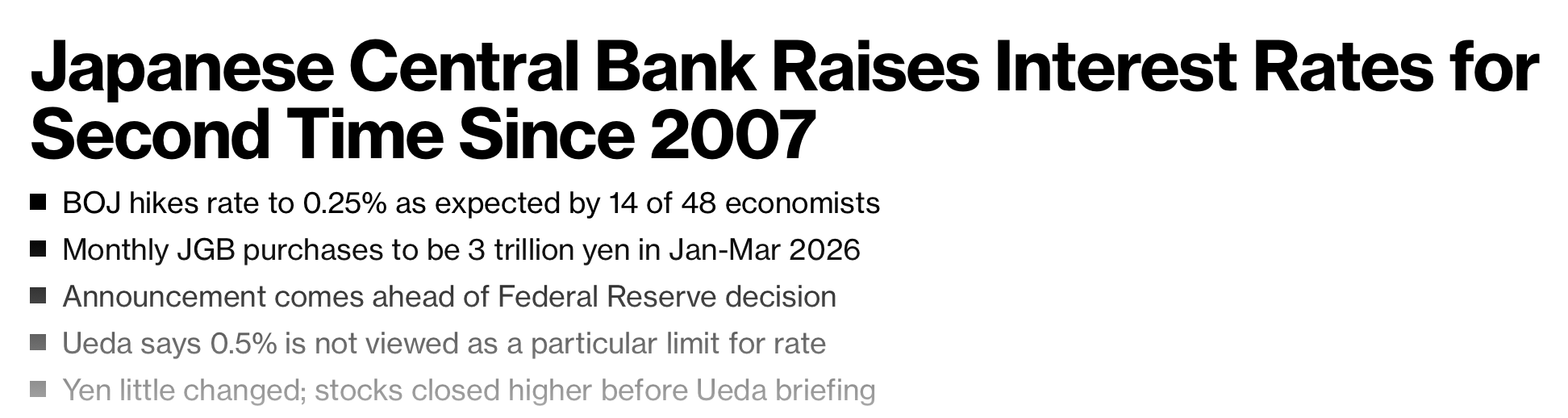

Today, the Bank of Japan (BoJ) raised interest rates to 0.25% and announced a reduction in its bond-buying program. This move caused sudden fluctuations in the cryptocurrency market, leading to Bitcoin (BTC) dropping to a critical support level of $65,500 and then rising above $66,000. BoJ’s decisions also caused significant fluctuations in the Japanese yen and stock markets along with Bitcoin and other cryptocurrencies. Now, all eyes are on the decisions of the Federal Reserve (Fed).

Reasons Behind BoJ’s Interest Rate Hike

The continuous depreciation of the Japanese yen against the US dollar forced the BoJ to raise interest rates this year. This pressure brought Japan’s interest rates back to a positive level after two years. Speaking to Bloomberg, Charu Chanana from Saxo Markets stated that this move is one of BoJ’s most hawkish steps and emphasized the need for a cautious approach in Japanese stock markets.

In the last three hours, Bitcoin’s price found support at $65,500 twice and then rose. This volatility is expected to continue until the Fed’s interest rate decision is announced. Additionally, Mt. Gox’s movement of $3.15 billion worth of BTC today also contributed to market fluctuations.

Besides Bitcoin, the price of the altcoin king Ethereum (ETH) also showed volatility and is currently around $3,300. The positive flow of spot Ethereum ETFs in the US today is interpreted as a positive sign for ETH. Ripple’s XRP, on the other hand, defied broader market trends with a 9% increase.

All Eyes on Fed’s Interest Rate Decision

Meanwhile, both traditional and cryptocurrency markets are focused on the Fed’s interest rate decision to be announced today at 21:00 GMT. No interest rate cut is expected from the Fed yet. While the Fed is expected to keep rates unchanged, analysts are considering the possibility of a 25 basis point rate cut in September.

As known, such developments tend to affect both traditional and cryptocurrency markets. Experts warn of high volatility in the cryptocurrency market as the Fed’s interest rate decision is awaited.