On December 2nd, while the BTC price was holding at $38,500, AVAX Coin continued to find buyers at $22. Due to the weekend, the trading volume decreased by 26% and dropped to $390 million. However, maintaining the $20 level is positive for predictions for December. The price has struggled to surpass this level for a long time.

Avalanche (AVAX) Review

Google searches for AVAX Coin dropped to the levels of November 8th and started to recover from there. Despite the increased interest with announcements from JP Morgan and others, we are currently seeing a slight pullback with the price. The weakening of the previous week’s increased interest can be considered normal.

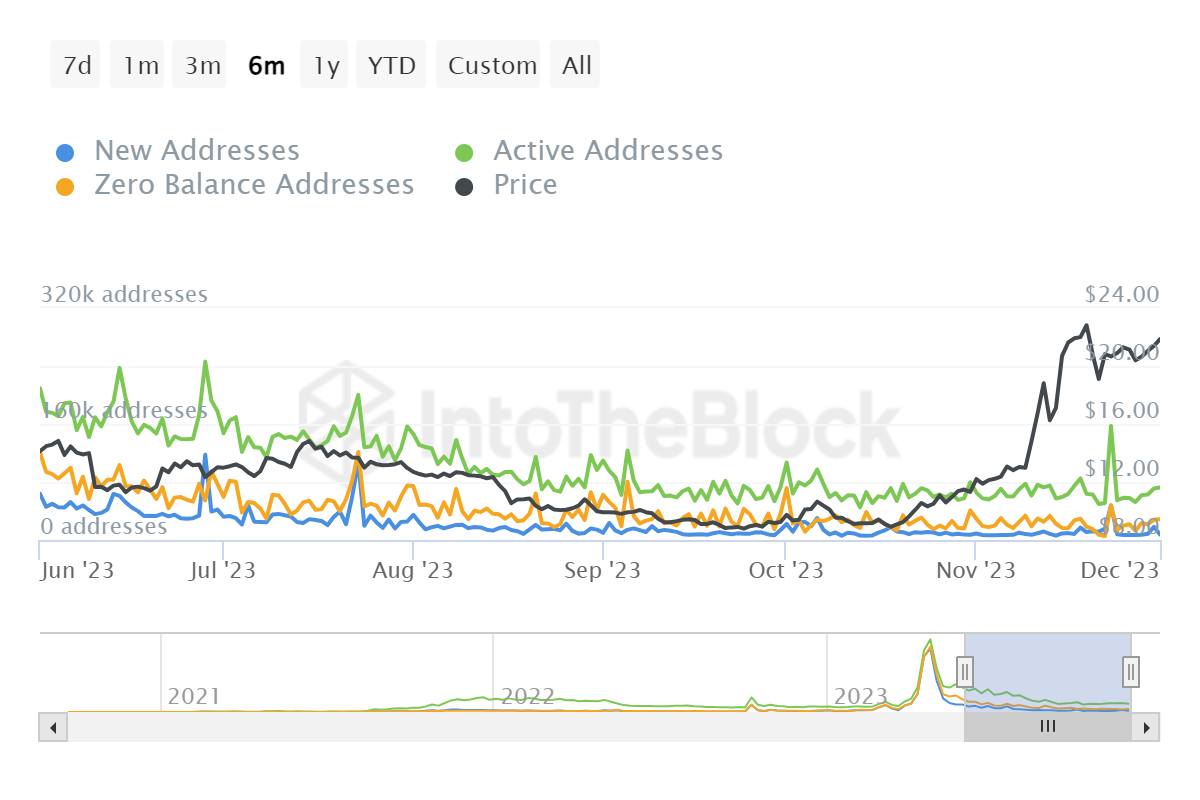

Although the daily active addresses reached August highs on November 23rd, they returned to the average of October and November. This indicates that the interest in the network has rapidly increased and subsided. However, the recovery in addresses with balances greater than zero is promising. Active addresses have also recovered by 30%, which can support the price increase.

In the middle of last month, the total number of addresses exceeded 6 million. The Binance incident kept the agenda busy between November 20th and 22nd, and we saw an increase in whale transfers during this period. There were probably those who wanted to take advantage of the possible decline for profit-taking.

AVAX Coin Price Analysis

Buyers showed that they are trying to keep Avalanche above $22 on December 1st, indicating that demand is alive at higher levels. Although the volume has weakened for now, the fact that the price can hold in a critical zone can be considered a positive development.

If the bulls can keep the price above $22, we may see the $24.69 target come back into play. This area is among important resistance levels, and overcoming this tough resistance is necessary for an impressive rally. If the resistance is overcome, there may not be a significant sell wall up to $28.5. However, BTC performance will be decisive.

Closing below $22 or the start of panic selling can be halted by the $19.8 support level. However, if it is lost, levels of $18.9 and lower will come into radar.

Türkçe

Türkçe Español

Español