Axie Infinity (AXS) bears finally broke the $6 support level on August 12th after multiple attempts over the course of a month. Amidst increasing downward momentum, data on the chain examines the chances of bulls forcing an early AXS price recovery.

After losing the critical $6 support level, Axie Infinity (AXS) bulls are now making intense efforts to stage an early recovery. Will they break the $5 support as losses continue to mount or can bulls initiate a recovery from here?

AXS Approaching Oversold Territory

The current price of AXS is hovering around $5.37, marking a 24% decline from its peak of $6.90 last month. After a month-long frenzy of selling, AXS now appears to be entering oversold territory.

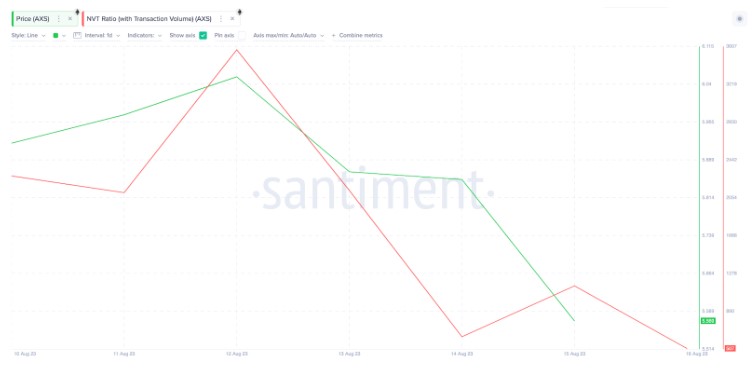

Since the retreat from the $6 support on August 12th, the Network Value to Transaction Volume (NVT) ratio for AXS has rapidly declined. AXS experienced a staggering 85% drop in the NVT ratio from 3,571 to around 507 between August 12th and August 16th.

The NVT ratio examines the relationship between the current market value and the fundamental transaction activity in a blockchain network. When it declines for an extended period, it indicates that the token is currently oversold and may soon reverse the downtrend. If this analysis holds true, Axie Infinity bulls will likely establish a buying wall for recovery around the $5 region.

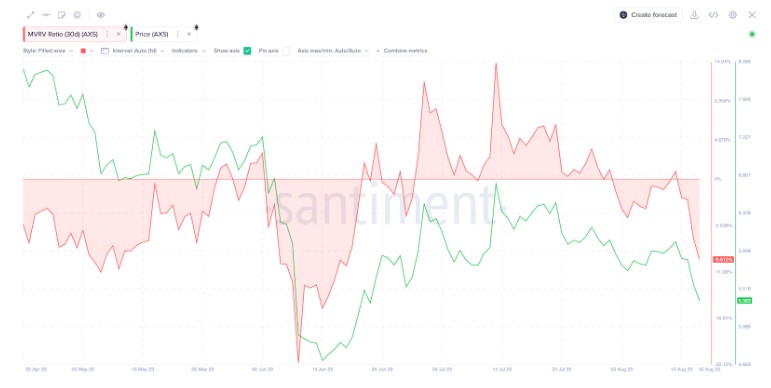

Additionally, data on the chain suggests that most AXS holders may not want to sell in the coming days due to unfavorable prices. According to MVRV data, current holders will face double-digit losses if they continue to sell. As seen below, the majority of investors who purchased AXS in the last 30 days would incur approximately a 10% loss if they sell today.

The Market Value to Realized Value (MVRV) ratio indicates the net financial position of investors who have recently bought an asset. Historical data trends reveal that AXS holders have not suffered losses exceeding 15% since mid-June.

Therefore, the current holders approaching a 10% loss already indicate that they will end their sales and wait for more favorable prices. As a result, while bears still maintain their dominance at present, AXS bulls may soon take advantage of low prices and oversold conditions to stage a recovery.

Axie Infinity (AXS) Price Prediction

The aforementioned on-chain indicators for Axie Infinity show vital signs of an imminent AXS price recovery. In/Out of Money (IOMAP) data displays the distribution of purchase prices by Axie Infinity holders within a 20% range of the current market price. As seen below, it could confirm the possibility of a rebound from the $5 range for AXS price.

Clearly, 819 holders had purchased 40,560 AXS tokens at an average price of $4.93. If they hold strong as predicted, they could trigger an immediate AXS price recovery. However, if this support level does not hold, a supply wall of $4.50 could help prevent panic selling.

Nevertheless, if AXS surpasses the $7 region, bulls could firmly take control. However, as seen above, a cluster consisting of 969 addresses had purchased 20.7 million Axie Infinity tokens at a maximum price of $6.17. If they establish a sell wall in this region, it could force a decline. However, if this resistance level does not hold, AXS could move towards $7.