Australia’s leading stock exchange, the Australian Securities Exchange, approved its first Bitcoin exchange-traded fund (ETF), which closed its first trading day with a volume of $1.3 million. This is significantly lower than the first trading day of US-based spot Bitcoin ETFs, which saw a total trading volume of $4.5 billion across 10 funds, each averaging $450 million.

Australia and the Bitcoin Market

VanEck, the issuer of the VanEck Bitcoin ETF (VBTC), expressed optimism about the product’s growth potential despite the market size difference compared to US Bitcoin ETFs. Jamie Hannah, VanEck’s Deputy Head of Investments and Capital Markets, stated:

“Although the Australian market is much smaller than the US and our flow is largely retail rather than institutional, we might follow a similar path. We have noted a strong interest from a significant number of individual and professional investors to access Bitcoin via ASX.”

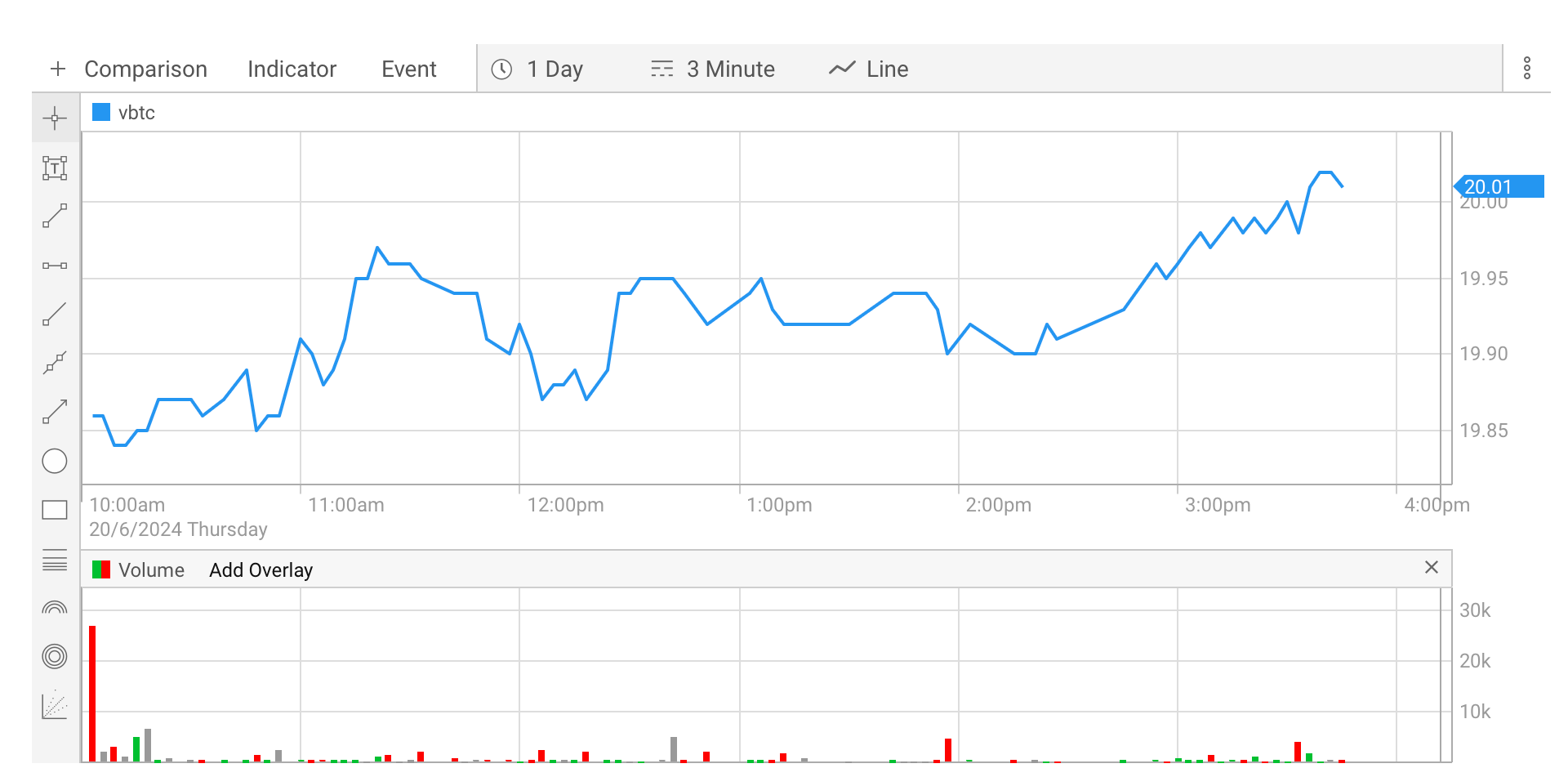

ASX data showed that VBTC opened at $13.24 and closed the day at $13.34, with 96,476 shares traded.

Statement from a Renowned Figure on Bitcoin ETFs

On June 15, VanEck CEO for the Asia-Pacific region, Arian Neiron, stated that demand in Australia has increased, particularly through a regulated, transparent, and familiar investment vehicle. He shared the following insights:

“We recognize that Bitcoin is an emerging asset class that many advisors and investors want to access. VBTC also makes Bitcoin more accessible by managing all the back-end complexities. Understanding the technical aspects of acquiring, storing, and securing crypto assets is no longer necessary.”

Despite being the first spot Bitcoin ETF listed on the ASX, two more Bitcoin ETF products have been launched in Australia. Recently, the Monochrome Bitcoin ETF was approved and began trading on Cboe Australia, the country’s second-largest stock exchange. In April 2022, the Global X 21Shares Bitcoin ETF became the first Bitcoin ETF product launched in Australia.

Türkçe

Türkçe Español

Español