fluctuations fueled by the expectation of a spot BTC exchange-traded fund (ETF). ARK, managed by Bitcoin advocate Cathie Wood, sold 100,739 GBTC shares from the ARK Next Generation Internet ETF in transactions conducted on October 23. The value of the shares was over $2.5 million at the time of writing.

Why Did ARK Sell GBTC?

This notable decision comes as GBTC reaches its highest levels in recent months, surging to $24.7 for the first time since May 2022. According to TradingView data, GBTC has seen an increase of over 200% since the beginning of the year, with a 30% growth in the past 30 days alone.

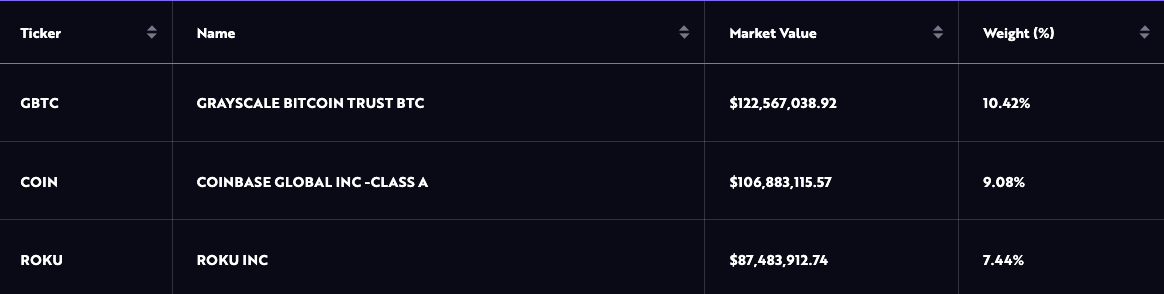

The sale of GBTC marks the first transaction reported by ARK since November 2022, when they added 450,272 GBTC shares worth $4.5 million to ARKW. The recent GBTC sale accounts for approximately 2% of the total GBTC value in ARKW’s portfolio, amounting to $122.6 million as of October 23. GBTC remains the largest asset held by ARKW, representing 10.4% of the product’s supply. Coinbase holds 9% of the supply, while Roku holds 7.4%.

ETF Applications and ARK’s Strategy

According to Bitcoin advocate Samson Mow, ARK’s recent sale of GBTC shares may be related to a decision by the SEC regarding the firm’s application to list a Bitcoin-based ETF. Shortly after ARK amended its spot Bitcoin ETF application on October 11, Grayscale submitted a new BTC ETF registration statement to the SEC on October 19. Mow expressed the following in a statement:

“It makes sense for ARK to sell GBTC now because the spread between the investment vehicle and Bitcoin is narrowing, and their ETF applications are pending.”

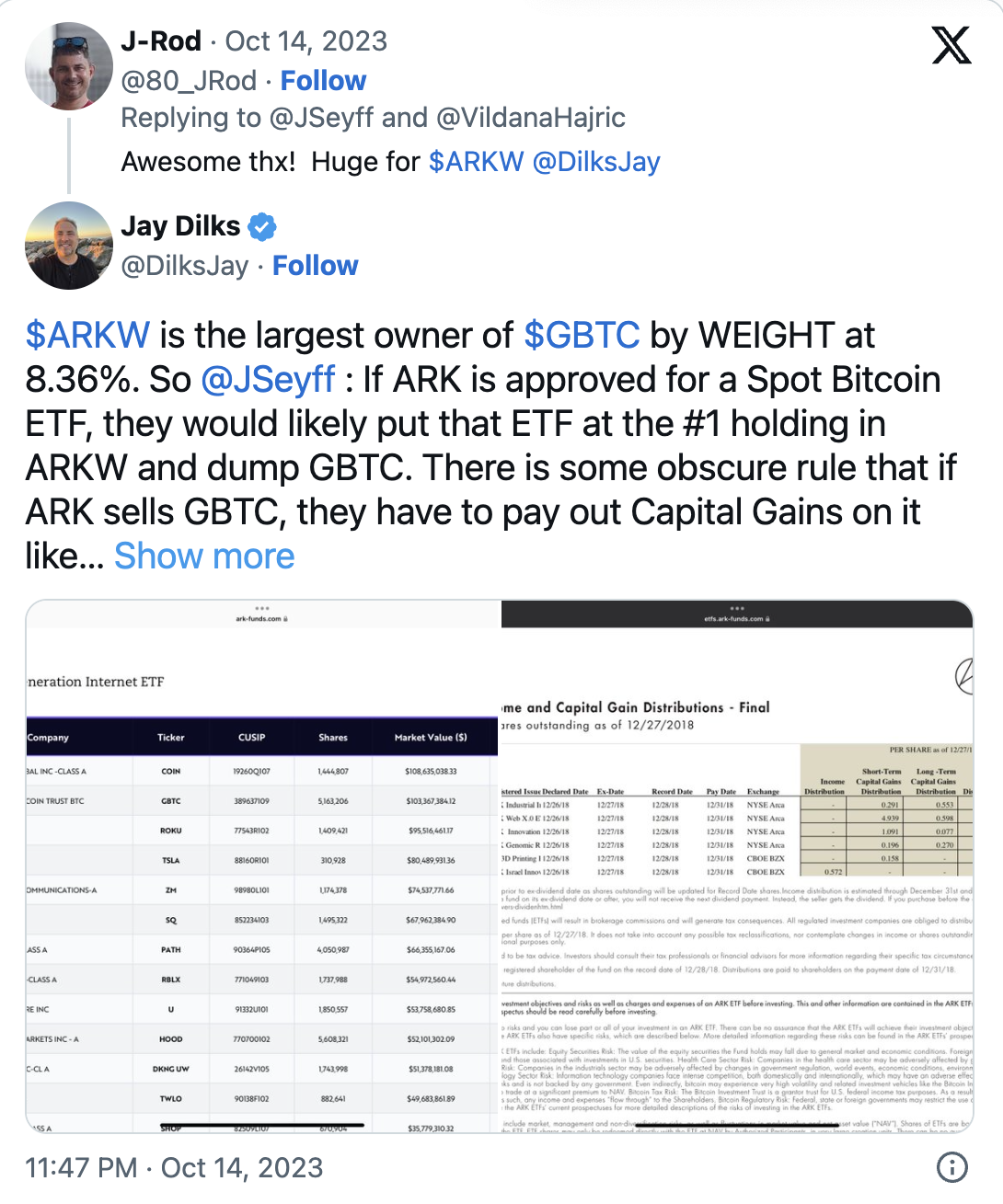

Some investors speculate that if ARK receives approval for a spot Bitcoin ETF, they will hold their ETF as the first holding in ARKW, leading to the sale of GBTC.

In addition to the GBTC sale, ARK sold 32,158 Coinbase (COIN) shares from ARKW and 10,455 COIN shares from the ARK Fintech Innovation fund for a total of $3.4 million. The company continues to accumulate shares of investment firm Robinhood (HOOD), purchasing 32,158 HOOD shares worth $300,000 on October 23.

Türkçe

Türkçe Español

Español