The DeFi sector has taken a big hit in recent months. However, despite this, a few projects in the sector, such as Real World Assets (RWA), have witnessed tremendous growth. Initially, protocols like MakerDAO were among the few protocols benefiting from RWAs, but it has been observed that Avalanche (AVAX) has also entered this space recently.

Critical Development in Avalanche!

According to recent data, Total Value Locked (TVL) in RWAs has surpassed a significant milestone of $1 billion, indicating a notable growth trajectory of approximately $900 million within this year alone. Throughout the year, Avalanche has made significant capital commitments towards tokenized assets and has demonstrated a strong driving force in this direction. It would not be surprising if this scenario gains momentum under Avalanche in the foreseeable future.

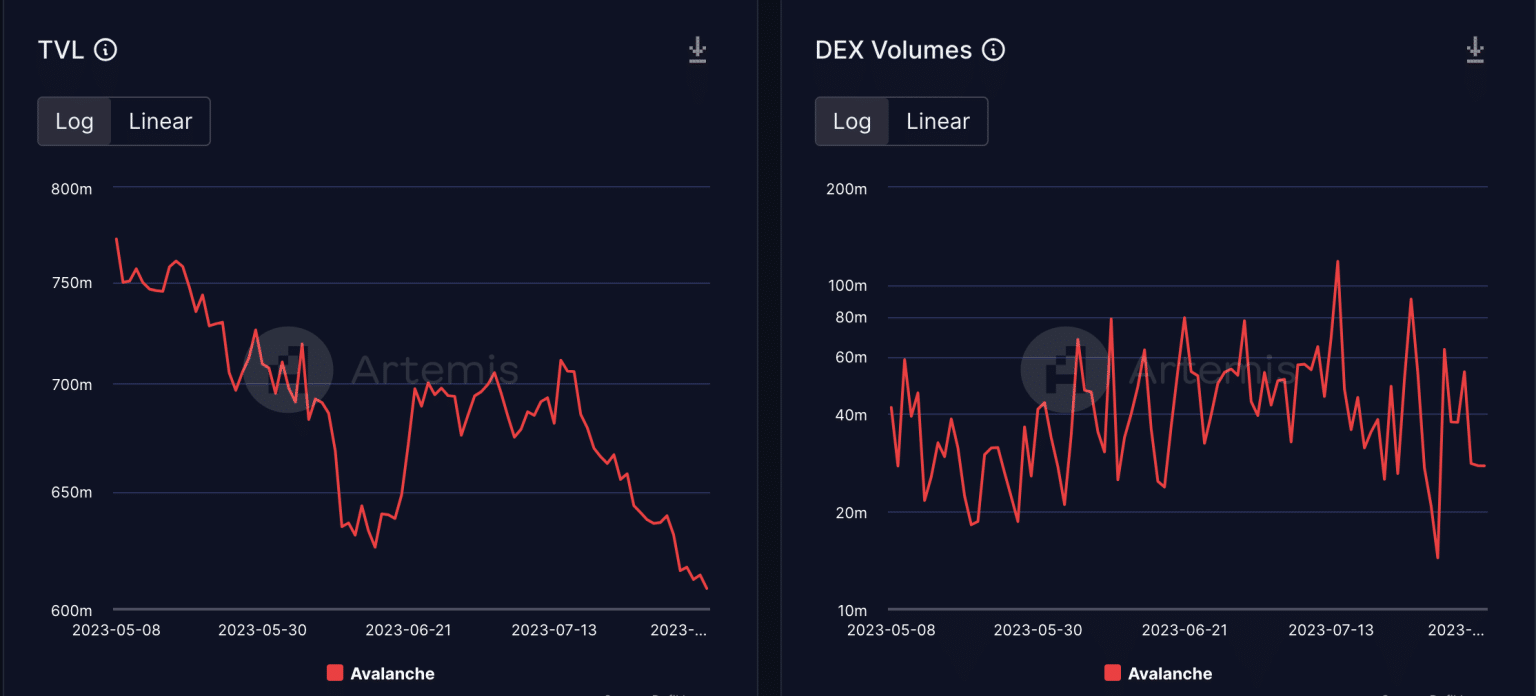

The increasing TVL in RWAs and Avalanche’s strategic commitment highlight the growing importance and potential of tokenized assets in the broader financial landscape. Despite Avalanche’s efforts to increase its presence in the DeFi space, its TVL continues to decline. According to Artemis data, Avalanche’s TVL has dropped from $770 million to $608 million in the past few months.

AVAX Coin’s Future!

However, Avalanche has witnessed stable growth in terms of DEX volumes. This indicates that despite the decrease in TVL, the protocol continues to attract attention through DeFi-related dApps on the protocol. In addition to its performance in the DeFi sector, the Avalanche network has also experienced a downward movement in terms of price.

After showing an upward movement and testing the $15,978 resistance level on July 14th, AVAX prices observed a significant drop of 21.17%. During this period, AVAX’s price formed a downward trend, displaying multiple lower lows and lower highs. The price decline occurred in line with the decreasing CMF, which dropped to -0.01 at the time of writing. The negative CMF implies a lack of buying pressure.

In contrast, RSI showed a positive outlook for AVAX. It was at 52.7 at the time of writing, indicating that price momentum was on the rise. It remains to be seen whether AVAX will test the $12.11 support levels before breaking the downtrend or experiencing any positive movement.