Last week’s approval of the spot Bitcoin ETF has so far failed to excite a price increase, leading to a pessimistic mood in the cryptocurrency market. Following Bitcoin’s (BTC) recent crash, the market has become more stagnant, with a noticeable slowdown in the crypto market. A decline in interest and activity in the altcoin market in recent days has also been observed. Despite all this, Avalanche (AVAX), which saw a remarkable rise last year along with SOL, could be one of the altcoins to watch in 2024.

Current Status of AVAX

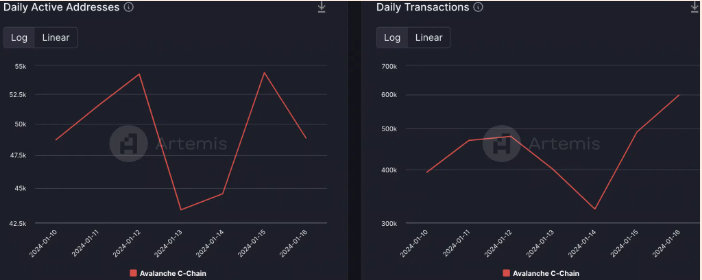

In the days following the ETF decision, the shine and decreased altcoin interest did not seem to affect AVAX. Looking at the Avalanche network, there has been an increase in activity. A closer look at this situation reveals an increase in Daily Active Addresses and Daily Transactions on the network as of the beginning of 2024.

The reason for this is attributed to the subnetworks owned by the blockchain. Avalanche’s subnetworks tackle scaling challenges by redirecting activities from the main chain, providing users with unique scalability and customizations.

In addition, partnership efforts on the Avalanche side continue. In this context, new agreements have been made between Avalanche and major banks such as Citibank and JP Morgan, highlighting the network’s prominence.

The Future of AVAX Coin

On the other hand, looking at the AVAX price, as of the time of writing, it was trading at $35.5, down 0.67% in the last 24 hours.

The current price still seems far from creating an upward trend that could attract investors, indicating that the downward trend that began last month continues. Moreover, the RSI value is at 43.63, suggesting that sellers are somewhat dominant.

Furthermore, AVAX’s trading volume also fell by 0.67%, standing at $511 million. A closer look at the overall volume shows a drop of less than 1%, at $13 billion, indicating a decline in interest.

Additionally, the Social Volume specific to AVAX has seen a noticeable decrease in the past few weeks. The Weighted Sentiment for the token also fell, increasing the uncertainty of sentiment among investors. As a result, the sentiment towards Avalanche on social media platforms appeared negative.

Despite all this, with the upcoming Bitcoin halving and the increase in social adoption, some challenges for AVAX may be overcome due to the connections on the Avalanche side. With its price movements during the last bull cycle and the rise it experienced in 2023, AVAX continues to hold the potential to be one of the most significant risers in 2024.