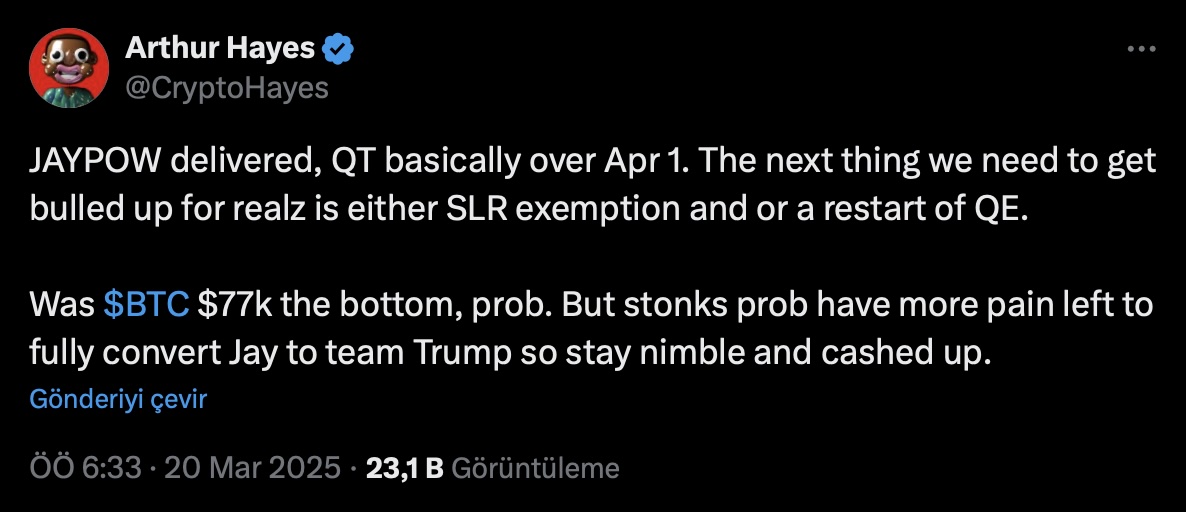

Arthur Hayes, co-founder and former CEO of BitMEX, recently commented on the cryptocurrency market through social media platform X. He highlighted Federal Reserve Chairman Jerome Powell’s remarks from March 19 and emphasized that the Fed plans to slow down quantitative tightening (QT) by early April. According to Hayes, stronger signals are required for the markets to enter a new upward trend, suggesting that Bitcoin (BTC)  $91,967 may find support at the $77,000 level while predicting further declines in stock markets.

$91,967 may find support at the $77,000 level while predicting further declines in stock markets.

Could $77,000 Be a Support Level for Bitcoin?

Hayes noted that Bitcoin’s price might have reached a bottom. With ongoing fluctuations in the cryptocurrency market, this raises the possibility that Bitcoin could establish support at the $77,000 level. The former BitMEX CEO stressed that the market may enter a new phase if the Fed slows down QT in April.

According to Hayes, Bitcoin will need more than just QT adjustments to begin a new upward trend. He mentioned the necessity of reinstating the Bank System Leverage Ratio (SLR) exemption or restarting quantitative easing (QE). He added that failure to take such steps would lead to continued uncertainty in the markets.

It is well-known that the Fed’s policies play a critical role in determining direction for the cryptocurrency market. Therefore, the announcement regarding the slowdown of QT has been interpreted as a positive signal. However, as Hayes indicated, actions concerning SLR and QE will be fundamental factors determining the market’s future trajectory.

Hayes Predicts Further Decline in Stock Markets

On another note, while assessing Bitcoin’s price, Hayes expressed his expectation of further declines in stock markets. He suggested that Powell might adjust economic policies to provide more support to the Trump administration.

Recent fluctuations in U.S. stock markets have been driven by economic uncertainties and interest rate policies. According to Hayes, the Fed may need to see more declines in stock prices before making significant changes to its current policy, indicating continued volatility in the markets.

In contrast, the cryptocurrency market may show a quicker recovery than the stock market. For this to occur, Bitcoin must not drop below the critical support level of $77,000, which is essential for investors.