Crypto firm Bakkt announced on November 15th that it is adding support for six new tokens to its platform. The company seems to be bringing back its custody service. In addition to Bitcoin and Ethereum, Bakkt plans to expand its custody support to include Bitcoin Cash, Dogecoin, Ethereum Classic, Litecoin, Shiba Inu, and USD Coin. The company also stated its intention to add more tokens to its custody services in early 2024.

Bakkt’s New Move

Custody of crypto assets focuses on the protection of cryptographic keys, which are crucial for accessing and transferring assets. Custodians like Bakkt use various security measures, including storing crypto assets in cold wallets and employing multi-signature technology that requires multiple approvals for access, to safeguard the assets.

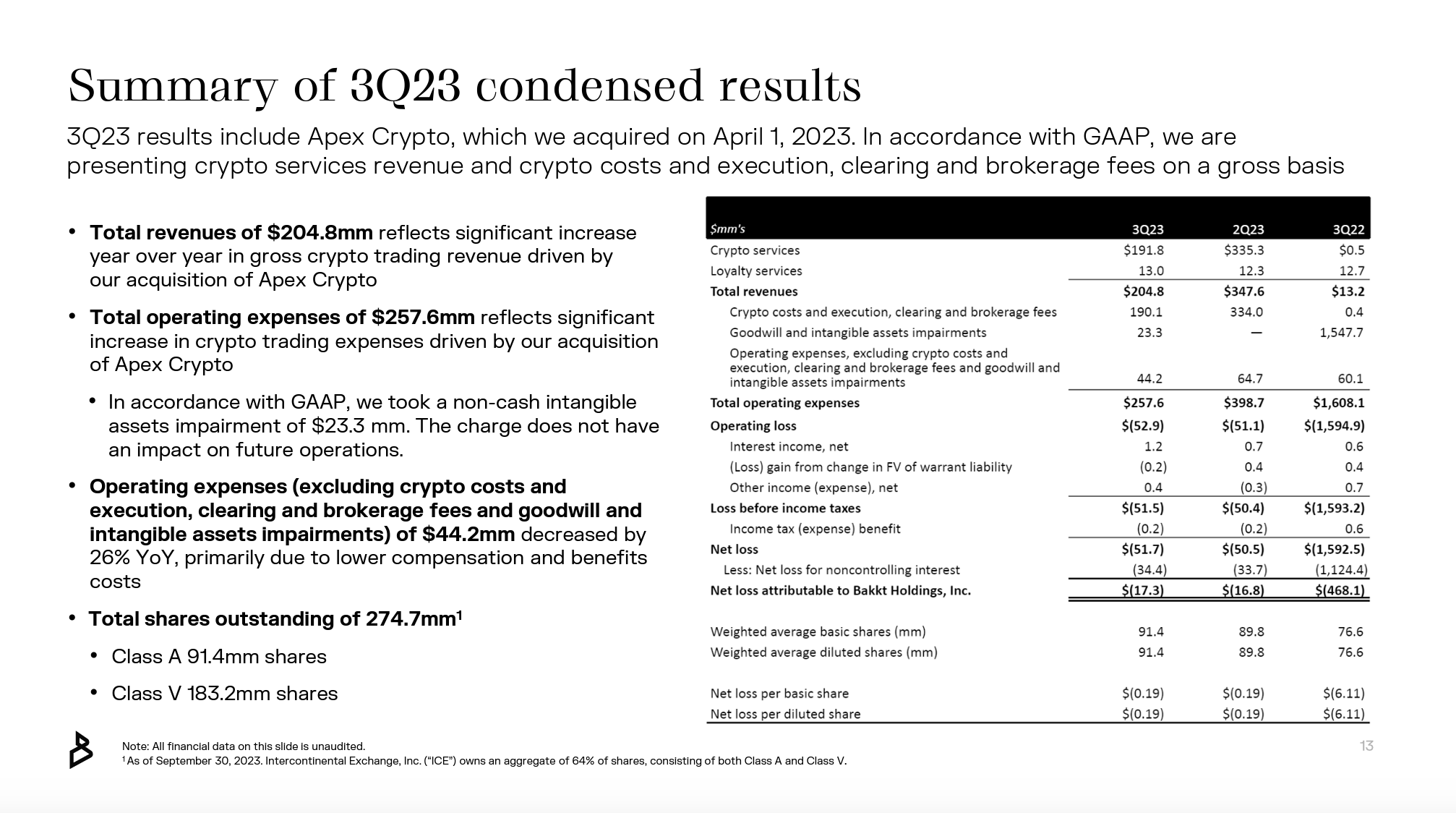

The announcement came after Bakkt reported a 30% decrease in adjusted EBITDA loss, amounting to $21.6 million, due to a decline in compensation and ancillary revenue, following the publication of its quarterly earnings report on November 14th.

According to the report, Bakkt revealed that its crypto revenue reached $191.8 million in the third quarter of 2023, driven by the acquisition of Apex Crypto in April. The company generated a total revenue of $204.8 million during the quarter. In terms of assets, Bakkt reported a $505.7 million asset under custody, marking a 28% decrease compared to the previous year.

Impressive Client Portfolio

Bakkt continues to develop partnerships to strengthen its crypto custody services. According to its quarterly report, the company plans to offer clearing and custody services for Wall Street-backed crypto exchange EDX Markets and initially serve as a qualified custodian. New customers for Bakkt’s custody services include Bitcoin platform Unchained and LeboBTC, a crypto advisory firm catering to institutional investors.

Expanding crypto custody services is also an important aspect of Bakkt’s strategy to target corporate clients. In February, the company announced its decision to shut down its consumer-oriented application launched in 2021, in order to focus on serving institutional customers amidst a bear market.

Türkçe

Türkçe Español

Español