Coinbase‘s Ethereum  $2,634 Layer 2 network, Base, has managed to retain its leadership position among Layer 2 solutions, despite experiencing a decline in activity following a record number of transactions in January. The seven-day moving average of transaction counts fell to 7.5 million from January’s peak of 12 million; however, Base still outperformed rivals like Arbitrum and Optimism. This performance is attributed to Coinbase’s extensive user base of over 100 million and the utilization of Optimism’s OP Stack technology.

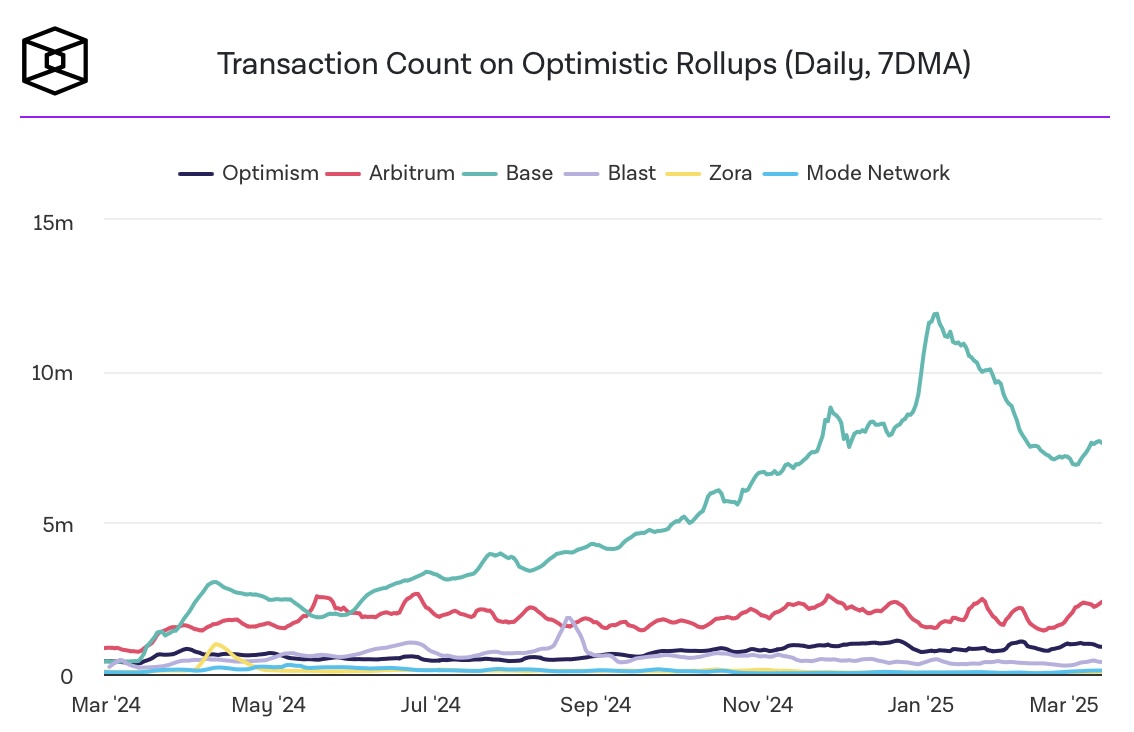

$2,634 Layer 2 network, Base, has managed to retain its leadership position among Layer 2 solutions, despite experiencing a decline in activity following a record number of transactions in January. The seven-day moving average of transaction counts fell to 7.5 million from January’s peak of 12 million; however, Base still outperformed rivals like Arbitrum and Optimism. This performance is attributed to Coinbase’s extensive user base of over 100 million and the utilization of Optimism’s OP Stack technology.

Base Maintains Leadership Despite Decreased Transactions

Since reaching a peak in January, transaction volume on the Base network has decreased by 38%. Nevertheless, the network continues to be the most active in the Ethereum Layer 2 ecosystem with an average of 7.5 million daily transactions. The stagnation or decline of transaction counts in competing networks has further solidified Base’s dominance in the ecosystem.

Coinbase’s user base plays a vital role in the growth of Base. With direct access to the network for over 100 million registered users, they have the opportunity to experience Base firsthand. This infrastructure particularly attracts the interest of institutional players, further enhancing Coinbase’s influence in the cryptocurrency market.

As DeFi Emerges, Base Ecosystem Grows Rapidly

Currently, there are nearly 3.5 million unique wallet addresses on the Base network, indicating ongoing user interest. However, it is essential to consider that this number may be artificially inflated, making it necessary to analyze other metrics like transaction volume and total value locked (TVL).

The Base ecosystem is shaped by decentralized exchanges (DEXs) and lending protocols like Aerodrome, Uniswap, and Pendle. A significant portion of the network’s TVL is concentrated in these protocols. The DeFi-focused growth parallels the early developmental phases of other Layer 2 networks, as new protocols built on Base contribute to the ecosystem’s diversity.

Türkçe

Türkçe Español

Español