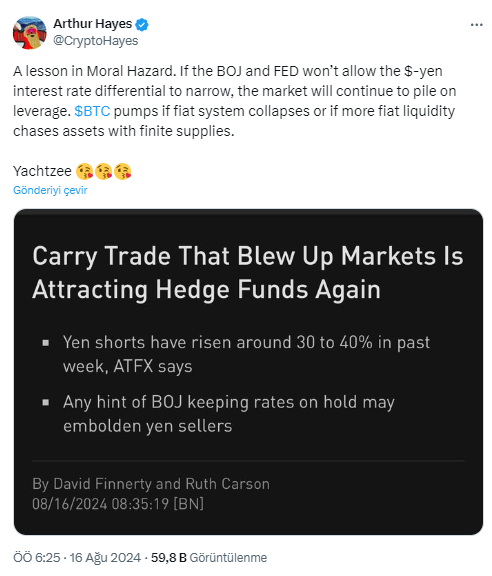

Arthur Hayes, one of the co-founders of BitMEX, is a prominent figure closely monitoring developments in the cryptocurrency markets and drawing attention with his insights. Today, in a social media post, he stated that if the Bank of Japan and the US Federal Reserve do not narrow the gap between their interest rates, markets will continue to use leverage. This statement provides significant clues about global economic balances and the future of cryptocurrency markets.

How Will Interest Rate Differences Affect Markets?

Arthur Hayes argues that if the Bank of Japan and the US Federal Reserve do not close the gap between their interest rates, markets will continue to use leverage. This difference could have a significant impact on foreign exchange markets and push investors to take on more risk. As a result, an increase in leverage usage in the markets seems likely.

Cryptocurrencies and the future of the fiat money system were also touched upon by Arthur Hayes. He stated that the collapse of the fiat money system or the shift of fiat money liquidity to assets with limited supply could lead to significant increases in the value of cryptocurrencies. Especially the money printing policies of central banks could direct investors towards alternative assets with limited supply, like Bitcoin. This scenario could lead to an increase in the value of cryptocurrencies.

Leverage and the Shift to Cryptocurrencies

The increase in leverage usage allows investors to take larger positions with less capital, which increases volatility in the markets. As Hayes pointed out, in case of instability in the fiat money system, investors are likely to turn to assets with limited supply. This could cause rapid value increases in cryptocurrencies like Bitcoin.

Looking at Arthur Hayes’ warnings, we see that he provides significant clues about the future potential of cryptocurrencies. The failure to narrow the interest rate gap could increase leverage usage in the markets, which could trigger interest in cryptocurrencies.

Under these scenarios, it is likely that cryptocurrencies with limited supply, like Bitcoin, could experience significant value increases. However, this expectation may not always materialize in the market, as it is a fact that Bitcoin is also affected by geopolitical problems.

Türkçe

Türkçe Español

Español