The staking feature generates earnings for investors by lending any altcoin and reducing the circulating supply available for sale. The reduction in circulating supply is a significant event that can trigger a price increase in cryptocurrencies. Indeed, many crypto projects work to support supply scarcity through the staking pools they create. A venture striving for BTC in this field recently received a $70 million investment.

What is Babylon?

The Bitcoin ecosystem continues to grow and develop. Especially with spot BTC ETFs, we clearly see that efforts in this area have increased. The popular Bitcoin venture Babylon is one of them. This initiative is working on a unique staking solution that integrates Bitcoin with other blockchain networks.

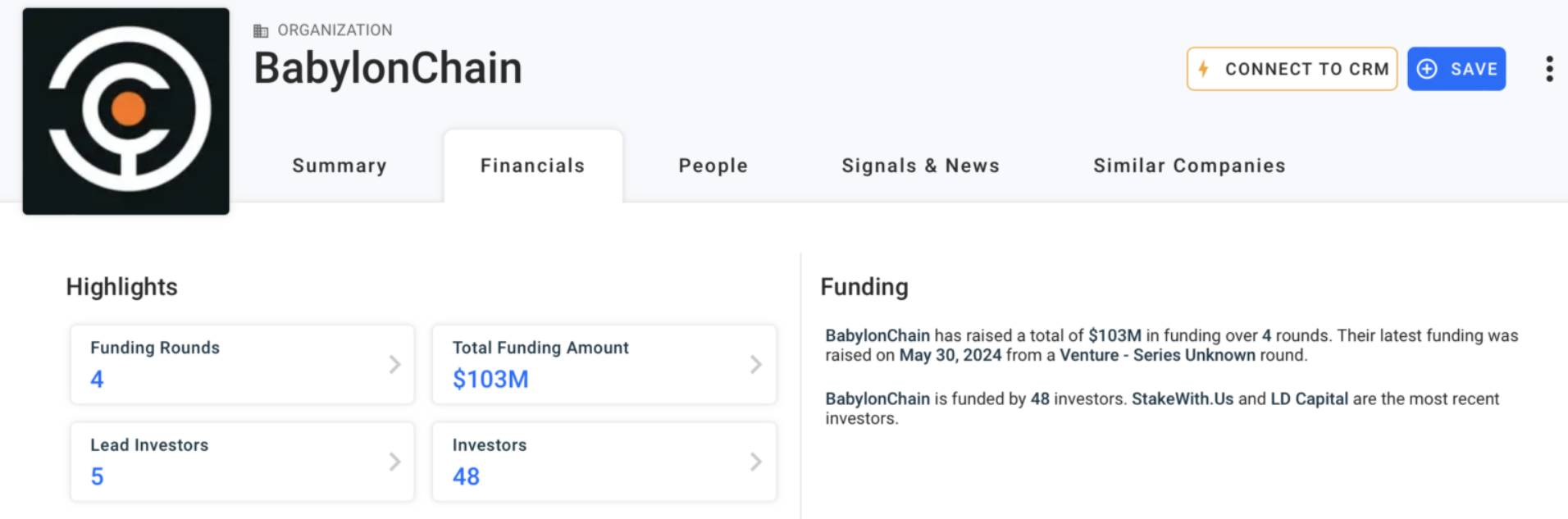

Recently, the company, which received a $70 million investment, was led by Paradigm in this funding round. Polychain Capital, HashKey Capital, and other investors also contributed here. Normally, the working logic of PoS networks is already to ensure network security through staking. Babylon’s approach is trying to apply Bitcoin, a Proof of Work (PoW) asset, in a PoS-like system.

Babylon Investment

Bitcoin is now much more in the spotlight, and this is expected to continue with the bull market anticipated until mid-2025. Babylon, striving for Bitcoin’s potential to play a more versatile role in the broader ecosystem, had previously raised $33 million in various rounds.

Binance’s investment arm, Binance Labs, also announced that it had invested in the venture, although it did not disclose the amount. Babylon co-founder David Tse said the following about the recent good news;

“We are very excited about the confidence shown by Paradigm, Bullish Capital, Polychain Capital, and other investors. This fund will accelerate our mission to make Bitcoin the security backbone of PoS systems.”

Launched in February 2024, the venture attracted the interest of more than 100,000 Bitcoin investors within 24 hours. If it receives the expected interest, we may see days when BTC investors have a greater appetite for income, further reducing the supply available for sale on exchanges.

Türkçe

Türkçe Español

Español