In the cryptocurrency world, the AVAX token associated with the Avalanche network finds itself in decline once again amid a broader market correction. While Bitcoin and Ethereum experience modest declines, AVAX remains relatively stagnant. Consequently, neither bulls nor bears dominate the price action.

AVAX Price Stuck in a Range

Currently, the cryptocurrency AVAX consolidates in a narrow range between its 50-day moving average (MA50) acting as resistance at around $36.97 and its 200-day moving average (MA200) providing slight support at around $36.81. This narrow trading range indicates a period of consolidation and indecision in the market.

The Relative Strength Index (RSI) stands at 49.63, indicating a neutral stance without significant bullish or bearish momentum. For AVAX to recover from its current decline, it needs to decisively break above the MA50 resistance. Failure to do so could lead to further testing of lower support levels, potentially around $36.50 and even $36.00, if downward pressure intensifies.

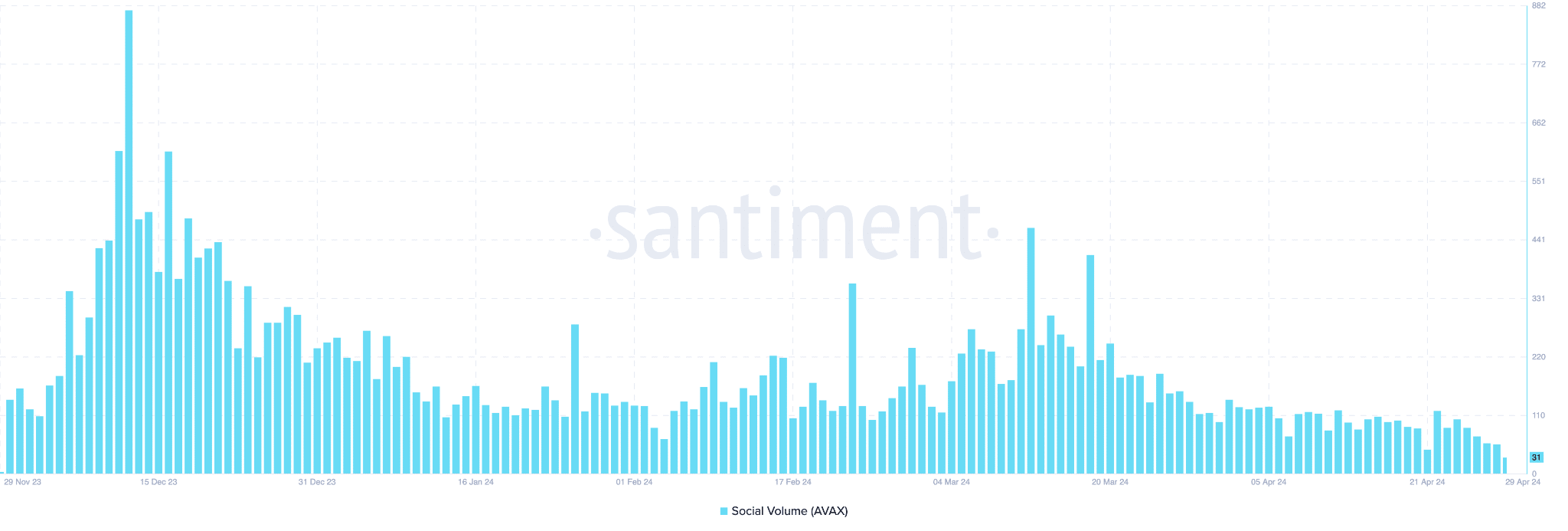

Social Volume Also Declined

The decline in AVAX’s social volume and open interest on exchanges indicates a cooling period in market enthusiasm, where both bulls and bears seem to be taking a breather. This decrease in social interaction may reflect a lack of strong catalysts to push the cryptocurrency AVAX in a clear direction in the near future.

From a technical perspective, the cryptocurrency AVAX appears to be in a state of flux without a clear path forward. Negative sentiment regarding volume and market dominance could further depress the price, making it necessary for the cryptocurrency to find stronger catalysts to rally.

At this stage, the cryptocurrency AVAX currently resides in a neutral zone where neither bulls nor bears have full control over the price action. The near-term performance of the cryptocurrency will likely depend on its ability to break short-term resistance levels and the emergence of stronger market catalysts.

Türkçe

Türkçe Español

Español